Canara Robeco AMC won the Morningstar Best Fund House (Equity) award for the first time owing to its superior and consistent performance in 2020 and over the long term. Read about the methodology of fund awards here.

The fund house manages assets worth Rs 28,714 crore as on February 2021. It manages Rs 16,380 crore across seven equity funds.

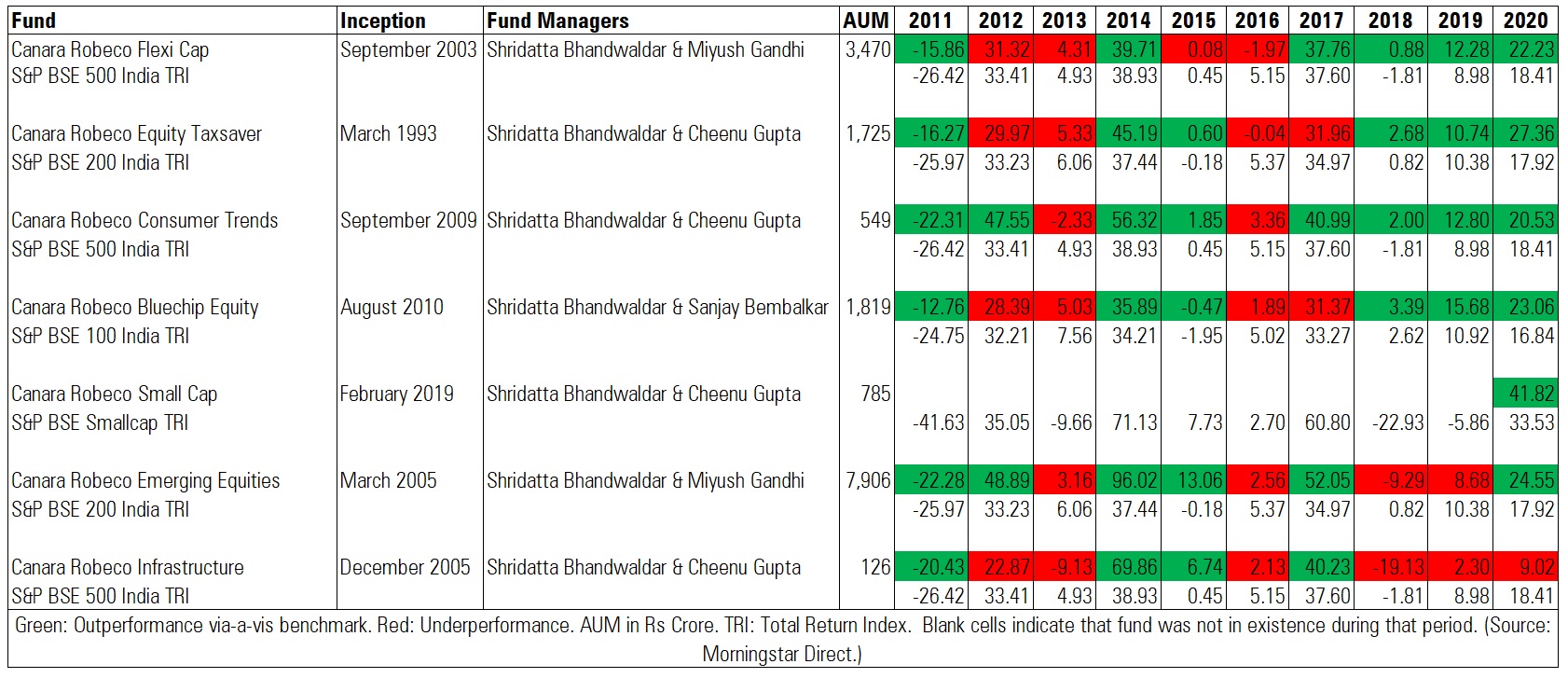

In 2020, of the total seven equity funds managed by Canara Robeco, six funds outperformed their respective benchmarks. Here is an overview of the performance of equity funds from the Canara Robeco stable over ten years.

(Click on the image to enlarge)

Nimesh Chandan, Head – Investments, Equities, Canara Robeco Mutual Fund, talks about what helped the fund house deliver this stellar track record.

There are three ingredients to delivering a consistent risk-adjusted performance.

Firstly, we need to believe and stick to our investment philosophy. Companies that have robust growth-oriented business models run by competent management and when invested at a reasonable valuation crates long term wealth for investors. Our belief and adherence to this philosophy over the years and cutting out the noise has held us in good stead.

Secondly, we have a team of investment professionals who collaborate and support each other. A team that helps each other does well in investing.

The third important ingredient is a sound investment process. A good investment process is like a diet plan. If you have a nice diet plan written on a piece of paper but don’t follow it won’t lead to desirable results. We constructed the investment process way back in 2008. Over the years, we have evolved and added certain tools and processes to make it more effective. These factors have helped us deliver consistent returns.

Learnings from 2020

In the first quarter of 2020, people underestimated the pandemic. There was a rally in the beginning of 2020 when the pandemic was spreading. There was overconfidence, followed by fear and panic. When fear grips the crowd, the smallest losses look huge. People were redeeming at that time. Myopic loss aversion (the more we evaluate our portfolio, the higher our chance of seeing a loss) prevented people from investing. In hindsight, it was a fantastic investment opportunity. When the economy started recovering and COVID cases started coming down, people started thinking that the market is moving illogically. The GDP was down, and the market was running up. People need to realise that corporate profits were growing at that time. In September 2020 quarter, there was a surprise in earnings. There was a certain underreaction to positive news flows and earnings.

We had to see if these earnings were sustainable. Each phase of this pandemic has taught us something new about human nature, crowd behaviour, and only those who were able to adhere to their investment philosophy and process gave them the strength to tide through this time and make the right decisions. It is not that we have not made mistakes. A lot of things were difficult to forecast during the pandemic. In investing, if you are right 60% of the time you do very well. You don’t need to be 100% right.

Similarities between investing and marathon

Kenyan marathoner Eliud Kipchoge became the first human to run a marathon in under two hours, covering the 26.2-mile distance in 1 hour, 59 minutes and 40 seconds. Success in running a marathon is akin to success in investing. While trading maybe 100 metre sprint, where you look for one patch of performance, investing over the long term is like running a marathon. You have to see that you don’t exhaust yourself mid-way. You have to be a consistent performer over the long term. Sprinting takes a lot of physical effort. Running a marathon is also a mental effort. Eluid chose the right track and climatic condition so that he can perform to his best. Eluid used some special customised shoes for his run. Similarly, in investing, leveraging technology is important. It can be a small screener or a quant model, which helps you in making decisions.

Shridatta Bhandwaldar, primary fund manager for Canara Robeco’s seven equity funds, talks about the stock selection process of the fund house.

We aim to invest in quality businesses with strong management. Within that framework, we try to find segments where earnings delivery is expected to be superior relative to others. Quality doesn’t necessarily come from fast-moving consumer goods or FMCG sector only. Quality companies exist in other sectors as well. For instance, over the last five years, auto, which is equally good quality, has been underperforming because earnings growth has been tepid. The non-auto discretionary space has done well because earnings growth has been superior. In all our equity funds, we try to anticipate which firms could have superior earnings.

Growth versus value

We have been following growth style in our portfolios over the last few years. We look at valuation and growth in a context. Growth rates also go through cycles be it in individual securities and sectors. We look at the expectations that are built in the valuations and whether the growth rate is keeping pace with that valuation. As long as growth continues, we are willing to sacrifice on valuations because you can’t get great growth at a cheap valuation.

When somebody is buying a stock at 30 Price to Equity, or PE, versus someone who is buying at 10 PE, both investors believe that the earnings growth will be superior going ahead. Both growth and value investors see value in a stock and thus they are buying them.

Value does well when you have exceptionally good nominal Gross Domestic Product, or GDP, growth for five to seven years. Value businesses are beneficiaries of the system growth rather than on internal capabilities of the business itself. It can’t be one against the other. Value investors need to have a longer time horizon. If we get a high growth company even if it is at a slightly higher valuation, that is our first preference. If we get a stock where it is currently value, but the earning prospect is changing and there are discernible time-bound drivers, we will not hesitate to buy such stocks. Wealth creation is a function of earnings growth. Every cheap stock is not value and most of them could be value traps. There are only a few stocks where value realisation actually happens.