Morningstar’s Manager Research team has released its latest Offshore Spy Report. This report provides insights into performance, estimated flows, and asset trends for offshore funds focused on the Indian equity market. The flows are estimated from assets and total returns for the quarter ended June 2020.

An offshore India fund is one that is not domiciled in India but invests primarily in Indian equity markets. In this report, we have included the asset flows of funds and exchange-traded funds with an allocation to Indian stocks as of June 2020.

Here are some key takeaways from the report on assets and flows of India-focused offshore funds and ETFs covering 255 primary funds and ETFs (oldest share class):

- There was no respite for the India-focused offshore funds and ETFs segment as it continued to witness net outflows during the quarter ended June 2020. This was the category’s ninth consecutive quarter of net outflows.

- Through the June quarter, the category lost net assets worth USD 1.5 billion, which was significantly lower than the net outflows of USD 5.0 billion recorded in the previous quarter.

- So far in this calendar year (until June 2020), the category has witnessed a net outflow of USD 6.5 billion, which is noticeably higher than the net outflow of USD 5.9 billion that the category witnessed in the full calendar-year 2019.

- Of the total net outflows from the category during the quarter ended June 2020, the India-focused offshore fund segment witnessed net outflows of USD 698 million, whereas India-focused offshore ETFs segment witnessed net outflows of USD 776 million.

- Despite net outflows, the asset base of the India-focused offshore funds and ETFs category swelled during the quarter-ended June 2020 boosted by the recovery in the domestic equity markets. Through the quarter, the assets of the category grew by almost 13% to USD 33.8 billion from USD 29.8 billion recorded in the previous quarter.

- Given the emergence of negative sentiment caused by the coronavirus pandemic, the net inflows into funds were largely muted during the quarter. Yet, there were a few funds that stood out and managed to garner assets. JPMorgan India (acc) - USD was one of them, as it garnered the highest net inflows of USD 53 million for the quarter. This was followed by JPMorgan India (acc) - USD (net inflows of USD 35 million) in second place and HSBC India Open (net inflows of USD 30 million) in third place.

- After declining by almost 41% in the previous quarter, the total assets of the 10 largest India-focused offshore funds and ETFs grew by 11% to an estimated USD 14.5 billion as of June 2020 from USD 3.1 billion as of March 2020. They constitute almost half of the overall assets of the offshore-India universe. The top 10 funds included two ETFs—iShares MSCI India ETF and Lyxor MSCI India ETF Acc EUR—that contributed about USD 3.5 billion.

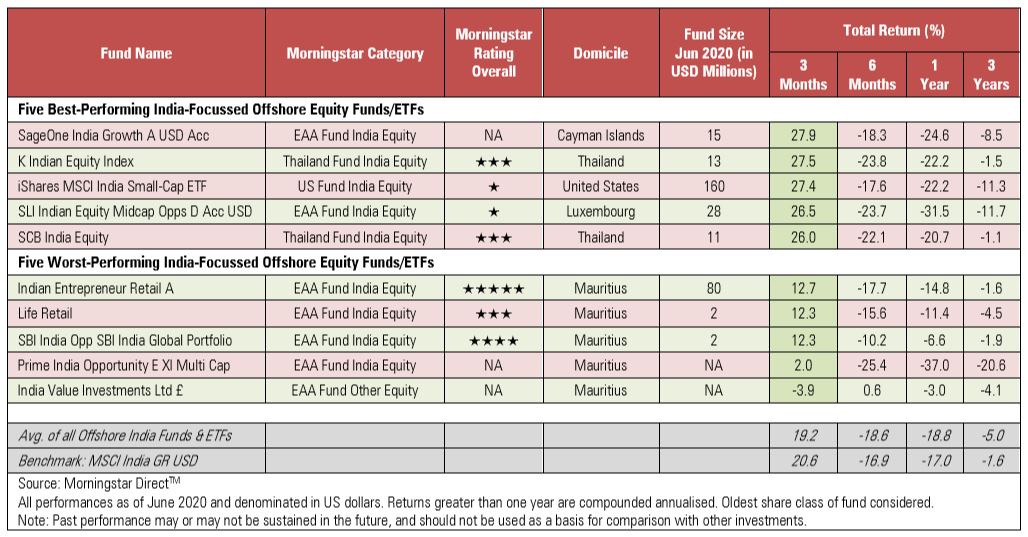

5 best and worst-performing India-focused offshore equity funds and ETFs in the quarter ended June 2020

Click on the image to enlarge.

Download the full report here.