Despite 2020 being a volatile year for markets, 27 out of 40 fund companies saw a positive growth in their assets under management.

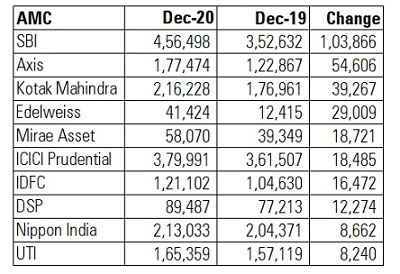

SBI Mutual Fund retained the mantle of being the largest fund house in terms of assets. Its assets under management, or AUM, grew by Rs 1.03 lakh crore, from Rs 3.52 lakh crore in December quarter 2019 to Rs 4.56 lakh crore in December quarter 2020. Inflows in Exchange Traded Funds, coupled and other debt and equity schemes, helped the fund house achieve this growth.

Axis Mutual Fund recorded the second-highest growth in AUM from Rs 1.22 lakh crore to Rs 1.77 lakh crore during the same period. Kotak Mahindra saw the third-highest growth in assets. Its asset base increased by 39,267 crore from Rs 1.76 lakh crore to Rs 2.16 lakh crore in 2020.

The launch of Bharat Bond ETFs helped Edelweiss AMC record the fourth-highest growth in assets. Mirae Asset recorded the fifth highest growth in assets.

These ten AMCs collectively added Rs 3.09 lakh crore to their kitty. They manage Rs 19.18 lakh crore assets, which is 65% of the industry’s total Rs 29.69 lakh crore assets as on December quarter 2020.

The growth in AUM is a function of net inflows and mark-to-market gains. The Sensex has gained 15.75% in the calendar year 2020. Open-ended debt funds have received net inflows of Rs 1.87 lakh crore from January 2020 till November 2020. Open-ended equity funds have received Rs 19,249 crore worth net inflows during the same period. ETFs have been gaining traction lately. ETFs (excluding Gold ETFs) received Rs 44,325 crore net inflows from January 2020 till November 2020.

10 AMCs which recorded the highest AUM growth in 2020

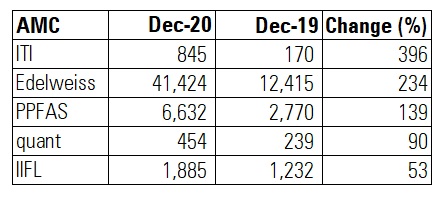

5 AMCs that recorded the highest percentage AUM growth in 2020

It is worth noting PPFAS manages three schemes. Its largest fund - PPFAS Long Term Equity, which invests in a mix of global and domestic equities has seen its asset base jump from Rs 2,699 crore in January 2020 to reach Rs 5,757 crore in November 2020, a growth of 113%.

ITI Mutual Fund, which debuted in the Indian mutual fund industry in April 2019, saw its asset base grow by 396%, the highest in terms of percentage.

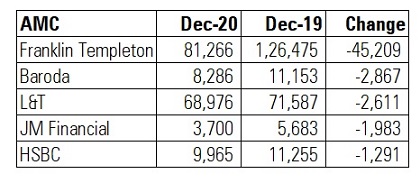

5 AMCs which saw the highest dip in assets in 2020

Franklin Templeton AMC, which shut down six debt schemes in April 2020 due to illiquidity in bond markets, saw its asset base dip by Rs 45,209 crore in 2020.

(Data source: AMFI, quarterly AUM disclosure)