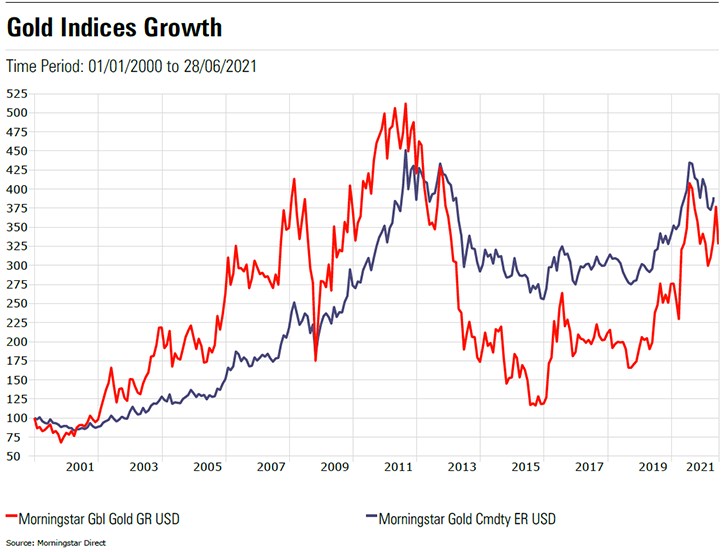

The price of gold has grown on average 11% a year over the past 20 years, outpacing both the consumer price index (inflation) and cash savings.

As with previous recessions, gold drew attention at the start of the Covid crisis, which began at a time where the supply chain was already struggling to get enough raw materials to satisfy demand. This led to substantial price growth.

Several factors affected gold’s price during the Covid pandemic. First, the metal saw a surge in demand as investors rushed to protect themselves in case of recession, before an easing off as vaccines were rolled out and economies began to reopen. Many investors looked to increase exposure to the metal again as inflation rises, but demand has again tailed off as the U.S. Federal Reserve signalled it could raise interest rates earlier than expected.

According to this article in Economic Times, Swiss gold accounted for almost half of India’s imports of the yellow metal, at $16.3 billion, in 2020-21. India imported gold worth $34.6 billion last fiscal against $28.2 billion in the previous year despite the raging Covid-19 pandemic. Among India’s top 10 import partners, inbound shipments increased from Switzerland only in the last fiscal, up 7.8% to $18.2 billion, led by gold.

Gold exchange-traded funds (ETFs) in India attracted Rs 1,328 crore from investors in the quarter ended June 2021. In comparison, inflow in the category was at Rs 2,040 crore in the same quarter last year, according to data available with Association of Mutual Funds in India (Amfi).

Stuart O’Reilly, market insight analyst at The Royal Mint

During a recent Royal Mint webinar, he noted that gold’s rally predates the pandemic - the price of the yellow metal climbed 18% against the USD in 2019. He adds, however, that following a crisis, the gold price tends to stabilise at a higher level.

The Royal Mint says there are three key market developments to watch:

- changing monetary policy due to inflation risk, low interest rates and government debt

- central banks actions such as crisis performance and de-dollarisation

- pent-up demand for jewellery

Steve Land, lead portfolio manager of the Franklin Gold & Precious Metals Fund

The path to a full global recovery is unlikely to be smooth. Despite notable improvement in the U.S., China and elsewhere, the global economy is still under extreme stress after a year of pandemic-induced lockdowns.

Inflation will be important for many countries as they look to deflate their way out of the debt accumulated from the crisis – debt which due to inflation, will be worth less over time. And as a result, regional demand for gold could be driven up.

Of course there is speculation that Bitcoin and other cryptocurrencies might be the new gold, replacing the yellow metal in some investors’ minds as an inflation hedge. However, there are significant differences in the way many governments view and treat cryptocurrencies as compared to gold. Government regulations are a major risk factor that does not exist to the same degree for gold given the long history and central banks’ heavy involvement in the gold market.

Although the pullback in gold from the 2020 highs is noteworthy, the opportunities in gold- and precious-metals-focused equities are compelling, especially if gold prices can hold current levels or move even higher.

More consolidation could take place, with mergers and acquisitions already happening in 2021. Small- and mid-cap gold equities may present some of the best M&A opportunities, as mining companies seek more resources following years of limited exploration and development.

Paul O’Connor, head of multi-asset at Janus Henderson

Even gold has a history of not living up to its reputation as an inflation hedge. For example, from last summer and into the spring, it traded lower despite a reflationary market environment. We expect real yields to head higher in the months ahead as investors focus on central banks’ QE exit strategies. Rising real bond yields will present significant headwinds for gold.

Louise Fribourg, tactical asset allocation analyst at Fidelity Solutions & Multi Asset

Currently neutral on the prospects for gold overall, but have been adding to white metals (such as Silver and Platinum) as an inflation hedge, with some exposure to industrial activity. Over the coming months, the key for investors will be to understand the nature of current inflationary dynamics. We believe them to be transitory, but any change to this and evidence of more persistent inflation could mean a re-think of exposure to gold for many investors.