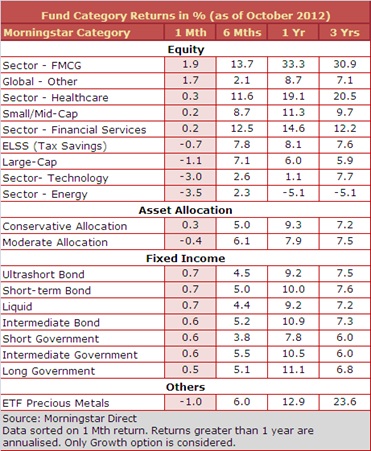

Defensives were once again back on the menu, as investors returned back to them amidst an otherwise tepid market in October. FMCG sector funds topped the charts with an average gain of about 2% during the month. Healthcare sector funds also managed to close the month in the green. Global funds fared better during October—posting an average gain of 1.7% during the month.

With oil and power company stocks taking a beating in October, energy sector funds were the bottom performers during the month—and posted a loss of 3.5%. Technology funds were close behind with a loss of 3% during the month. The recent appreciation in the rupee and speculation on the ongoing US elections took a toll on technology stocks.

After posting a heady return in September, diversified equity funds put up a timid show in October, but still managed to better the benchmark indices. Small/mid-cap equity funds posted an average gain of 0.2% during the month, despite a 1% loss suffered by the CNX Midcap index. Large-cap equity funds returned -1.1% on average in October, compared to -1.4% returned by the BSE 100 index.

Over the past year, small/mid-cap funds have managed to put up a good show, and outperformed their large-cap counterparts by a considerable margin. The Morningstar Small/Mid-cap category posted a 11.3% return over 1 year, significantly bettering the 7% gain posted by the CNX Midcap index. More than 80% of the funds in the small/mid-cap category managed to beat the CNX Midcap index over the same period. Meanwhile the Morningstar Large-Cap category managed to post a gain of only 6% over the past year.

Bond yields rose sharply at the end of the month, after the RBI kept the main policy rate unchanged in its monetary policy review on October 30. However, the central bank did cut the CRR rate by 25 bps, in line with market expectations. The 10 year yield finally closed the month up 7 bps. Shorter tenure funds did a tad better than longer tenure funds in October.

Gold ETFs posted a loss of 1% during the month of October, ahead of the festive season. YTD in 2012, they have still managed to put up a good show, with an average gain of 13%.