Given that we are in the last month of the year 2011, the ongoing scenario suggests a high possibility of equity markets ending the year sharply down, first time after 2008. One of the major reasons for the same is the un-favorable global economic environment that has haunted equity markets worldwide since the beginning of this year. Indian markets have also faced the brunt of the falling global markets and has traded with downward bias for larger part of the year.

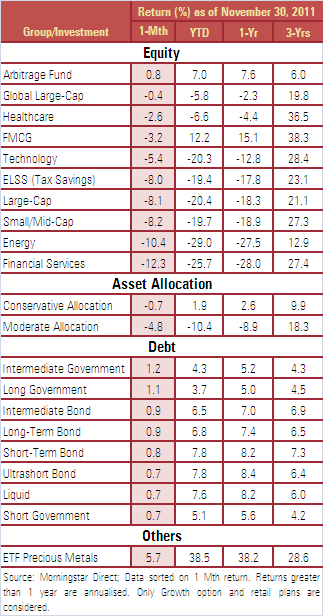

The scenario in November was no different. Continuing global economic uncertainties, coupled with a series of weak domestic economic data releases, hurt overall market sentiment. The Sensex and the Nifty tanked by almost 9% during the month. Mid cap and small cap stocks were hit the most and therefore significantly underperformed their large cap peers. Both the BSE Mid-cap and BSE Small-cap indices shed 10.6% and 12.6% respectively. As a result, all the equity-oriented mutual fund category (except for Arbitrage funds) ended the month sharply lower. International equity funds, which delivered an average return of -0.4% during the month, was the second best performing category (after Arbitrage funds) during the month. Better performance of the US, Europe and some of the emerging markets restricted the fall in these funds.

Arbitrage funds managed to have their share of glory

The volatility in the markets is something Arbitrage funds breed on, and given it was in abundance in November helped them to top the charts within the equity segment. A typical Arbitrage fund tries to spot the difference in the price of a stock in the cash segment and its future contract in the futures market. It uses arbitrage opportunity by buying the stock and selling its future contact if the latter is trading at a higher value. In this way, it locks the return (which is the difference in the price) at the time of the trade. This type of investment strategy makes arbitrage funds market neutral as they reverse the position at expiry of future contract. Hence, it ensures that the returns do not tread into negative territory. Arbitrage funds are best equipped to deliver in volatile times when there is enough arbitrage opportunity.

In the month of November, arbitrage funds clocked a return of 0.8%, making it the only equity-oriented category with positive returns. While other equity-oriented mutual fund schemes treading in negative territory due to falling markets, arbitrage funds unique structure and investment proposition helped them to clock good performance on a year-to-date basis as well as over one-year period.

FMCG, Healthcare and technology funds fare better than traditional equity funds

FMCG and Healthcare sectors, which are popularly known as defensive sectors, fell relatively less in low single digits during the month. The BSE FMCG and BSE Healthcare indices fall by 1.32% and 3.71% respectively. The same was reflected in the performance of FMCG (-3.2%) and Healthcare (-2.6%) funds during the month.

FMCG funds are the top performing funds on a year-to-date basis as well as over one-year period. What has helped the category is the defensive nature of FMCG sector, and more recently, fall in food inflation.

IT sector also fared relatively better in November with BSE IT Index falling by 5.65%. Subsequently Technology funds fell by 5.4% during the month. IT stocks declined mainly due to euro-zone debt concern given Europe is the second largest market for Indian software exporters after the US. However, the fall was restricted due to the sharp depreciation in the rupee / dollar rate in November.

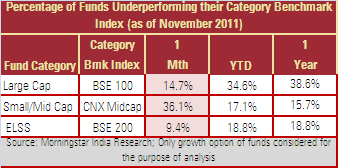

Most equity funds managed to outperform their category benchmark indices in November

Unlike October, a bulk of the equity funds (in Large Cap, Mid Cap and ELSS categories) outperformed the category benchmark indices in the month of November. This could have been due to outperformance of certain sectors such as Healthcare, FMCG and Capital Goods to which these funds have exposure. On an YTD basis in 2011 as well, most equity funds have managed to outperform their category benchmark indices. Large cap funds did witnessed a tough time outperforming their benchmark indices as almost 35% of the funds in the category have underperformed the category benchmark index (BSE 100). Refer to table below for underperformance analysis of key equity fund categories versus the respective category benchmark index.

Intermediate and Long-Term Government Bond funds finally got a boost

On the fixed income side, the scenario was a tad better. The yields fell sharply in the one-year, five-year and 10-year segments. However, they rose in the three-month, 20-year and 30-year segments and remained unchanged in the six-month segment. The yield on 10 year benchmark 8.79%, 2021 bond ended 16 bps lower during the month. The Reserve Bank of India’s effort to ease liquidity crunch in the market by buying bonds through open market operation boosted market sentiments. Also, expectation that RBI will not hike policy rates in its forthcoming monetary policy review on December 16, 2011, owing to the slowing of Indian economy, kept sentiments upbeat. This helped debt-oriented mutual fund schemes, especially Intermediate and Long-Term Government Bond funds to outperform other debt funds during the month.

While Intermediate Government Bond funds delivered an average return of 1.2%, Long-Term Government Bond funds registered an average return of 1.1% in November. This was in stark contrast from October when both the categories were the worst performer within the fixed income segment. Expectedly, Ultrashort Bond funds, Liquid funds and Short Government Bond funds found themselves at the bottom within the fixed income segment.

Gold retains its glitter

Starting-off from where it left last month, Gold continued its upward march in November as well. Consequently, Gold ETFs delivered an average return of about 6% during the month. This brings the YTD return clocked by Gold ETFs to an impressive 38.5%.