I am interested in Edelweiss Balanced Advantage Fund. I want to invest Rs 25 lakh lumpsum for the long term. Is it advisable to invest in this market peak?

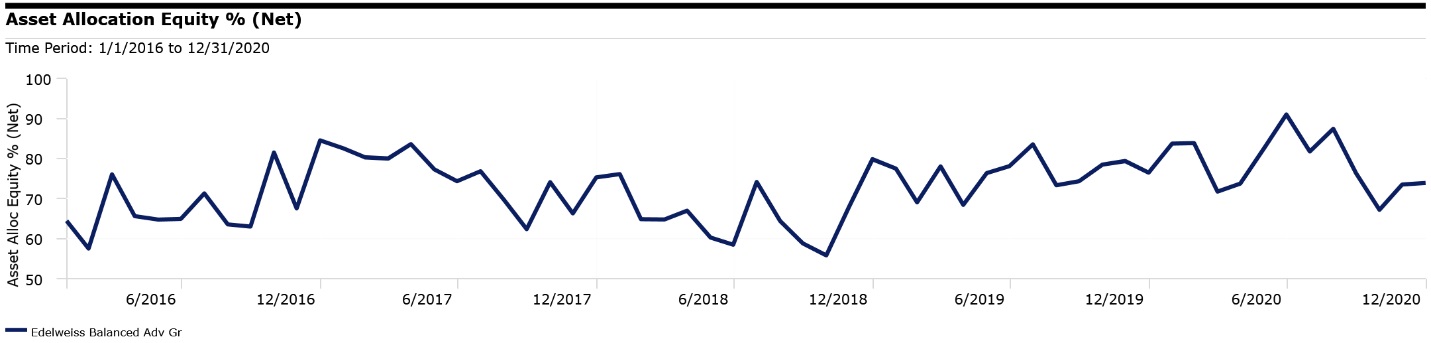

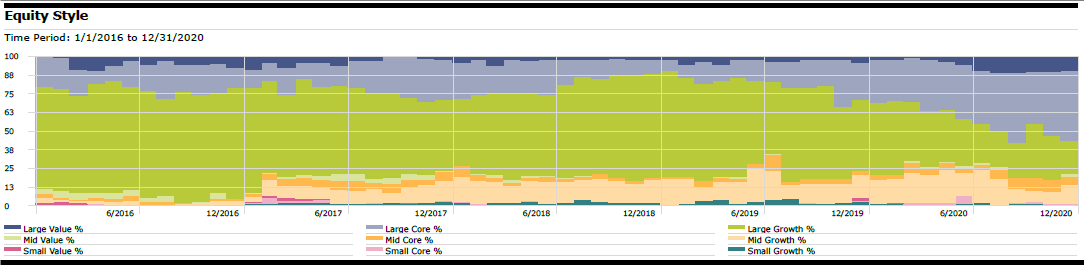

This is a well-managed fund which modulates the net equity exposure of the fund based on various parameters including valuations and fundamental metrics. This helps reduce the overall risk in the portfolio in overheated markets. The equity portion is actively managed, with a large-cap bias. While the fixed income portion is largely invested in high quality credits.

What you need to consider when investing in the fund is your overall investment objectives and desired asset allocation in conjunction with your investment time horizon. Evaluate how this fund fits into your overall portfolio from that perspective. While the stock market is at an elevated level, as long as you have the correct investment time horizon, you shouldn’t worry about market levels at entry. This is even more true in a fund such as this, which is already modulating net equity exposure depending on various variables including valuations.