Why is asset allocation always between equity and debt? Is it right to do asset allocation and rebalancing between gold and equity mutual funds?

Does asset allocation and balancing between gold and equity (50:50) give more return than 100% equity?

Diversification is an important aspect to look at while building your portfolio, as it cushions the portfolio against any adverse movements in a single asset class/security. Asset classes (equities, fixed-income, gold, commodities, real estate) and even securities within an asset class respond differently to the same set of economic drivers, and hence the benefits of diversification.

Diversification is the basic premise of asset allocation.

The idea behind effective diversification is taking exposure to assets which behave differently to the same set of factors. Hence, an asset allocation-based approach (mix of various assets) is advisable for investing towards one’s goal, as it improves the risk-reward potential of the portfolio and provides for a less volatile portfolio experience.

However, it is advisable to get your risk appetite assessed before deciding upon the asset allocation, as it should be in line with the risk appetite of the investor.

As mentioned above, asset allocation need not always be only between equity and debt, it can involve any combination of assets classes. But since you specified equity and gold, let us look at them.

Fixed-income lends stability to the portfolio.

Equities play a crucial role in wealth generation over the long run with a potential to deliver superior inflation-adjusted returns compared to fixed-income.

Gold plays an important role as a diversifier in a portfolio due to its low correlation with other asset classes and is seen as a safe-haven asset in times of global risk-off sentiment. It is seen as a store of wealth and as a hedge against inflation and currency depreciation.

(click on images to enlarge)

Gold’s importance as a diversifier has been re-instated even as recently as early 2020, as it witnessed a drawdown of only 11% (S&P GSCI Gold Spot index) compared to 38% drawdown by domestic equities (S&P BSE 500 TR Index) in the COVID-19 pandemic led sell-off in global markets.

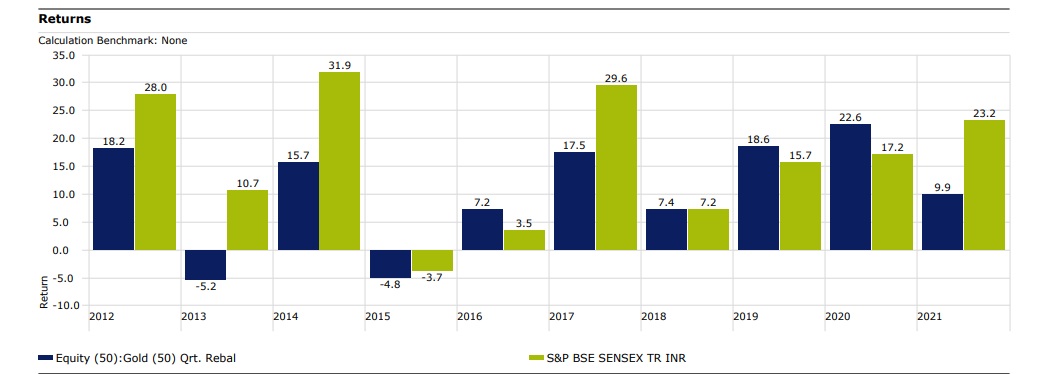

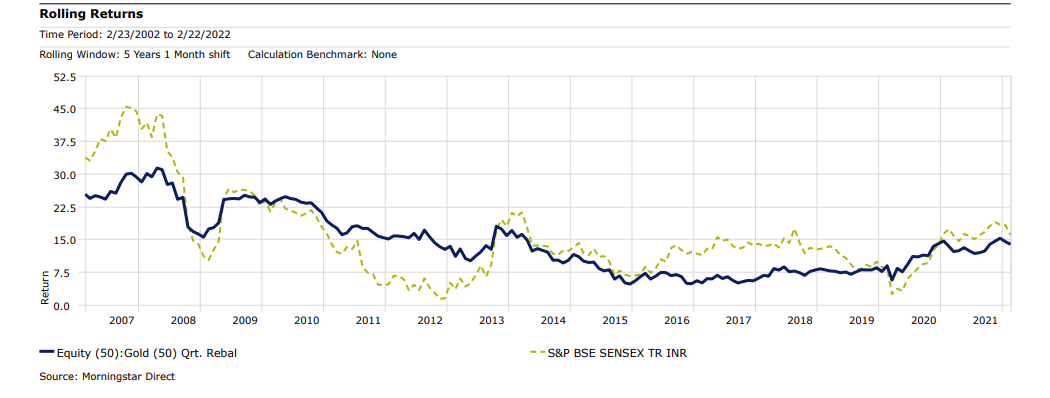

The chart shows (CY returns) that a portfolio of 50:50 equity (S&P BSE Sensex TR Index) and gold (S&P Gold TR Index) has outperformed an equity only portfolio in 3 of the last 5 calendar years. Even over longer time frames, it has outperformed an equity only portfolio over several 5-year periods (see rolling returns chart).

Apart from debt and gold, one should also consider allocation to international equities (10-25% of your equity allocation) which offer exposure across geographies with exposure to diverse economic growth drivers, and also provide a hedge against the depreciation of the rupee. International equities have less than perfect correlation with domestic equities providing diversification benefits to the portfolio.

Do read

Valuations play a crucial role while entering any asset class /security. Lower (cheaper) valuations reduce the risk of high future capital loss and improve upside potential, and vice-versa. One should be cognizant of the prevailing valuations at the time of investment, and make allocations accordingly.

Do read: Look at valuations, not index levels

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.