When I think of legends in finance, a few women pioneers definitely come to mind.

Muriel Siebert, known as the First Lady of Wall Street. Hetty Green, the Witch of Wall Street, found that her personal quirks, eccentricities and obsession with frugality, were more newsworthy than her financial exploits. Geraldine Weiss was known as the Grande Dame of Dividends or the Queen of Blue Chips.

Today, women in finance are no longer an oddity.

In India, the market and mutual fund regulatory body, the Securities and Exchange Board of India, is headed by Madhabi Puri Buch. Radhika Gupta became the CEO of Edelweiss Mutual Fund at the age of 33. Lakshmi Iyer was the CIO and head of fixed income products at Kotak Mahindra AMC before being elevated to the role of CEO at the firm's investment advisory business.

However, the percentage of women fund managers in India continues to disappoint.

Absolute numbers

While we gratefully acknowledge that the number has increased considerably over the years, women still comprise a meagre 9.81% of the industry (42 females out of 428 fund managers).

- 2017: 18

- 2018: 24

- 2019: 29

- 2020: 28

- 2021: 30 across 19 fund houses

- 2022: 32 across 19 fund houses

- 2023: 42 across 24 fund houses

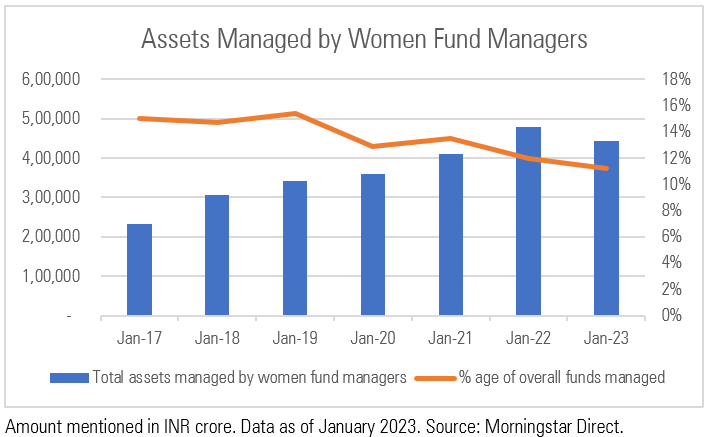

Total assets

Since 2017, we have continuously witnessed a rise in the total assets managed by women. So it was not pleasant and very surprising to see the trend reverse last year. The decline in total assets managed by women as of January 2023, in comparison with the previous year, could be attributed to the exit of two prominent players - Swati Kulkarni (UTI Mutual Fund) and Lakshmi Iyer (Kotak Mahindra Mutual Fund).

Percentage of assets

Over the last few years, there has been a marginal but steady decline in percentage terms with respect to the assets managed by women. Over the past year, the number dropped from 11.98% to 11.19%.

Performance

Scrutinizing the data threw up a bright spot, and this has been the case over the years. Of the total open-end assets managed by women fund managers, 82% of the AUM outperformed the peer group average on a one-year basis, 93% of the AUM outperformed on a three-year basis, and 99% of the AUM outperformed on a five-year basis—a feat truly worth commending.

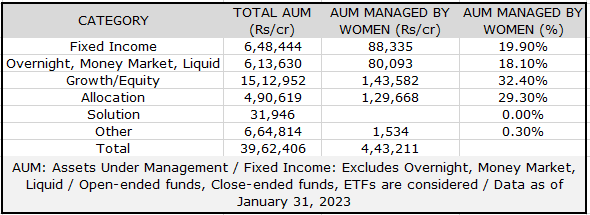

Type of assets

From the perspective of assets managed across various asset classes, out of the total open- and close-end fund assets managed by women (4.43 lakh crore), the equity/growth asset class corners the largest share at 32.4% of the assets, followed closely by the allocation asset class with 29.3%.

Since 2017, we have been publishing an annual report on women fund managers in the asset-management industry.

2023: 42 women fund managers. Constitute 9.81% of the industry. Cumulatively manage assets worth Rs 4.43 lakh crore.

2022: 32 women fund managers. Constituted 8% of the industry. Cumulatively managed assets worth Rs 4.55 lakh crore.

2021: 30 women fund managers. Constituted 8% of the industry. Cumulatively managed assets worth Rs 4.11 lakh crore.

2020: 28 women fund managers. Constituted 8% of the industry. Cumulatively managed assets worth Rs 3.59 lakh crore.

2019: 29 women fund managers. Constituted 8% of the industry. Cumulatively managed assets worth Rs 3.41 lakh crore.

2018: 24 women manager managers. Constituted 8% of the industry. Cumulatively managed assets worth Rs 30,650 crore.

2017: 18 women fund managers. Constituted 7% of the industry. Cumulatively managed assets worth Rs 2,320 billion.

2016: In Brazil, India, Germany, and the U.S., the local rate of women-managed funds is below the global standard.

The women fund managers are either primary/secondary managers or heads of equity/fixed income.