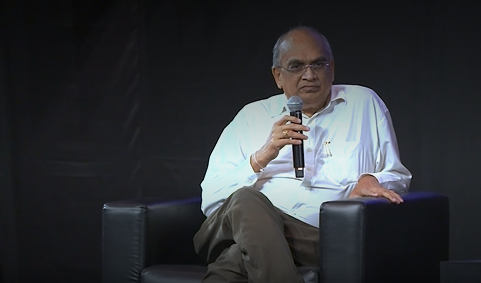

BHARAT SHAH, Executive Director, ASK Group, is one of India's most renowned investors and has often participated in the Morningstar Investment Conference India.

His investment philosophy is centered around buying quality businesses that enjoy superior growth, which are available at reasonable valuations to enable an adequate margin of safety. Over the years, he has consistently spoken about his investing ideology, and his delivery is articulate with a healthy dose of brutal honesty.

Here are some of the insights he shared at the 2022 Morningstar Investment Conference.

Growth vs. Value.

Growth and Value is the classical ongoing debate that I've never subscribed to, neither do I believe in.

It is an artificial divide and efficient investing should combine both elements. To pick one to the exclusion of the other is foolhardy. Without any meaningful long-term compounding growth, it is hard to generate adequate value. If it is growth at any price (GAAP), then it is unlikely to be intelligent investing. Even that package of growth and longevity has to be found at a price which tilts the economics in your favour; there must be adequate margin of safety.

Big fish in a small pond vs. Small fish in a big pond.

Equity is about finding a big pond rather than trying to overly debate the size of the fish.

If the fish is capable and the pond is large, the fish will grow to be fat and big and productive and healthy. If the pond is small, the big fish will get stifled and eventually strangulate itself. Therefore, the size of the pond is crucial to enable fish to grow. The size of the pond will provide the opportunity to grow and get bigger.

Think about it conceptually. When you buy equity, essentially what are you doing? You are postponing gratification. You're making the sacrifice today in the hope of getting a larger outcome tomorrow. You've paid X price, and you're hoping to get X+Y either tomorrow or the day after or whenever. That difference between what you have paid out and what you hope to get additional is the return. And that extra will come only if what you have invested into will get bigger over a period of time.

That act of getting bigger will essentially come from growth, and that growth essentially will come from the size of the pond - the size of the opportunity, along with the capability of the fish.

Patience to stay in the game vs. Timing the entry and exit.

In my early days of the investing as a fund manager, Infosys and Wipro were the two biggest

positions in my portfolio. Infosys went up 200-odd times from the time that I purchased, and Wipro went up even higher.

In retrospect, I exited too early. Did I know that Infosys would go up 200 times? No. All that I knew when I invested was that it was a good business, fundamentally attractive, a good, competent and honest management, and given the size of opportunity, it looked like it will probably grow. In mathematical terms, the valuation was attractive. So there were sufficient reasons to stay with it. It is the staying with it that gave that wing rather than my real capability to figure out whether it will go up 200 times.

Far more money is made in terms of the patience devoted to something which is actually worthy, rather than one’s prescient capability to pick out something at most opportune moment or most opportune price.

A lot of the time we ascribe astute skills and judicious competency to ourselves, especially when something wins handsomely. A small part of it may have some merit, but a large part of it is nothing but self-reflected glory or ego or arrogance.

To purchase at the perfect point of time or pick an outstandingly winning business sounds intellectually gratifying. While patience and the long term appears very pedestrian, boring, lazy, and intellectually mediocre. But, generally speaking, far more money is made by time spent with the good thing and patiently riding the market upheavals. Time and patience work like magic and that power is unbeatable.

Of course, you need to be with a good thing. However much of time and patience is devoted to pebbles and stones, they will never turn into diamonds.

Known businesses vs. Profitless companies with potential.

I do not invest in profitless companies as I don't have any particular fetish for self-injury.

Businesses have to create value. They will create value if they make real, economic profits. And these profits have to be predictable and large enough over a reasonable timeframe so that the value assigned today makes a sensible equation vis-à-vis the price. If any component is challenged, then investing is based on a floating narrative rather than any realistic and fundamental understanding.

Investing is art and science. Investing is language and mathematics. Trying to deemphasize one and over emphasize another is going to lead to consequences where you float on dreams rather than be grounded in reality.

This is not to say that some of these new-fangled businesses will not succeed. But you have to have be confident that there are sufficient reasons for them to profit in a defined timeframe, and have some predictability and certainty so that value can be assigned. If you cannot do that then you are likely to enter into the dangerous zone of errors of commission rather than errors of omission. Errors of omission don't gladden the heart, but at least they can be lived with. Errors of commission leave scars and give you a bleeding heart. They are far more dangerous and challenging.

Investing in good companies vs. Investing based on macro trends.

I think a set of fatuous circumstances have come together which indicate that India is in a position of respect and strength. The relative superiority of India's value proposition is now getting acknowledged. Simultaneously, the weaknesses of Western capitalism are emerging to the fore. Therefore, on balance, India is a great attraction. In 34 years of investing in this country, I have never been more positive regarding India’s prospects and the opportunities available for investing.

Having said that, investing for me remains bottom-up. It is doing the hard work of finding a good opportunity and riding that opportunity. It is not about riding some general idea. It is not about riding on macros. It is not about riding some trend or theme.

You may have a broad idea or view, but pick your baits. There are plenty of opportunities to be seized on a bottom-up basis. Go through the hard work of choosing and picking and analysing and be clear about the reasons why you want to invest in something. If you have long-term approach, value emerges more easily. If you're looking for immediacy inthe short-term, then it could be hard to find. The perspective for a longer period is to distinguish between noise of the immediacy and power of its long-term sustainability.

If I see a good business that is available at a good price, and I find it attractive, I will buy. It doesn't matter whether America will go up or down, or whether Europe will diminish and go through hell. How does it matter so long as a business that you are buying is going to grow and make real profits and have strong cash flows?

This obsession about macros and global issues cloud our minds with so many distractions and so much of noise, while investing remains a simple thing.

2022: 5 stock investing insights from Bharat Shah

2022: Bharat Shah on why rebalancing is not always optimal

2018: Bharat Shah's 3 principles in preservation of capital

2016: Bharat Shah on his investment philosophy

2014: How Bharat Shah picks his stocks