Dividend stocks are often coveted by many investors. IAN TAM, director of investment research at Morningstar Canada, presents you with perspective on that affinity. No one is saying you should avoid them, but just be aware of their role in your portfolio.

- Understand your role and the company’s role.

Financial theory tells us that as an investor purely concerned with the growth of financial capital, one should be indifferent between receiving a dividend, or receiving capital gains, all things equal.

For illustrative purposes, let’s assume that you are looking at two theoretical companies with identical businesses and somehow magically identical management teams, but with different policies on dividends (a Black Mirror-type scenario, if you will).

Company A does not pay a dividend.

The company opts to re-invest its earnings to fuel growth by expanding business lines, increase efficiencies, and conduct R&D to innovate and bring new products to the market. The eventual investment return provided by Company A comes when you sell the stock, if the company is successful at deploying that capital and turning a profit, thus commanding a higher company valuation.

By investing, you are taking a calculated risk by assuming the management team can effectively deploy that capital to fuel growth.

Company B opts to pay out a percentage of its earnings in the form of dividends on a regular basis.

You receive this amount in cash, and you are now responsible for doing something with that cash. You may choose to take that cash and purchase more of the same stock, which will increase your stake in the company and entitle you to more wealth when you eventually sell. In turn, company B will likely take that additional investment and deploy it much like Company A did. In other words, if you re-invest your dividend back, the wealth in your pocket will be similar to Company A. If you do not re-invest, Company B’s growth rate will be lower than Company A’s because it now has less capital to deploy (since they paid you a dividend). This said, they will still grow but likely without your re-investment they will not grow as fast as Company A.

Over the long term, both conceptual companies will provide the same amount of pre-tax wealth to you as the investor. The difference is in the timing of when you receive the cash. Company A pays you when you sell the company while Company B pays you along the way and will sell for less than Company A, all things equal.

- Revisit the income requirement.

Some investors require a steady income stream, namely those who are in retirement and require the steady income to fund regular expenses. Traditionally, this income comes from the duly named fixed income portion of a portfolio. But investors also look for dividend-paying companies to supplement the income requirement.

But investors can derive income from a stock investment by selling off some portion of their equity in a disciplined manner. Doing so has the same effect as a dividend paid by the company and allows you to de-couple the income requirement from the type of stocks that you pick.

- Taxes: Why all things are not equal.

It’s also important to remember the effect of a tax rate on dividends is two-fold: the tax rate itself, and the effect of compounding. Paying taxes out of dividends received every quarter means that you are stifling the amount being re-invested and are reducing the effects of compounding.

India’s Union Budget 2020 mandated that from April 1, 2020, companies that provide dividends to shareholders won't have to pay the associated Dividend Distribution Tax (DDT). Instead, dividends will be taxed in the hands of investors based on their income-tax bracket.

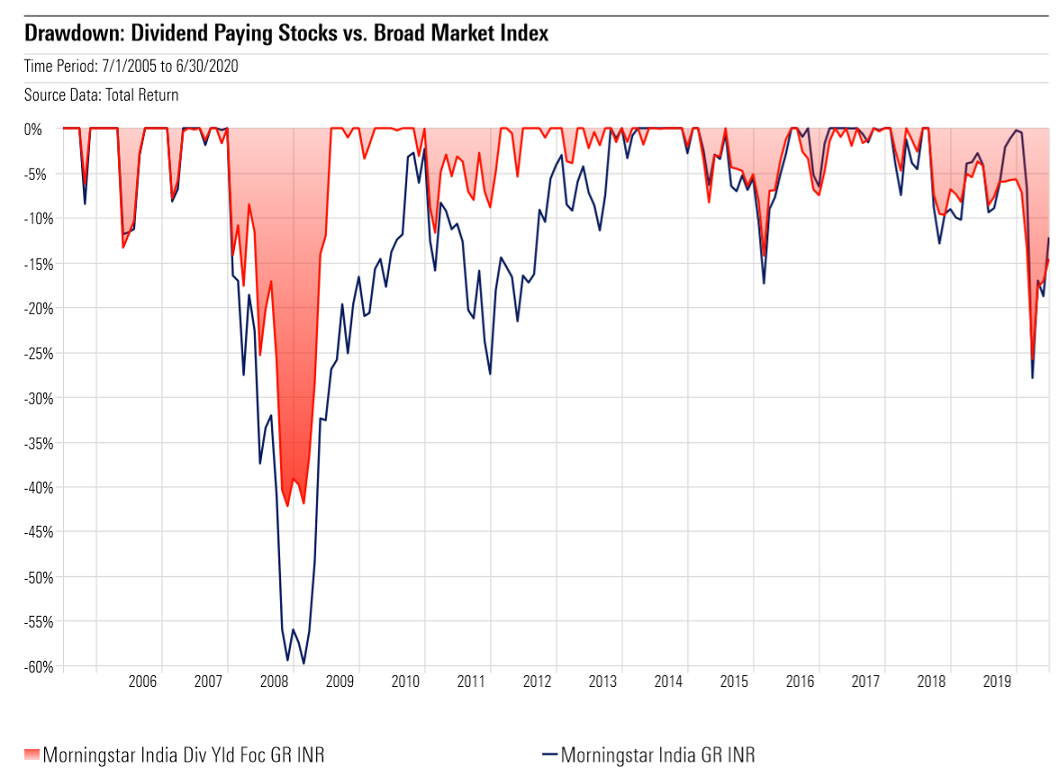

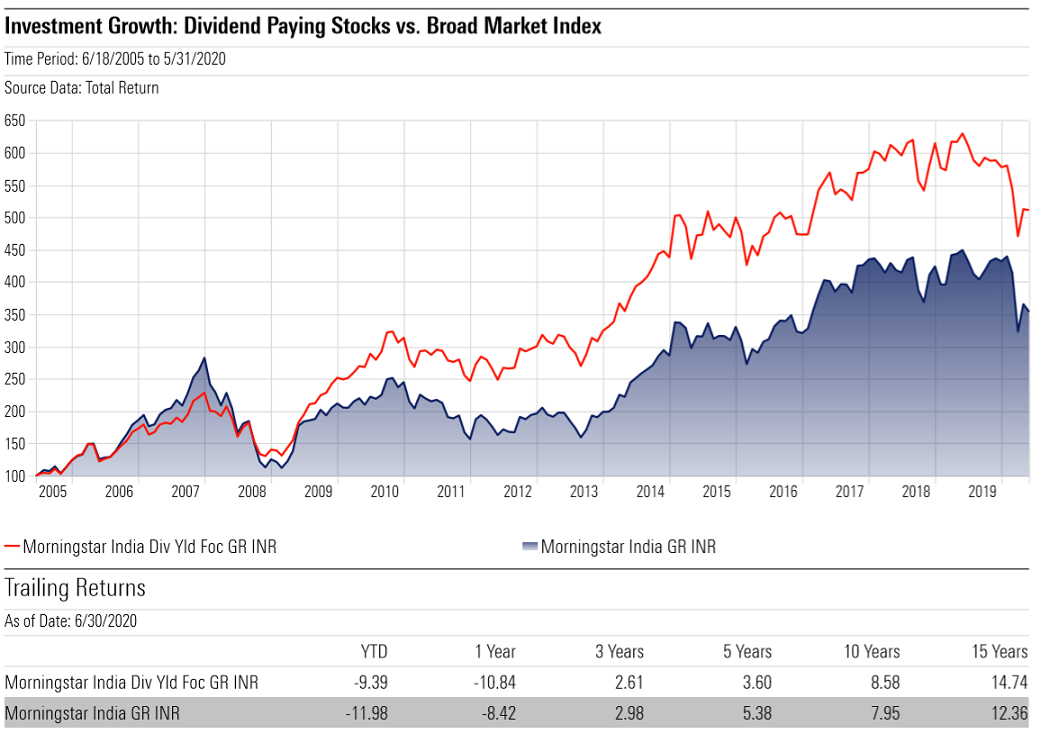

An often-cited statement is that dividend paying companies offer more protection than those that don’t pay dividends. There is certainly some truth to this.

But dividend stocks are still stocks. Which means that they will exhibit volatile characteristics similar to the rest of the asset class. So stay very close to your risk tolerance always, when evaluating such companies for your portfolio.

During times of economic hardship, the decision to maintain or cut dividends rests solely on the shoulders of company management. When dividends do get cut, not only does the fundamental valuation of the company gets reduced, but so too does market sentiment which will cause short-term fluctuation in the stock’s price.