On June 25, 2020, Dev Ashish, a SEBI registered investment adviser, tweeted: Many DIY investors are DIY not because they are capable, but because they want to avoid paying any fee.

The responses to that were very interesting.

One said that he burnt his fingers and so became a Do-It-Yourself (DIY) investor. Another said that he did not get sufficient value from his financial planner. Others suggested that the integrity and competence of the IFAs should also be considered.

The perception around money is fascinating. And advisers should never downplay the emotional element of money. It is experiences that shape a client’s perception, and the financial adviser will have to combat that to earn someone’s trust and confidence.

If you are an adviser, ask your potential client these questions. You should even try it with existing clients who are difficult, who question you needlessly or never listen to what you say. Their answers will help you tackle the emotion and cloudy reasoning that is jeopardising their financial future.

1. What was your first positive experience with money?

Was it a gift from someone you love? Was it a reward for running errands or doing household chores during your school summer vacation? Was it money you earned in college by giving tuition to school kids?

2. What negative experience with money comes immediately to mind?

Was it a stock tip that failed miserably? Was it a distributor who got you to invest in numerous life insurance schemes? Was it lending money to someone very close who never ever returned it?

3. Who has influenced most of your money decisions till date?

This will help you understand the source of the client’s questions and who or what is influencing her decision.

4. What is it that you really want from me?

This will help you figure out why they think they need help. The responses may surprise your. They may be expecting you to make them rich quickly. They may expect you to solve a big challenge, such as perennial debt. It could be a specific life event – death, divorce, windfall. You need to know what it is that drove them to find a financial adviser, and then more precisely, what led them to you.

Answers to these questions will help you understand your client’s apprehensions and help you communicate accordingly to establish trust and confidence.

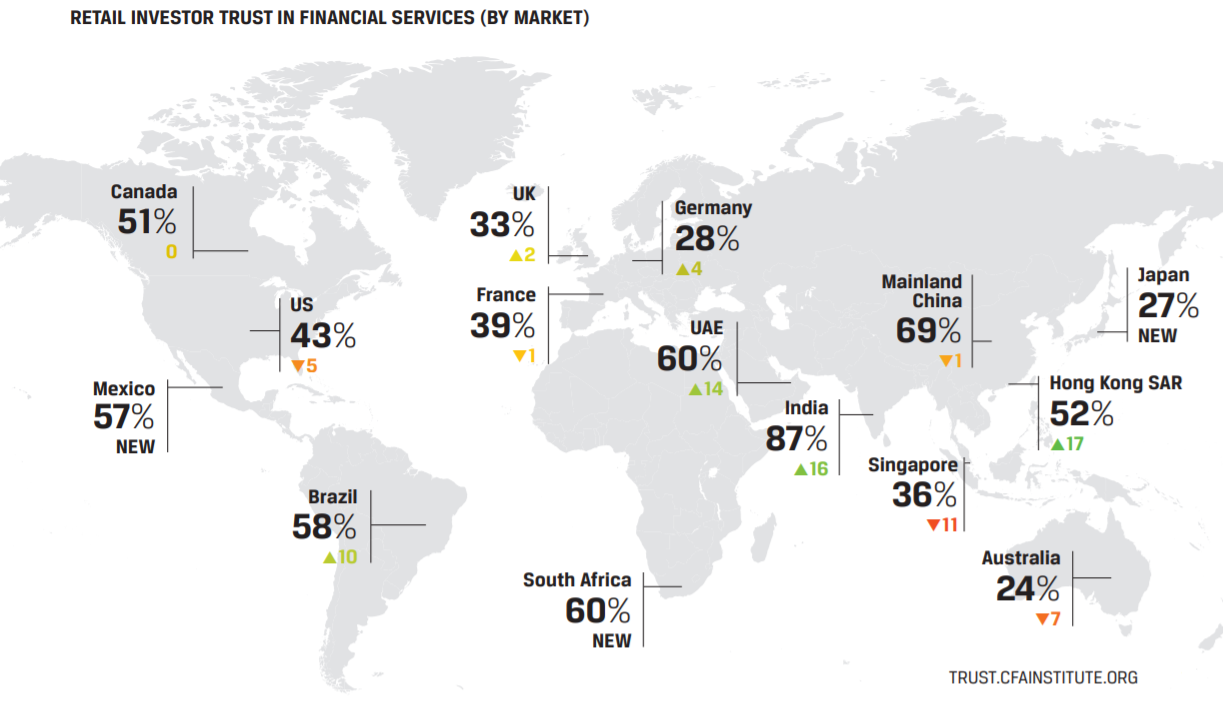

In this context, I would like to mention the 4th edition of the CFA Institute Investor Trust Report. It addresses the question: What does it take for someone to put their capital at risk and entrust their funds to someone else to manage? The concept of trust lies at the heart. Trust cannot exist without value, and value creation without trust is unsustainable.

What is the main reason a retail investor would consider leaving your current financial adviser or asset manager?

- Underperformance: 42%

- Fees are too high: 38%

- Data/confidentiality breach: 35%

- Lack of communication/responsiveness: 34%

With regards ONLY to India, here are some numbers:

- In 3 years, do you think a financial crisis is very likely or extremely likely? 78% said yes.

- In 3 years, which of these two will be more important? Having access to the latest technology platforms and tools to execute your retail investment strategy? (92%) Having a person help you navigate what is best for you and execute on your retail investment strategy? (8%).

- If you are eligible for a state-sponsored financial benefit in old age, do you trust it will pay out benefits as promised?: 94% said yes.

- What is your preferred source of trusted advice? Human adviser (82%), Robo adviser (5%), Both equally (14%).

- Younger investors would rather work with a firm with “a brand I can trust” than one with “people I can count on.” The importance of brand was put at 90%. Brand is truly a proxy for trust.

Access the report here.

The above results are from the online survey conducted by Greenwich Associates.

- Retail investors: 3,525 / 25 years or older

- Institutional investors: 921

- Dates: October and November 2019

- Markets: Australia, Brazil, Canada, Mainland China, France, Germany, Hong Kong SAR, India, Japan, Mexico, Singapore, South Africa, UAE, UK, US.

- Minimum investible assets for retail investors: $100,000, India it was Rs 5 lakh

- Institutional investors included individuals responsible for investment decisions with at least $50 million assets under management, from public and private pension funds, endowments and foundations, insurance companies, and sovereign wealth funds.