I invested in a healthcare fund when the sector was not doing well at all. I remember being taunted on Twitter: “Oh your fund must be really struggling.” The same voices were silenced when the sector began to rally impressively last year.

When it comes to investing, every investment will have bouts of underperformance. This gets all the more amplified with a sector fund. And it is with such funds that one has to be very careful of behavioural biases.

Investors hop onto sector funds for all the wrong reasons. Herd mentality. Everyone is investing in this sector and they can’t all be wrong. I would be a fool not to. FOMO. The fear of missing out on a once-in-a-lifetime chance is a big driver. The story is too good to ignore. Recency bias. The particular fund or sector is shooting the lights out and there’s no stopping it.

Investing based on emotion is almost always a disaster. I borrowed from the insights of Alex Bryan, Director of Product Management - Equity Indexes, at Morningstar, and put it in the form of questions. Answering them should help you figure out whether you are investing with your mind or your heart.

Are you driven by the marketing spiel?

If you are really honest with yourself, it may be just that. While we all like good stories, they need not translate into good investments.

Good investment stories often seek to capitalize on well-publicized, long-term macro trends that transcend the business cycle. But good stories are often the best thing these funds have going for them; they don’t necessarily make sound investments.

Investors in these funds must get three bets right for these stories to translate into market-beating performance:

1. The macro trend must play out as expected. Yet long-term trends don’t always play out as expected. For example, in the late 1990s, investors were enamoured with Internet stocks, convinced they would fundamentally transform the economy and allow e-retailers to take market share away from brick-and-mortar stores. The story was right, but the timing was wrong. It took longer than many expected for that transition to happen, which prevented many from profiting from it.

2. Companies in the portfolio must benefit significantly from that trend.

3. Stock prices don’t fully reflect the impact of this expected growth.

Are you driven by recent performance?

Investors rarely act on a well thought out strategy. They simply gravitate towards the flavour of the year, which means that they are already behind. Individuals who invest in today’s winners are “buying backward”. They enter the fund at its peak, leaving little leeway for the investments to run. And then they have a horrible investing experience.

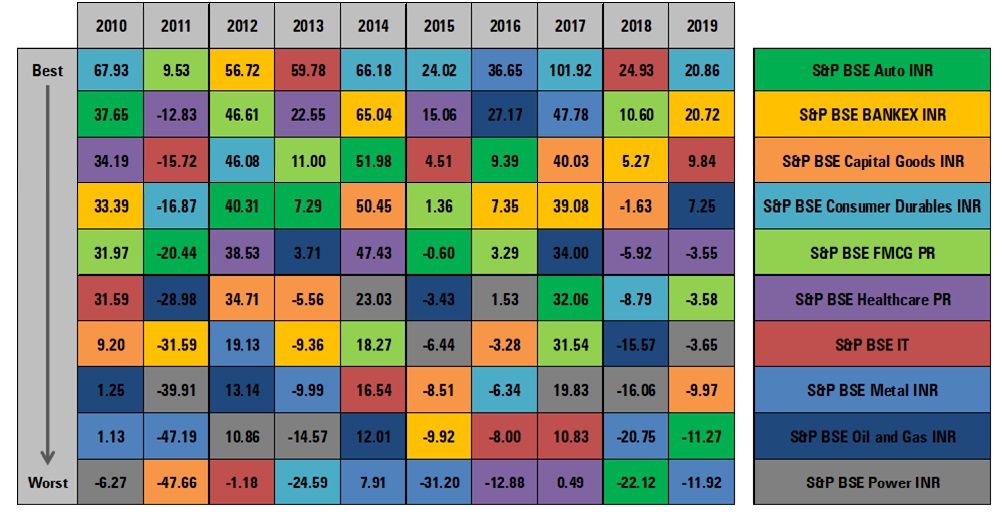

An essential characteristic of sector funds is that they can shoot out the lights one year and be a loser the next because they essentially lack the diversification to ride out trouble. One should never commit the grave error of investing in a sector fund simply because it has had a great run that year. Unlike a regular equity diversified fund, the fund manager does not have much latitude if the sector falls from favour. And the volatility can be unnerving.

Has the market appropriately priced the trend?

On the surface, the fund may seem like great ideas. They attempt to capitalize on a seemingly inevitable long-term trend. It may seem plausible that stock prices don’t fully reflect those trends, given the widely held perception that the market is focused on the short term.

Even if a trend plays out as expected and a fund is well-positioned to take advantage of it, that won’t necessarily translate into market-beating returns. The market may have already priced in that trend. Macrotrends aren’t a secret. If you know about it, the odds are so does everyone else.

The key is to identify underappreciated trends, which is no easy feat. The relationship between earnings growth and stock returns is tenuous at best, as faster-growing companies tend to trade at higher valuations, which offsets the benefit of that growth.

What matters is growth relative to the market’s expectations, not the absolute level of growth. It is difficult to forecast the impact of a trend on businesses more accurately than the market. Doing so requires more than just an understanding of the macro story, but also understanding what the market is currently pricing in and how the competitive landscape might evolve. That’s a tall order.

Have you researched your fund?

It’s necessary to look beyond the fund name to understand the exposure the portfolio delivers. Not all thematic funds will effectively profit from the growth of their targeted trend. It’s tempting to take for granted that the stocks are positioned to benefit significantly from the targeted theme. After all, fund providers wouldn’t be doing their jobs if they delivered a portfolio incongruent with the fund’s mandate.

Being a thematic or sector fund will ensure that the portfolio is narrow. But all portfolios are not equal. Not in the stocks selected, the weightage to the top 5 stocks, or the number of stocks.

Some may be pretty diversified to negate the risk, while others may decide to go all in with some really bold bets. Undoubtedly, it creates considerable upside potential for those fortunate enough to find one of the few winners. The key word being potential; the risk hovers.

Check the expense ratio. It could be pretty steep.

How much is your allocation?

Sector funds can be useful tools for investors with strong views who want to give a tactical slant to their portfolio. In areas of the market you are confident about or see an upturn in the future, you can employ a sector strategy to increase exposure. But if you invest in them, you need to understand exactly what you’re buying — and how much risk is involved.

Be geared to take a hit if your call goes wrong or takes a long, long time to fructify. And, as long as you are invested, don’t let hair-raising volatility disturb you.

Decide on your sector allocation based on your risk capacity, not on how well that particular sector is doing. Keep your allocation small, and never let a sector fund be a core holding.

What is your investment thesis?

Before you invest in a sector fund, you should be in a position to articulate your stance on why you believe that sector is likely to outperform, and what your criteria are for exiting it.

Ask yourself:

- Why do I believe that this particular sector is likely to outperform?

- What is the time frame I am looking at?

- Is this money I can afford to lose?

What is your exit strategy?

Have a harvest strategy. You know what happens to unharvested crops, right?

What is your criteria to offload? Do you have a return in mind? Then when you attain it, walk away. Don’t be upset about leaving potential gains on the table. You took a call and made money – don’t let greed mess it up.

This is a mistake I made when I invested in the pharma fund. I could deal with the fund slumping or its volatility or the long wait. But as I did not put an exit strategy in place, I have no idea when to pull out. I thought of selling in the recent run-up, but hesitated. Now it has dipped and left me indecisive.

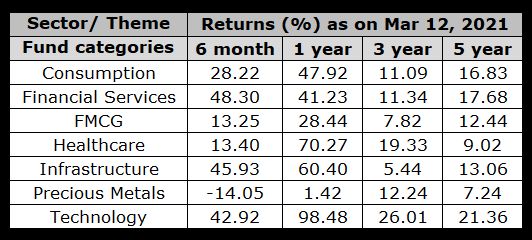

Returns above 1 year are annualised.