As the name suggests, Dynamic Bond Funds have the leeway to manage their duration or maturity depending on where the fund managers predict interest rates are headed.

As interest rates are currently headed northwards, the Dynamic Bond Fund category is currently maintaining effective maturity of 3.49 years. Fund managers who are expecting interest rates to go up will typically have a shorter duration. Funds like IDFC Dynamic Bond Fund (99%) and Mirae Asset Dynamic Bond (75%) are holding a larger portion of their portfolio in securities of 3 to 5 year maturity bucket.

In comparison, Long Duration Funds are holding effective maturity of close to 12 years. By definition, the Securities and Exchange Board of India (SEBI) mandates that Long Duration Funds maintain Macaulay Duration of more than seven years.

Medium to Long Duration Funds maintain effective maturity of close to 7 years. Similarly, Medium to Long Duration Funds maintain Macaulay Duration between four to seven years.

In contrast, Dynamic Bond Funds do not have any restriction on the duration or maturity of the securities they invest in.

Where do they invest?

These funds invest in a mix of government securities (central and state), corporate bonds, and keep some portion in cash. As of April 2022, two funds are holding more than 90% of net assets in government securities - IDFC Dynamic Bond (99%) and Nippon India Dynamic Bond (95%).

Funds like ITI Dynamic Bond, DSP Strategic Bond, L&T Flexi Bond, and Quantum Dynamic Bond are holding more than 70% of net assets in Money Market instruments, which have a maturity period of less than a year.

Performance during different rate cycle

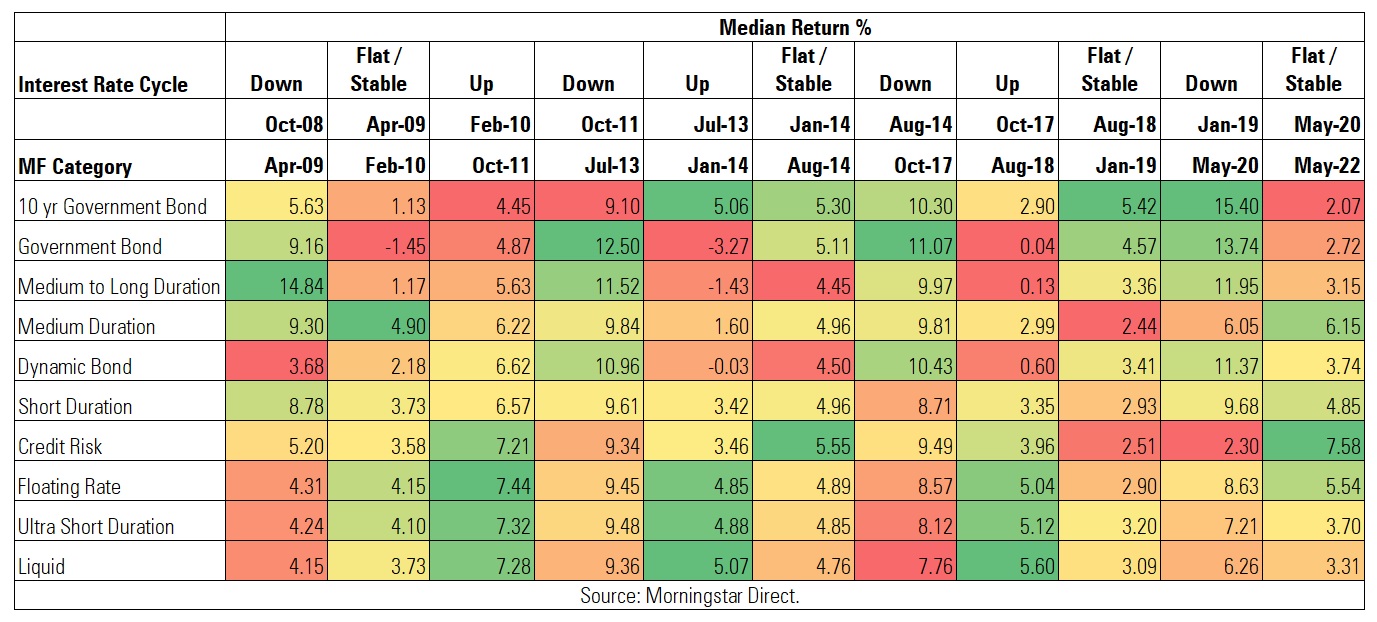

We looked at the performance of Dynamic Bond Funds from October 2008 till May 2022 during rate hikes, dips and stable periods.

Dynamic Bond Funds delivered double digit returns during a falling interest rate regime. From October 2011 till July 2013, when the policy repo rate fell from 8.50% to 7.25%, Dynamic Funds category delivered 10.96% annualised return, outperforming other categories like Liquid, Ultra Short Duration, Floating Rate, Credit Risk and Short Duration funds and Medium Duration funds.

However, during upward rate cycle (July 2013 till January 2014), these funds delivered negative -0.03%. Similarly, from October 2017 till August 2018, when policy rate went up from 6% to 6.5%, Dynamic Bond fund category delivered a paltry 0.60%, underperforming other categories like Liquid, Ultra Short Duration, Short Duration and Floating Rate Funds.

In recent times, from May 2020 till May 2022, when repo rate was kept stable to revive the economy, Dynamic Funds category delivered 3.74% while Floating Rate Funds delivered 5.54%. Credit Risk was the best performing (7.58%) category during this period, followed by Medium Duration Funds (6.15%).

As can be observed from the above table, returns from this category can be highly volatile depending on where interest rates are headed and the fund’s duration.

It is advisable to invest for at least three years in this category as interest rates follow a cycle. Funds having a longer duration, which are expecting a drop in rates, can be susceptible/volatile to interest rate changes during a shorter tenure.

What portion of your debt allocation should be invested in these funds? “Given that these funds can take sharp interest rate calls, the invested corpus is exposed to the fund manager’s skills in assessing the macro conditions and security selection. So, there is that risk element that must be considered. As a cautionary move, it is advisable that investors allocate the non-core portion of their fixed-income portfolio to such funds. Let the core allocation stay in accrual fixed income funds with a high credit quality portfolio such as Banking & PSU debt funds, Corporate Bond Funds and Short Duration funds,” says Mohasin Athanikar, Investment Analyst, Morningstar Investment Adviser India.

Rushabh Desai, founder of Rupee With Rushabh Investment Service, points out that Dynamic Bond Funds can be quite volatile in the current environment. “I am currently not recommending Dynamic Bond Funds. These funds are akin to Flexi Cap Funds. However, to flex and manoeuvre in different debt instruments across the yield curve can be way more difficult and complicated. Liquidity can be a big issue and is immensely important in the debt market. Lack of liquidity in the corporate bond market can limit the flexibility of these funds.

Hence, they may not be able to manoeuvre across the yield curve efficiently. This can have a huge impact on the fund and its net asset value or NAV. In the current volatile and rising yield scenario, my view is that it is better to stick with simple accrual/roll down/target maturity funds somewhere at the shorter end of the yield curve to minimize drastic downside mark to market hit.”