Would you pick a cricket team with only 11 top batsmen? Absolutely not. Your team wouldn’t be able to bowl out the opposition. Would you have the same team play in tests, ODIs and T20s?

Probably, not all players are suited for all formats and may not adapt to varying playing conditions essential for winning. Similarly, investing in a single asset class such as Indian equity or debt or gold or real estate may not be suited to varied market cycles and may not help achieve one’s financial goals.

Each asset class has its own risk and return characteristics due to which its performance varies in different market conditions. For instance, equities are volatile over short-term periods but carry the potential to generate superior returns over the long term. Within equities as well, risk & reward varies across segments such as large, mid & small cap or domestic and international markets. Mid & small caps carry higher return potential but tend to be more volatile than large caps.

Similarly, Emerging market performance fluctuates more than that of developed markets. Debt performs well in a softening interest rate environment and importantly acts as a cushion in one’s portfolio when equities are witnessing significant volatility (e.g. debt outperformed in 2008-09 during the Global Financial Crisis and at the onset of the pandemic in March 2020).

Similarly, gold outshines during periods of significant economic or market uncertainty. Multi-asset investing is about building a portfolio with a mix of asset classes that react differently to varying economic or market scenarios, thereby helping generate superior risk-adjusted returns across market cycles. Going back to the cricketing analogy, it’s like building a team with a good mix of batsmen, bowlers and all-rounders suited to the playing conditions and format.

Here are the three reasons why multi-asset investing is essential: 1 Diversification is key, 2 Reduces risk, and 3 Potential to generate superior returns if managed well.

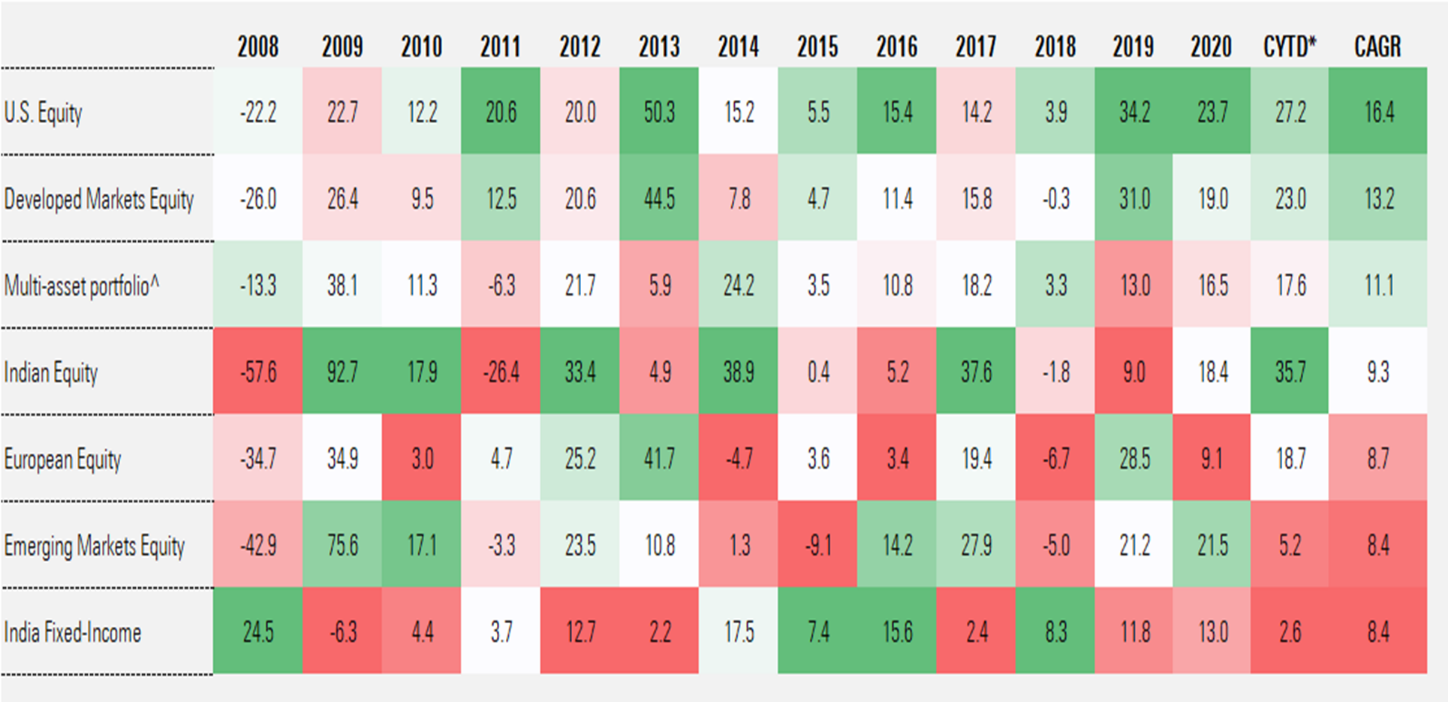

1. Diversification is key: Asset class performance varies across time periods making it difficult to predict losers and winners on a year-on-year basis. The image below outlines the calendar year-wise returns (in INR) for various asset classes/markets. The best performing asset for each year is marked in a dark green shade and the worst performer in red. A closer look at the chart indicates that winners in certain years were losers in subsequent periods and vice-versa. For instance, Indian equity outperformed in 2009 and 2010 but turned out as the worst performer in 2011. When global equity markets witnessed sharp corrections in 2008, Debt outshined. In 2013 and 2019, when Indian equity generated poor returns, international equity markets such as US and Europe witnessed superior performance. On a CAGR basis, developed markets driven by US equities have outperformed Indian equity since 2008.

Global winners and losers: The benefits of diversification

(Source: Morningstar Direct, returns as on October 05, 2021; ^Composite index constituting S&P BSE 500 TR Index (40%) + MSCI ACWI (10%) + S&P GSCI Gol Spot (5%) + CCIL All Sovereign TR Index (45%). Performance of Indian Equities is represented by S&P BSE 500 TR Index, of Developed Market Equities by Morningstar Developed Market Index, of Emerging Market Equities by Morningstar Emerging Market Index, of U.S. Equities by Morningstar U.S. Market Index, of Europe by Morningstar Europe Index, and of India Fixed-Income by CCIL All Sovereign Bond Index. This is for illustrative purposes only and not indicative of any investment. CAGR performance shown is from January 2008 till date.)

Why does asset class performance vary across time periods? Each asset class tends to have different economic or return drivers resulting in varied performance across time. For instance, Indian equity provides exposure to Indian economic drivers and would perform well during positive domestic economic & corporate earnings cycles and underperform in an economic downturn (for e.g. 2008, 2018 & 2019). International equities, on the other hand, provide exposure to global economic drivers and a hedge against the local currency - INR depreciation improves returns for Indian investors investing into international markets. Interestingly, a multi-asset portfolio (40% India equity, 10% global equity, 45% India fixed income and 5% Gold) hasn’t been at the bottom of the chart in any year and has outperformed several assets over time, highlighting the essence of diversifying one’s portfolio across asset classes and markets.

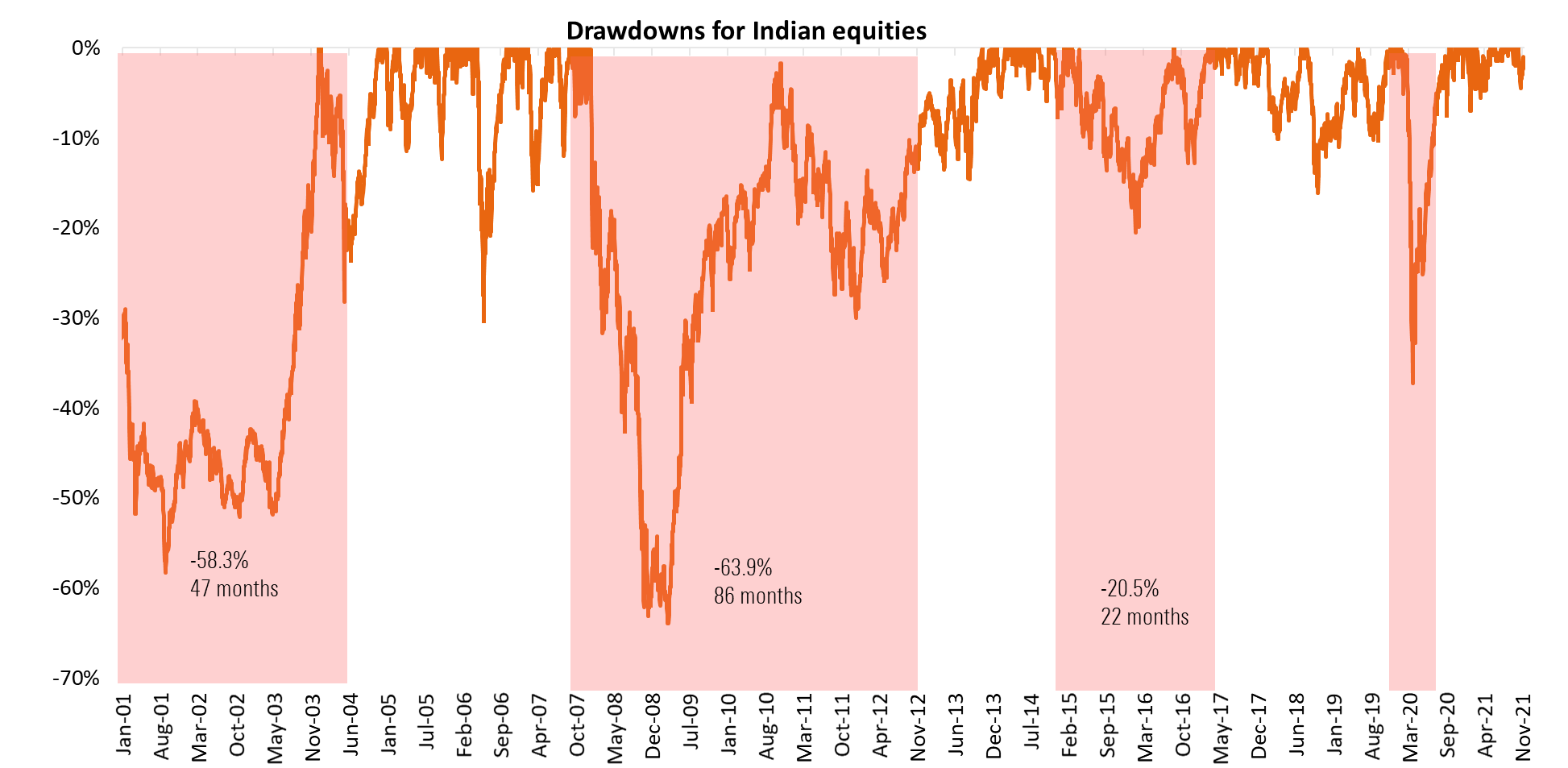

2. Reduces risk: Indian equities have performed well over time but have encountered sharp drawdowns and long recovery periods from time to time. Drawdown is the maximum fall in the value of a security or index during market downturns. And the recovery period indicates the time taken to recover the initial value of investment. The chart below indicates periods when Indian equities have witnessed drawdowns of more than 20% and the subsequent recovery period. For instance, if one had invested Rs 100 in Indian equities at the market peak in January 2008, its value fell by 64% to Rs 36 during the Global Financial Crisis and it took around 86 months to recover the initial investment of Rs 100!

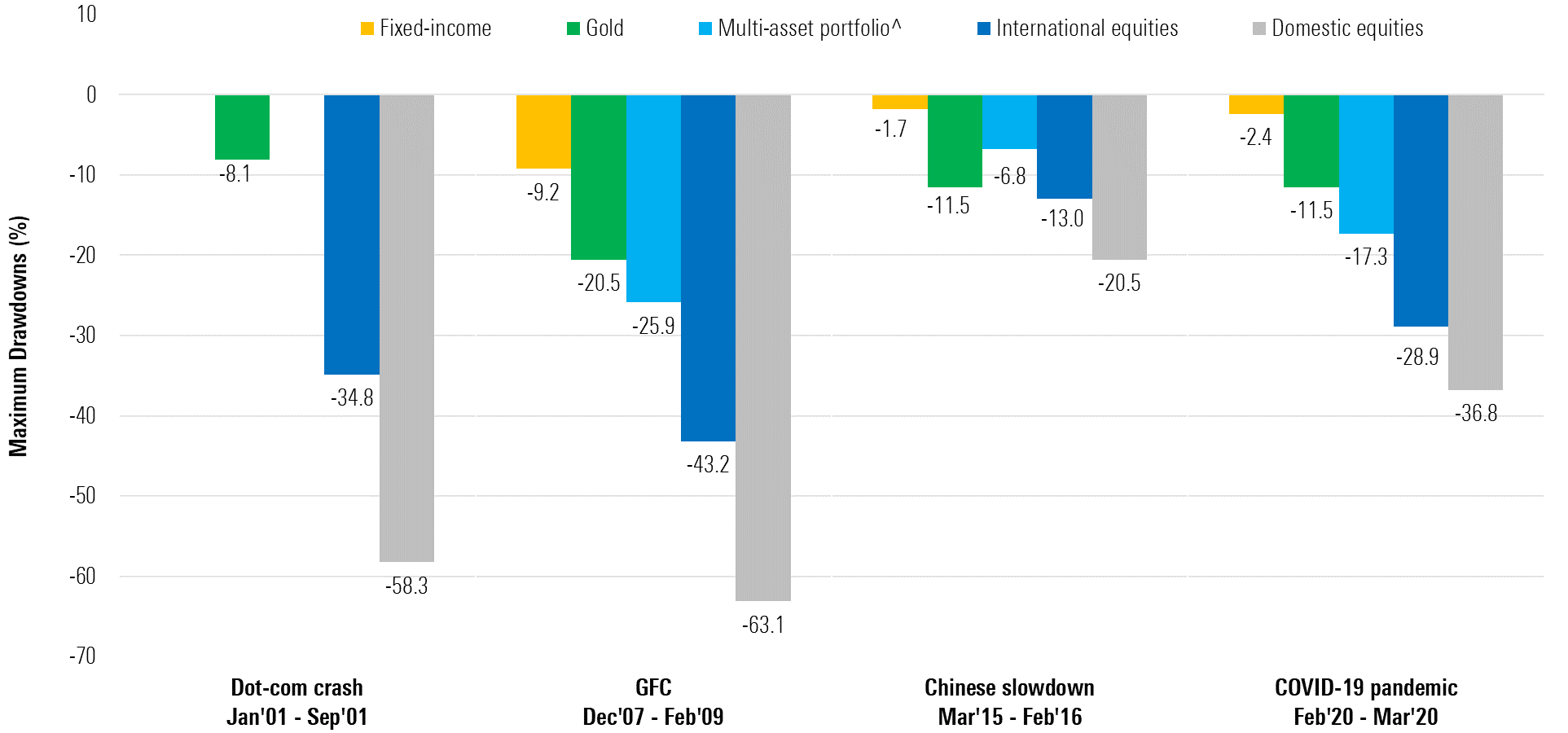

Several asset classes have witnessed lower drawdowns during crisis periods, as depicted in the chart below. Markets / asset classes perform differently, in terms of risk & return, due to less than perfect or at times low correlation of one asset vs others. In other words, asset classes don’t typically move up and down to the same extent across market cycles. This signifies that a multi-asset portfolio would cushion the portfolio during downturns compared to an equity-only portfolio by reducing drawdown risk.

Drawdowns across asset classes & multi-asset portfolio

Source: NSE, Factset, MSCI, Morningstar Direct. Indexes Used in INR: S&P GSCI Gold Spot, CCIL All Sovereign TR, MSCI ACWI GR, MSCI India GR. ^Composite index constituting S&P BSE 500 TR Index (40%) + MSCI ACWI (10%) + S&P GSCI Gold Spot (5%) + CCIL All Sovereign TR Index (45%)

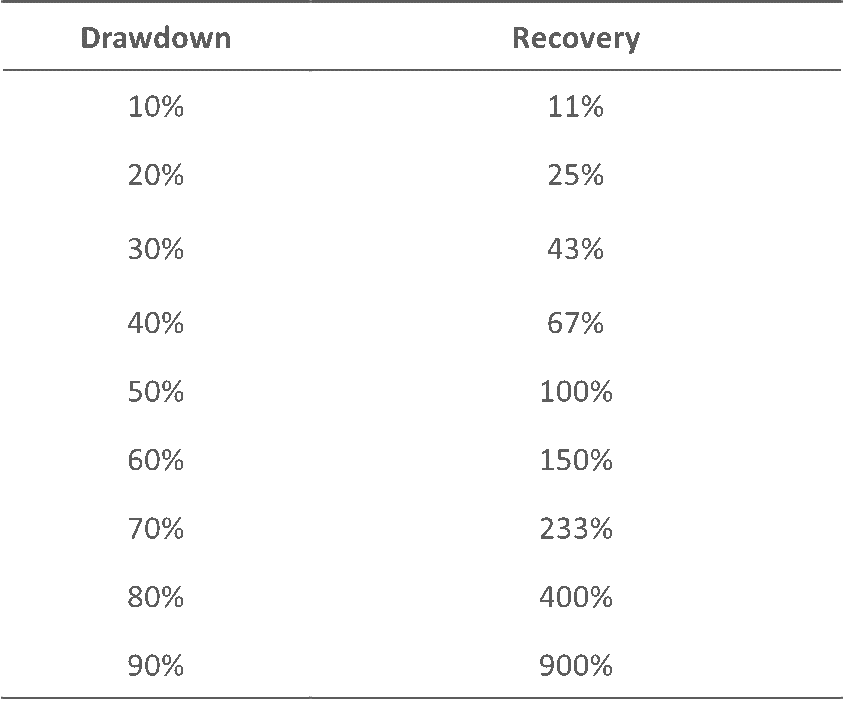

And why is it vital to reduce drawdown risk? As drawdowns increase, the subsequent market performance required for recovery needs to be higher than the drawdown percentage. The table below indicates the upside needed to recover from drawdowns.

3. Potential to generate superior returns: Research points to the fact that expected returns for asset classes vary over time in ways that are predictable, creating opportunities for investors to enhance returns. Morningstar Investment Management’s investing approach is geared toward opportunistically finding assets that are priced to deliver expected higher returns while keeping a long-term perspective. We call this valuation-driven asset allocation. Benjamin Graham, the grandfather of value investing, said, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” Said another way, markets measure sentiment in the short term, but real value drives returns over time.

Understanding the difference between price and value is an important point for asset allocators. We believe that in the very long run equity returns are almost entirely driven by fundamentals as measured by total payout yield (including dividend yield and share buybacks) and earnings growth. This insight puts the onus of long-term investing on a deep understanding of fundamentals.

Thus, the focus of valuation driven asset allocation today is to gain an in-depth understanding of the assets that we invest in. Our asset class team of dozens of investment professionals helps us uncover these opportunities around the world, as do the data and analysis from hundreds of analysts from Morningstar Inc., and its subsidiaries.

In India, Morningstar offers a range of multi-asset portfolios investing in Indian equities, fixed income and international equities, suited for various investment timeframes and risk appetites. Our approach is designed to buy assets when they’re trading at a discount to their fair value, and underweight assets that trade at a premium.

Buying assets that offer high expected returns given our forward-looking estimate of fundamentals is the hallmark of our valuation-driven asset allocation process. In conclusion, we view successful investing as finding assets that trade at a discount to their intrinsic value. It sounds simple, but it’s not easy. Five decades of asset allocation have taught us that it requires a long-term mindset, a deep understanding of fundamentals, a repeatable framework for decision-making, a willingness to go against the crowd, as well as an awareness of the capital cycle.