Institutional investors and high net worth investors are lapping up floating rate in the recent past. This is evident by over Rs 11,000 crore worth cumulative inflows in this category in September and October 2020.

Though the category emerged way back in 2013, only eight out of 40 AMCs offer floating rate funds currently. Securities and Exchange Board of India, or SEBI, carved a separate category for these funds in 2017. SBI Mutual Fund has launched its Floating Rate Fund in November 2020.

What are floater funds?

As the name suggests, these funds aim to invest a minimum of 65% in floating rate bonds issued by corporates, central and state governments that offer variable interest rate that are pegged to the Mumbai Interbank Offer Rate (MIBOR). These funds typically do well when interest rates are set to rise since the floating rate bonds reset their yields as per the prevailing interest rates. But this is not as simple as it appears because there aren’t many issuers of floating rate bonds. Thus, these funds employ a derivative strategy to comply with the minimum 65% investment in floating rate bonds by using a combination of fixed rate bonds and Interest Rate Swaps.

Where and how do they invest?

Floating rate funds typically maintain a duration of two years and invest in a mix of sovereign, corporate, money market and interest rate swaps. A large portion of the portfolio is invested in AAA rated instruments. Further, these funds are less volatile as compared to longer duration funds, which is evident by the low standard deviation of this category. Do note that these funds also take credit exposure.

The market for floating rate bonds in India is less liquid and there aren’t many issuers of such bonds. Anju Chhajer, Senior Fund Manager, Nippon India Mutual Fund, who manages Nippon India Floating Rate Fund explains the strategy she adopts in this fund. “There are two strategies used in this fund. Firstly, we buy fixed rate bonds, when there is a lack of availability of floating bonds, and convert them into floating rate bonds through Overnight Index Swaps or, OIS. The combination of fixed bonds and OIS also adds liquidity to the portfolio as both instruments are liquid. A floating rate bond does not mean zero interest rate risk. In the second strategy, we buy floating rate bonds. The OIS curve and bond curve do not move parallel always. Bond yields have dropped and OIS curve has not moved down parallel. Hence, we have made money in both segments of the market. We also benefited from higher carry. These funds aim to make money in falling interest rate scenario through the spread. The three-year OIS curve has been in a range in the last 6 months. Since there aren’t enough floating rate bonds in the market. We have to buy at the right spread.”

With interest rates likely to remain low for some time, how will these funds perform going ahead?

“The view in the market is that the Reserve Bank of India will remain accommodative for around a year and then reversal of liquidity measures will happen. So that segment of OIS has performed accordingly. The interest rates are going to remain lower for one year to 15 months. Typically, these funds have a duration of around two years. If rates rise, these funds will be less negatively impacted due to the floating rate component and the paid OIS positions,” believes Anju.

How have these funds performed so far?

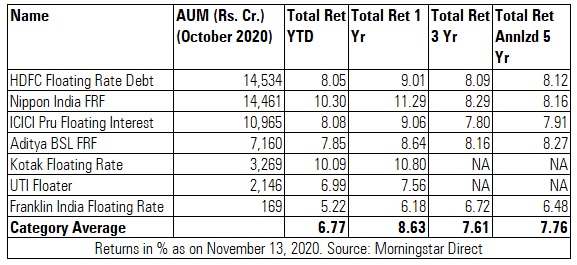

Over one-year period, the category average return of floating rate funds stood at 8.63%, which is higher than the returns delivered by medium duration, money market, low duration, money market, and ultra short duration, which is in the range of 3 to 5%.

Should you invest in these funds?

Mumbai-based distributor Rushabh Desai feels that retail investors should exercise caution while investing in this category. “Floating funds tend to benefit the most during favourable interest rate movements. The instruments are held till maturity which are closely linked to the prevailing interest rates. The average maturity of this category is around 2.5 years thus in this context investors should compare it with the short duration category. Investors can also expect floater funds to be less volatile vis-à-vis the short duration category. However, floating funds are not credit risk proof and one will need to look at the funds individually before investing.”

While such funds typically benefit in a rising rate scenario, Anju feels that they are an all seasons fund, so investors don’t need to time the entry and exit. Anju says that investors with two to three-year horizon can invest in floating rate funds as floating rate bonds protect investors from volatility in interest rates.