If you are not able to manage asset allocation, or your emotions (greed and fear) during market upheavals, this article is for you.

Sunil Jhaveri, founder of Misterbond.in - a B2B Platform for advisers in the mutual fund space, suggests investing purely in Dynamic Asset Allocation Funds, or DAAF.

His suggestion is based on his convictions borne out of 35 years of experience in finance. Over the past decade, he has approached this category of funds as an All Seasons Strategy that works well in any market condition.

Sunil Jhaveri’s mantra: Downside protection and being in the right asset class at the right valuation.

Below is an extract from the more detailed original version.

What do we achieve through DAAF?

- Manages asset allocation

- Manages value-based investing (invests-disinvests at right valuations)

- Buy Low – Sell High (constant profit booking, or through a pro-cyclical model which will reduce equity exposure during bearish trends and increase the same during bullish trends)

- Downside protection

- Average 50% in equity and 50% in debt with equity taxation – no need for separate debt allocation

- No need to time the markets (either for entry or exit)

- Participates in upside during bullish markets

- Protects downside during bearish markets

- Delivers returns even during stagnant market period due to Buy Low- Sell High strategy

- One can use it under SIP, STP or lump sum strategies

- Can be recommended for any age groups

- Can be used effectively for tax efficient cash flow creation for senior citizens through SWP

- Practically all fund houses have this scheme in their baskets –Dynamic Equity or Balanced Advantage Funds (BAFs). Not all BAFs may be DAAF. One or two schemes are called BAF but are aggressive hybrid schemes. Be cautious about selecting such schemes and AMCs.

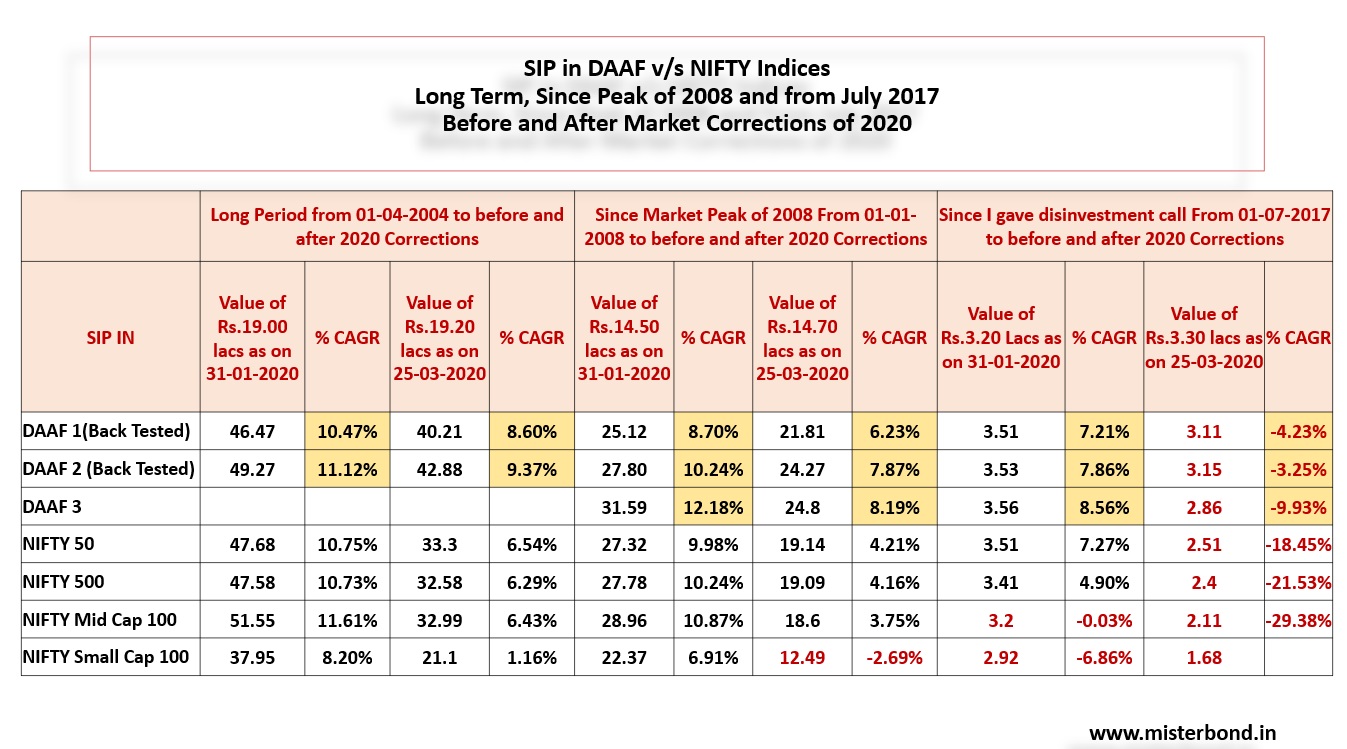

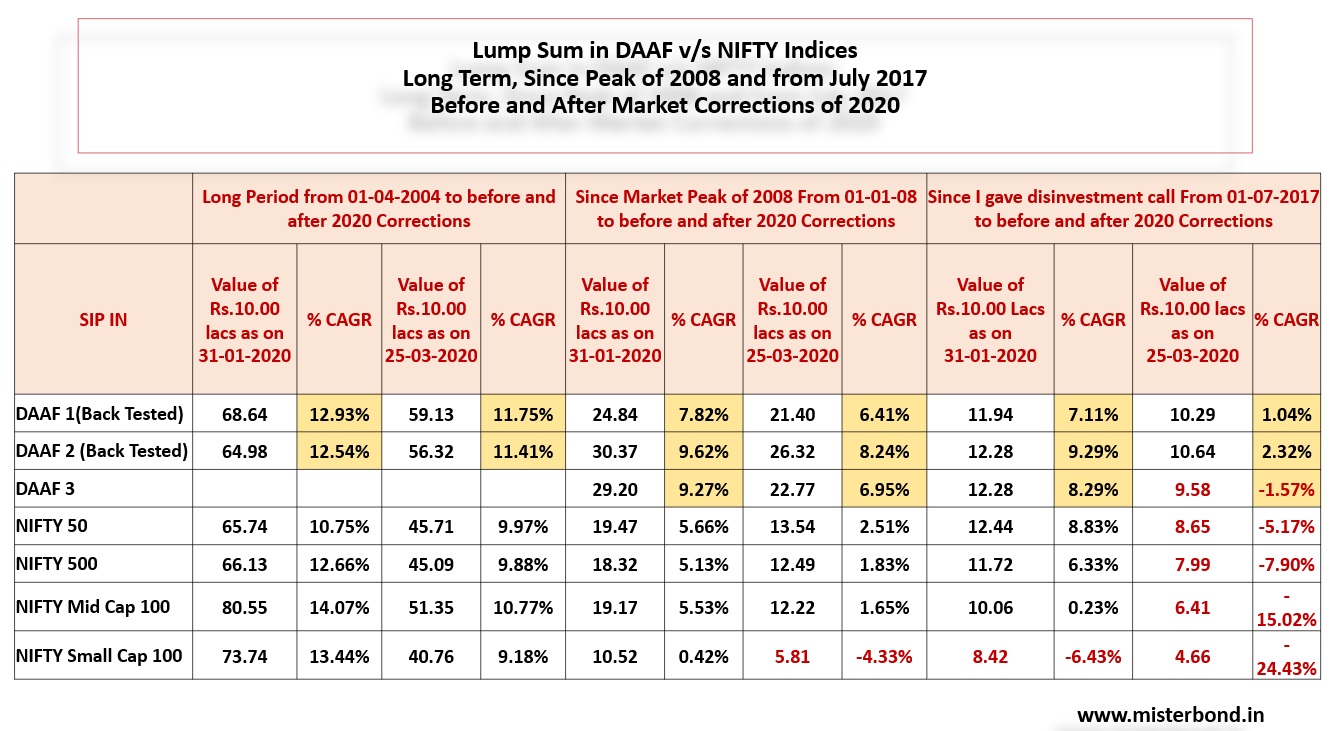

Let me showcase investments in some of these schemes under SIP or lumpsum under different time periods. Reasons for selecting these time zones are:

- From April 1, 2004 to January 31, 2020 – Period before market crash

- From April 1, 2004 to March 25, 2020 – Period after market crash

- From January 1, 2008 to January 31, 2020 and March 25, 2020 – from market peak in January 2008 to before and after the market crash of 2020

- From July 1, 2017 to January 31, 2020 and March 25, 2020 – from the date when I had recommended exit from equity as an asset class to before and after the market correction of 2020

- I have considered both SIP and lumpsum during these periods so no one can pitch one against the other

- I have taken examples of 2 DAAF schemes (based on their back tested NAVs) and one actual scheme which has been in existence since past 10 years or so

- One of the DAAF Schemes (back tested example) is of a pro-cyclical scheme and the other two schemes are counter cyclical. I have taken the examples of both models to showcase that both DAAF strategies are capable of delivering good investor experiences.

- Compared them with all segments of the market viz. Large Cap (NIFTY 50), Multi Cap (NIFTY 500), Mid Cap (NIFTY Mid Cap 100) and Small Cap (NIFTY Small Cap 100)

Conclusion

Conclusion

- DAAF has performed equal to or better than buy-and-hold and SIPs under any market period (before or after corrections, over longer or shorter investment horizons and even from dates of the market when it was at its peak in previous market cycles)

- Less volatile and much smoother investment experience

- No need for timing the markets (exits or entries)