Investors continue to redeem or switch out from equity to debt funds as markets continue to scale new high on the back of record foreign institutional investor buying.

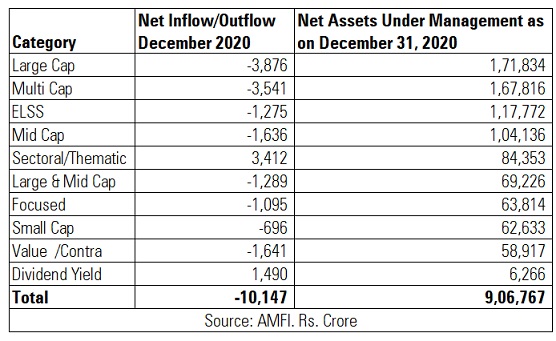

Equity mutual funds witnessed sixth consecutive month of net outflow at Rs 10,147 crore in December 2020. Hybrid funds, which include, balanced funds, dynamic asset allocation, multi-asset, arbitrage, equity savings, too witnessed net outflows to the tune of Rs 5,932 crore in December 2020.

“The net outflow number would have been higher had it not been for the new fund offers across multiple equity categories which collected Rs 7,600 crore. Moreover, while the gross purchase (new investments) was lower in December than the previous month; gross redemptions at Rs 36,220 crore was significantly higher than Rs 27,113 crore in November 2020. This also suggests that investors looked to book profits given the higher market valuations. Since July, equity-oriented mutual funds have witnessed a net outflow of Rs 33,003 crore,” observes Himanshu Srivastava, Associate Director, Morningstar Investment Advisers India.

The industry launched 14 new funds in December 2020 which collectively mopped up Rs 9,039 crore.

While redemptions and switches have increased, equity funds continue to see fresh sales. Equity funds gross sales in December 2020 increased to Rs 26,073 crore from Rs 14,195 crore in November 2020. Of this systematic investment plan inflows stood at Rs 8,418 crore. Although SIP contribution includes inflows from both debt and equity funds, a majority of the SIPs are channelized in equity funds. As on November 2020, 88% of SIP AUM was concentrated in equity funds.

SIP as a vehicle to invest in mutual funds is becoming increasingly popular. The total number of SIP accounts in the industry increased from 3.40 crore in November 2020 to 3.47 crore in December. Similarly, SIP inflows increased from Rs 7,302 crore to Rs 8,418 crore during the same period. The SIP AUM of the industry stood at Rs 3.98 lakh crore as on December 2020.

"MF Industry AUM at an all-time high, increase in retail folios and also SIP folios, is reflective of investor confidence in mutual funds. While net-inflows in equity and hybrid funds are negative, on the back of profit-led redemptions, the gross inflows are a healthy Rs 36,000 crore in these two categories,” said N. S. Venkatesh, Chief Executive Officer, Association of Mutual Funds in India.

Debt Funds

In December 2020, Corporate Bond Funds received the highest inflows at Rs 8,609 crore followed by overnight funds at Rs 7,410 crore. “I expect RBI to continue maintaining accommodative stance and keep rates at current levels for economy to play a catch up, which is reflected in positive flows in corporate bond funds owing to the schemes holding quality paper and also shorter duration strategies including floater and dynamic bond schemes,” added Venkatesh.

Net inflows in Banking & PSU Funds have subsided as compared to earlier. In December 2020, this category received Rs 2,072 crore as compared to Rs 3,874 in November 2020.

Overall, debt funds received inflows worth Rs 13,863 crore in December 2020.

Exchange Traded Funds

Gold ETFs received net inflows of Rs 431 crore in December 2020 after seeing net outflow of Rs 141 crore in November 2020. Gold funds have delivered 24% return over a one-year period.

ETFs which track the equity indices received net inflows worth Rs 6,832 crore in December 2020. This category is gaining traction as a number of asset managers are launching ETFs. Assets under management in equity ETFs has grown by 46% from Rs 1.75 lakh crore in January 2020 to reach Rs 2.56 lakh crore in December 2020.

Industry AUM reaches new high

The industry received total net inflow of Rs 2,968 crore across all schemes in December 2020. This was due to redemptions in equity funds, hybrid funds and equity linked savings schemes. The industry’s assets under management increased marginally from Rs 30 lakh crore in November 2020 to reach Rs 31.02 lakh crore, partly owing to mark-to-market gains in equity funds. Equity fund assets under management increased from Rs 8.57 lakh crore in November 2020 to Rs 9.06 lakh crore in December 2020.