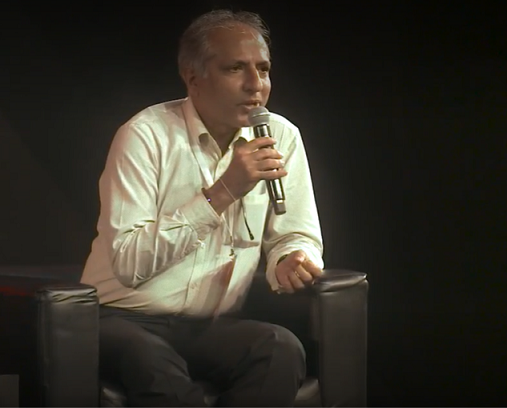

Samir Rachh focuses on mid- and small-cap strategies at Nippon India Mutual Fund. He currently manages one of the largest small-cap funds in the mutual fund industry: Nippon India Small Cap Fund.

In his own words, he shares insights for investors.

The stocks he mentions are not recommendations, but just examples to drive home a point.

I know a 90-year-old individual from my neighbourhood. His investment style is simple and unique. He reads annual reports and buys stocks. Whenever any stock doubles, he sells. With his freed-up capital, he invests in a new stock. Just by following the simple investing style with small amounts of money, his portfolio is now in crores, earning lakhs by way of dividends.

When I started my career, I was not a long-term investor. We were supposed to report profits on every quarterly basis, and that forced me to trade. I took a long time to understand what long-term investing is, and the importance of sitting and patiently waiting.

It also depends on the type of investment. I run a small-cap fund that is huge in size. Unlike a large-cap where we do top-down investing and enter and exit sectors, we are forced to be long-term investors in our small-cap fund. Because liquidity tends to be poor and impact costs are very, very high.

Given all the above, my core investing philosophy looks at three variables:

- The promoter. Do I trust him with long-term money? If you enter into a long-term relationship, you have to be comfortable with the other person.

- The business. However good the promoter is, if the business is not strong, it doesn't make sense.

- The valuation. The price at which I buy.

THE TAKEAWAY: Everyone must have an Investment Philosophy. Don’t blindly emulate one. Make it individualistic and don’t be afraid to evolve.

The general perception in the market is that concentrated portfolios are good and diversified portfolios are not that good.

Let me give an example from my portfolio. A stock called Navin Fluorine has been in the portfolio for the last 11 years. It has been a 35-bagger. Over this period, there would have been at least four or five occasions where the market fell dramatically and this stock would have corrected by 30-40%.

Imagine if this was my one of the largest holdings. Imagine if 5% of the portfolio was allocated to that one stock and it fell by 40%. I would lose 2% in just one stock.

When it comes to small caps, diversification works beautifully. Diversification gives me the ability to hold a stock for a longer period of time and enable me to benefit from it. So, while Navin Fluorine might be going through some correction in our portfolio, there are some other stocks going up. So the stable performance from some and the outperformance from others will balance the underperformance of Navin Fluorine. This happens many times with different stocks.

Another example from my portfolio - Tejas Networks. We bought from Rs 180 all the way up to Rs 240. The stock price went up to Rs 440. We were very bullish - the sector, a good company, good promoters, interesting hardware. But things didn't pan out the way we expected because of the delay in orders from the government. Payments were delayed. Exports didn't happen. In 2018, the market fell and the stock price corrected by 90%; from 440 to less than Rs 50. Since we had limited weight in our portfolio, we could withstand the blow. But our thesis and solid research gave us the confidence to add more.

One company I'm personally very excited about and which is the single largest holding in my portfolio is Tube Investments. Yes, it has run up tremendously. When we bought this in our portfolio, it was a small-cap stock that became a large-cap stock. And I am sure it will be a Nifty component eventually.

- Diversification allows me to ride my winners.

- Diversification takes care of the interim volatility.

- Diversification allows me to generate a much better risk-adjusted return.

We have a strong risk management process where we mandate no more than 4% to a single stock. Personally, I'm more conservative. I don't buy more than 3% in any stock. And the moment it crosses more than 5%, I start trimming it out back to 5%.

If you get your concentrated bets right, you can make a lot of money. But I am managing the money of lakhs of small investors, and they have limited risk appetite. They expect us to outperform in a down market and outperform in a bull market. They want a smoother return without much volatility. So, the kind of risk which you can take when you're investing individually and the kind of risk which you can take when you are investing monies of smaller people, are quite different.

THE TAKEAWAY: In the Diversification vs. Concentration debate, pick whatever works for you. The context and situation is very important.

Identify your mistakes. Out of every 10 decisions, 3 are going to go wrong. Take it in your stride.

Let me cite Magma as an example, though it was not a mistake. Basically, times were bad and maybe perception of the management was not good. We kept on meeting the top management. We met their various department heads. We met their subsidiaries. We got the confidence that it's not a bad investment but just a temporarily bad time. Fortunately, we held on. Finally, the management took the right step of selling it to Poonawala Finance. That created value for us.

We all make mistakes. But, how early on do you identify your mistake and correct it? Time is limited. If you are able to identify a bad idea and cut your losses early, it saves you a lot of time and emotional pressure. You can use the time to focus on better investments. And your money can be more efficiently allocated.

THE TAKEAWAY: Everyone commits mistakes, make your peace with it. Time is limited. Capital is limited. So cut losses quickly.

These views were shared during the Morningstar Investment Conference India, September 2022