While we are all aware that costs and fees have an impact, I sought to illustrate it clearly.

Annual Investment

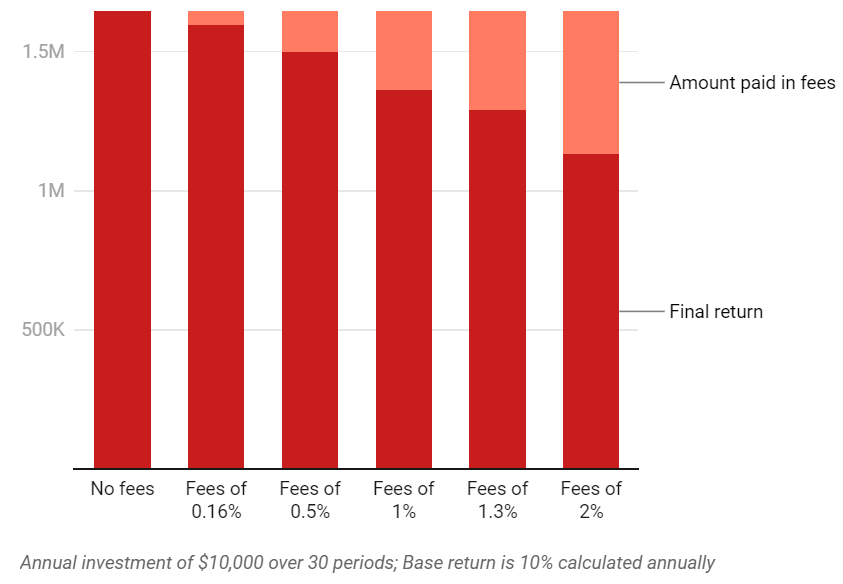

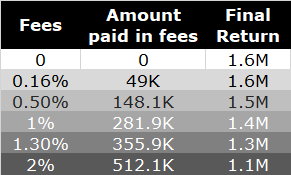

I calculated the returns for five hypothetical portfolios, over a period of 30 years. Each portfolio started off with investing $10,000 a year. Over the next 30 years they each earn the same hypothetical return of 10%.

The portfolios were identical in every respect except that the annual fees range from 0.16% to 2%.

Predictably, large differences in fees create large differences in returns. The investor paying 2% in fees is $460,000 worse off than someone paying 0.16%.

But tiny differences are significant over the long span of three decades. The difference between 1% and 1.3% equates to an extra $74,000 in retirement; between 0.5% and 0.16%, $99,000.

Lumpsum Investment

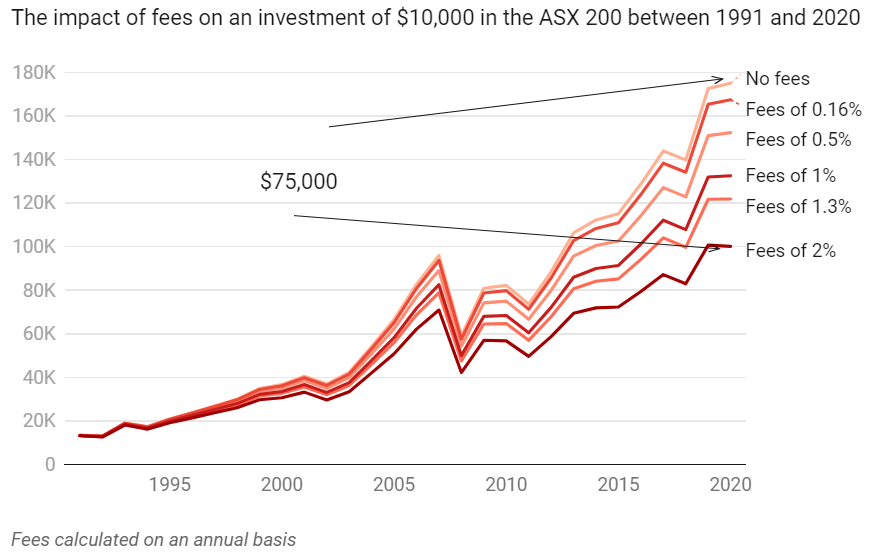

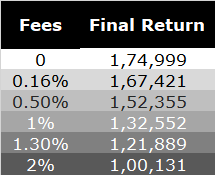

It’s a similar story if I track a lump sum invested in the ASX 200, Australia's leading share market index comprising of the top 200 ASX listed companies.

Had my parents invested $10,000 in 1991, when I was born, I’d be looking at $175,000 at the end of 2020, assuming no fees.

Had they paid fees of 2%, I’d be down $75,000 to $100,000; a hefty 43% haircut.

The impact of fees is barely visible at first. The large divergence in outcome is only visible over decades.

When evaluating mutual funds, fees are one of many important metrics for investors to assess, including performance, size, liquidity and management.

Read the original article here.