Instead of assuming that your goals are written in stone, change the focus. Just aim at being a little less wrong than being completely right.

Carl Richards tells us that well intentioned behaviour can produce suboptimal results. That is because of an inherent disconnect in the way we approach our goals and our savings. He explains the three biggest mistakes we make, and how to get it right. Or rather, how not to be wrong.

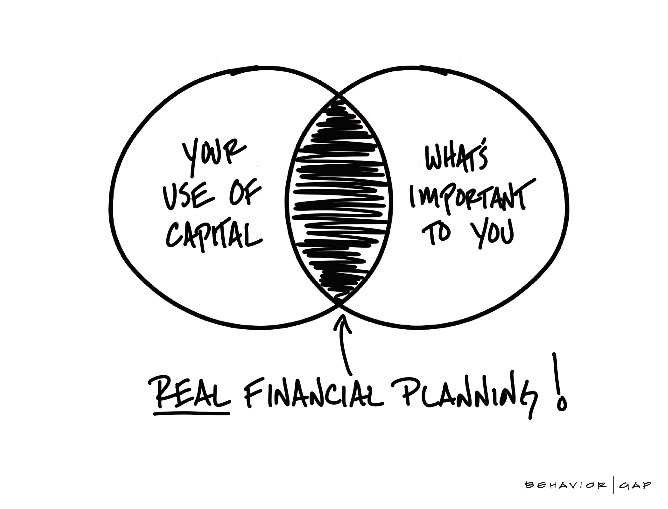

#Mistake I: Not connecting the use of your capital to your goals.

There is a lot of conversation about tactical asset allocation, economics, strategy, and deep analysis on stocks and funds. What needs to first happen is to link the use of your capital with what is important to you.

I have some questions that I love to ask people. One of the questions I began to ask a decade ago: Why is your money invested the way it is? I would get answers like, "Well, I read about it in The Economist. My friend told me. My neighbour told me." The ONLY correct answer would be along the lines of, my portfolio was designed to give me the highest likelihood of meeting my goals.

I've seen this on the institutional level--large university endowment that I got asked to come do a performance audit on. And I asked that question, "Why is this money invested this way?" Well, you know, the consultants came in and we had stacks and 2-inch-thick proposals. But no one said, "Well, it matches the spending policy of the endowment."

Investing is not an end in itself. You must be clear on why the money is invested where it is. If you're not, you're investing based on other people's goals and what you read in the news. Be an educated investor. Have access to really good information. And then overlay that on top of your own personal situation. You've got to be actively engaged in that process, or at least be the co-pilot.

#Mistake II: Underplaying mimetic desire.

René Girard’s mimetic theory is about desire. Human desire is not a linear process, where a person autonomously desires an inherently desirable object. Rather, we desire according to the desire of others. If we are not aware, others influence us on what to desire. And this is amplified on social media platforms such as Facebook and Instagram.

Be careful of social comparisons because they really impact our financial decisions and emotional well-being. As explained by French thinker Montesquieu, “If we only wanted to be happy it would be easy; but we want to be happier than other people, which is almost always difficult, since we think them happier than they are.” You see the person’s best on Instagram and compare it to your worst. But their failures and disappointments and days of depression are not displayed for the world to see.

Getting clear about what really matters to you is incredibly important, and not as simple as it appears. Don’t follow the desires of another. What makes them feel rich and fulfilled is not the same for you.

#Mistake III: Thinking that your goals are written in stone.

Once you decide that your goals are not your destination, but a process and a journey, the pressure goes off. You tend not to worry about being right today. Tomorrow you focus on being a little less wrong tomorrow. What may be important to you today may change tomorrow.

You may decide today that you want to retire at the age of 40. But a few years down the road, you may decide that it is really financial independence you desire and are completely fine with not technically retiring from your job.

If we know where we want to go, it's much easier to decide. Do we want to take a train, a plane, or an automobile to get there? But most of the time people argue about the mode of transport without giving thought to about where they are going. Try The Dan Sullivan question: If we were meeting exactly three years from today, what would have to happen in order for you to feel like the last three years have been a success, both personally and financially?

Make a guess. Where do you think you want to go? Take a step forward. When you take that new step forward, new information will become available. This is part of what it means to be human. Give yourself a little slack. You're going to overshoot it, you're going to undershoot, you're going to come back to it. But you will move in the right direction if you pay attention to the right question.