In Dividend Investing: Get 4 facts straight, Ian Tam, director of investment research at Morningstar Canada, set some basics in place.

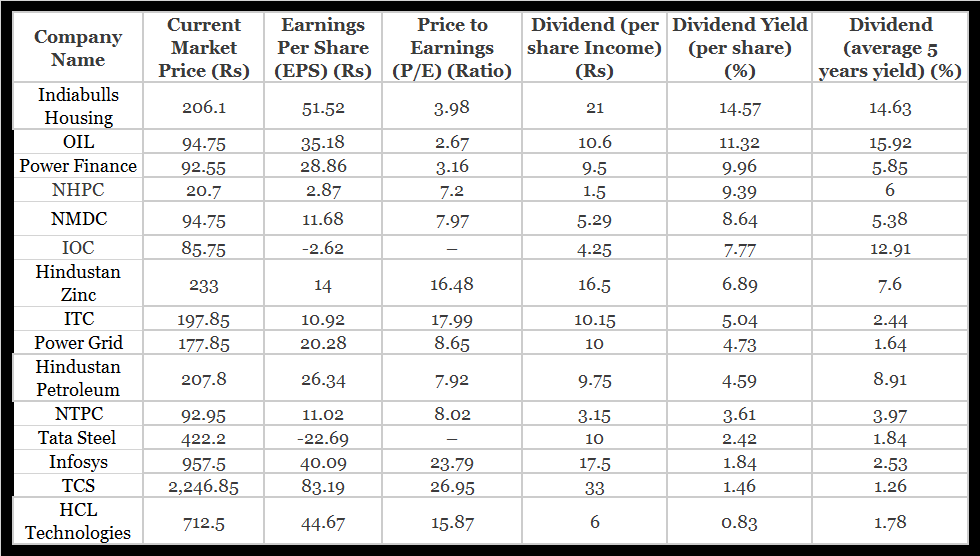

FinMedium, a financial web magazine, suggests some factors to keep in mind when looking at dividend stocks, and lists the highest dividend paying stocks of 2020. These are NOT stock recommendations, it is merely a listing.

Cash Flow

There have been cases where companies provide dividends to shareholders without stable earnings. They do so by selling their assets or taking loans, or sometimes both. All in an attempt to retain goodwill in the market.

To get a clear picture on the company’s solvency, read the cash flow statement. It will clearly explain the company’s earnings capability.

Cash flow is the movement of money in and out of the company. A positive cash flow means the company has more cash coming in than what is being spent. A negative cash flow means there is more cash going out than coming in.

Operational cash flow is the inflow of money into the company via provision of goods and services by the company – amount of cash a business generates from its regular ongoing operational activities. It is the main form of income the company generates. Hence, we provide it with high importance.

Earnings yield to dividend yield

To provide consistent dividend to its shareholders, the company has to have a strong cash flow, and maintain consistency in earnings. A company that’s consistent in both, providing dividends and improving its dividend yield is worth investing.

The company should provide a dividend only from revenue, the one that goes into the company reserve.

Earnings yield is the rate at which a company earns its revenue on a per share basis, and also known as Earnings Per Share (EPS). It is the revenue earned by the company divided on a per share basis.

Dividend yield is the earnings an investor earns on a per share basis. Let’s say the share price is Rs 200, and the company declares a dividend of Rs 10 per share. That’s 5% dividend yield.

Dividend Policy

A company is under no obligation to pay dividend to its shareholders.

As an investor, be aware of the company’s dividend policy. Check whether payment of dividends is an integral strategy of the company. If yes, look at the payment consistency, the rate of payment and the mode of payment.

The consistency of dividend yield must be given prime importance.

It is the management and the board of directors who make the decisions. of the company to decide the rate of dividend, if at all.

Also do a peer comparison. What are other players in the same industry offering? with other players in the same industry.

Dividend Reinvestment

Over the years, reinvestment of dividend has provided a better return to investors than one without dividend reinvestment. Consistent reinvestment of dividend into a well-established dividend based company can yield better return over time.