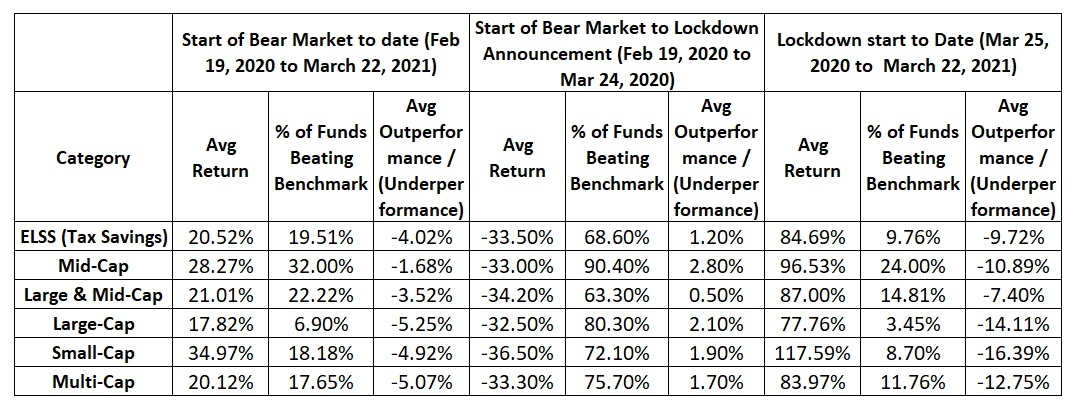

Despite markets witnessing a sharp correction in February and March 2020 ensuing the Corona pandemic, the sharp bounce-back in markets has helped most categories of equity funds deliver good returns.

Since the lockdown imposed on March 25, 2020, broader markets have recovered over 70%, but during this period most active managers have underperformed their benchmarks.

Bear Market and Lockdown Period Performance

Why funds struggled to beat benchmark

While active fund managers have found it difficult to beat the benchmark over a one-year period, their performance over the medium term (three to five years) has shown better success rates relative to the benchmark. For instance, only 24% of mid cap funds outperformed their benchmark over a one-year period (as on March 22, 2021). Over a five-year period, 52.38% of mid cap funds outperformed their benchmark. The polarization of markets witnessed in 2018 and 2019 has now diminished and the sharp bounce back witnessed since March 2020 has been broad based.

"There are a number of reasons for the underperformance of funds. First, remember that some stocks like Reliance Industries led the rally last summer but mutual funds were barred by regulations from having more than 10% of their assets in a single stock. Second, actively managed funds have underperformed in bull markets historically. Third, the market concentration of the earlier years gave away in the latter part of 2020 to a wider set of stocks rallying. Active managers who run a growth style did relatively underperform," said Kaustubh Belapurkar, Director - Manager Research, Morningstar Investment Adviser India.

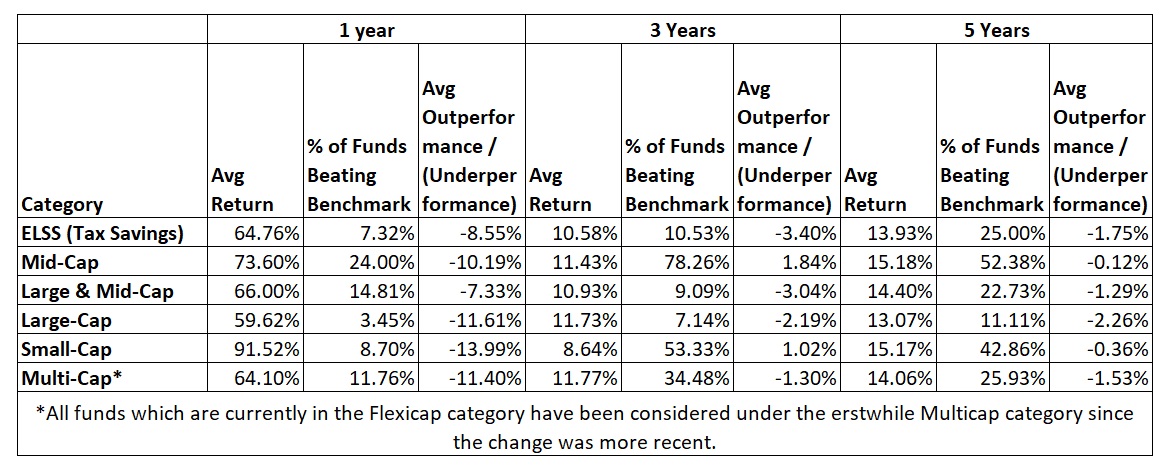

Long Term Fund Performance

Fund’s success rate improved with time

Over a one-year period, while the average returns across all categories of funds was high, most funds found it difficult to beat their respective category benchmark. The average magnitude of underperformance ranged between -7.33% to -13.99% across various categories.

Over a longer timeframe i.e. three-years, the number of funds outperforming the category benchmark saw a stark improvement across most categories. For instance, over 75% of the midcap funds outperformed the category benchmark over a three-year period and the average outperformance was around 1.84%.

On the other hand, when it came to large and midcap funds, only 9.09% of funds outperformed the category average. Since most funds underperformed the category average, the average outperformance of the category too over a three-year period was -3.04%.

The scenario over a five-year period has been similar where funds have shown improvement when it came to beating the benchmark relative to their one-year performance. However, the average range of outperformance/underperformance hovered between -2.26% and -0.12%.

Don’t fear volatility

Markets are always volatile, and investors should not be worried when they see a correction due to certain events or news. Rather, such corrections are a good opportunity to increase allocation to equities.

While equity markets are volatile and funds can often underperform in the short run, investors should continue to invest in sync with their asset allocation. If you are under-allocated to equities as per your risk profile, continue to allocate systematically towards equities. Keep at least a 7-10 year investment horizon in equities.

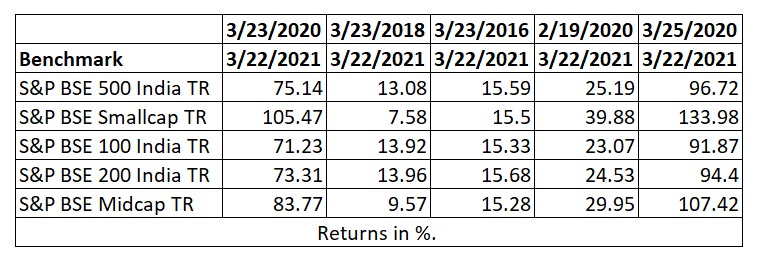

Benchmark indices considered

Only regular growth plans have been considered for calculation purpose in the tables considered above. The data provided above is for information purpose only and should not be construed as investment, taxation and/or legal advice.

(Data Source: Morningstar Direct.)