According to Forbes, there are 2,755 billionaires. That is a lot of filthy rich folks on this planet. Jeff Bezos is the world’s richest for the fourth year running, followed by Elon Musk. In the top 10, eight are based in the U.S., one in France and the other in India. You can check the entire list here.

On the subject of billionaires, my mind goes to Ruchir Sharma who often shares his views on wealth and inequality. Sharma is the chief global strategist at Morgan Stanley Investment Management, and author of Ten Rules of Successful Nations, Breakout Nations and The Rise and Fall of Nations.

Though he penned these words in different publications, years apart, the similitude is glaring.

Wall Street Journal, July 2014 - Liberals Love the 'One Percent'

Talk to anyone on Wall Street. If they are being frank, they'll admit that the Federal Reserve's loose monetary policy has been one of the biggest contributors to their returns over the past five years.

It has kept interest rates near zero in an effort to combat the great recession of 2008-09 and nurse the weak economy back to health. Many analysts will argue that the recovery might have been even worse without the Fed's efforts. Meanwhile, the stock market has never been so high at this point in a recovery. This is the most powerful post-recession bull market in postwar history, with the stock market up by a record 135% over the past five years.

The Fed can print as much money as it wants, but it can't control where it goes, and much of it is finding its way into financial assets. It's no secret who owns most of these assets. The wealthiest 1% of households, according to a study by Edward Wolff (National Bureau of Economic Research, 2012), now owns 50% of all financial wealth in the U.S., and the top 10% owns 91% of the wealth in stocks and mutual funds.

Financial Times, May 2021 - The billionaire boom

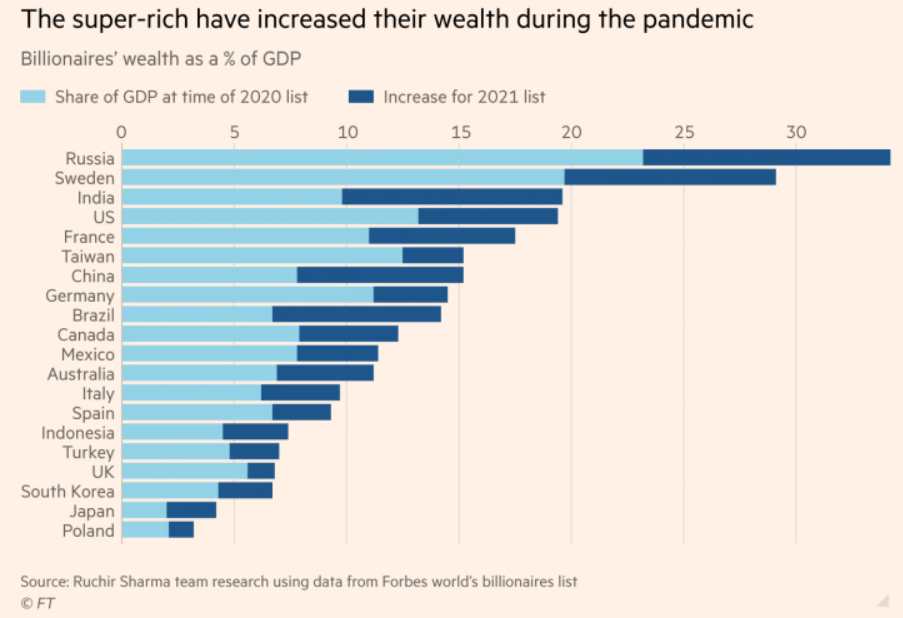

Over the past two decades, the global population of billionaires rose more than fivefold and the largest fortunes rocketed past $100bn.

The pandemic has reinforced this trend. As the virus spread, central banks injected $9tn into economies worldwide, aiming to keep the world economy afloat.

Much of that stimulus has gone into financial markets, and from there into the net worth of the ultra-rich. The total wealth of billionaires worldwide rose by $5tn to $13tn in 12 months, the most dramatic surge ever registered on the annual billionaire list compiled by Forbes magazine.

Economic inequity has always been a defining trait of human existence. In 1872, Victoria Woodhull, the first woman to run for president of the U.S., stated that it is not great wealth in a few individuals that proves a country is prosperous, but great general wealth evenly distributed among the people.

What a lovely thought.