The rupee depreciation has taken a toll on the bond rally in recent months. Till late May 2013, things were all hunky-dory in the fixed income markets, with bond yields dropping sharply. The yield of the earlier 10 year benchmark paper (8.15% GOI 2022) had fallen below the 7.4% mark towards the end of May. It had fallen from a yield of around 8% at the end of March 2013. The new 10 year benchmark paper (7.16% GOI 2023) which was issued at a coupon of 7.16% in mid-May, later saw its yield fall to a low of 7.11% during the month. This sharp fall in yields also worked wonders for returns of bond funds, especially intermediate and long term gilt (government bond) and bond funds, which are more sensitive to interest rate movement. At the end of May 2013, the Morningstar intermediate bond category was sitting on an average YTD (year-to-date) gain of almost 7%, while the medium & long term gilt categories had registered an average gain of more than 8% over the same period in the calendar year. The trailing 1 year returns at the end of May 2013, stood at a lofty 13-14% (on average) for these bond categories.

However, the rupee volatility played spoiler to this bond rally, and also receded hopes of an interest rate cut, which was being factored in by the fixed income markets earlier. The rupee breached the psychological mark of 60 in June, and recently in July had fallen to an all-time low—beyond the 61 mark as well. This has been prompted by the global strengthening of the US dollar, especially against some emerging market currencies. The recent comments by the Fed--of tapering its quantitative easing programme, have also prompted FII outflows (especially from the debt segment) putting further pressure on the rupee. The rupee depreciation, which is expected to stoke inflation (due to rising cost of imports), caused bond yields to rise sharply in the month of June. It also receded hopes of a rate cut by the RBI in the near future. The new 10 year government bond yield (7.16% GOI 2023) paper closed the month of June at 7.44%--up 20 basis points from previous month’s close.

Government bond yields see their sharpest one-day spike since January 2009, on the back of RBI’s steps to curb rupee volatility

However, markets were caught unaware by the RBI’s unprecedented move of hiking the MSF (Marginal Standing Facility) rate and bank rate, late on July 15, to squeeze the liquidity from the system and curb the rupee volatility. The central bank also capped total funds available under its repo window at 1% of banks' deposits, and announced an OMO auction for July 18, which further helps to squeeze out liquidity from the system.

This drying up of liquidity, and increase in cost of short term funds for banks, prompted a massive sell-off in the bond markets. This in turn caused government bond yields to see their sharpest one-day spike since January 2009. The 7.16% 2013 benchmark 10 year bond yield rose by more than 50 basis points in a single day to close the session at 8.07% on July 16. In price terms, the bond lost a massive 3.5% in a single day. And, the benchmark 10 year yield is now at levels last seen at the end of December 2012.

The sharp rise in yields play havoc for bond fund returns

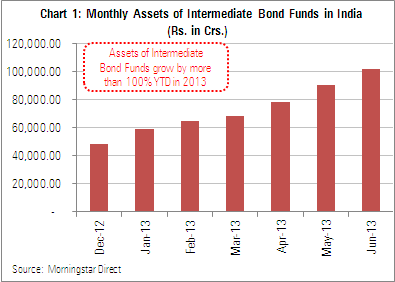

As mentioned earlier, intermediate & long-term bond & gilt funds had benefited most from the sharp fall in bond yields till the end of May, helping to bump up the performance of these categories. The fund categories also registered large inflows as result of the downtrend in interest rates, and on the back of expectations of further rate cuts by the central bank. The total assets under management of funds in the Morningstar Intermediate Bond category grew from around Rs. 49,000 crores at the end of 2012 to Rs. 90,656 crores at the end of May 2013 (Refer to Chart 1). It grew further to above 1,00,000 crores at the end of June 2013, despite the category posting negative returns during the month. This points to continuing inflows into these fund in the month of June as well. Medium and long term gilts funds also registered good inflows in 2013, upto the end of April. They saw some profit booking by investors, resulting in outflows in the months of May and June, as per AMFI data.

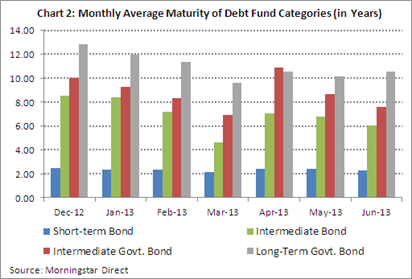

The rise in bond yields in the month of June played spoiler to returns of intermediate and long-term bond & gilt funds during the month. As mentioned earlier, the benchmark 10 year yield closed the month of June up 20 basis points. Intermediate bond funds delivered -0.7% (on average during the month), while intermediate and long-term gilt funds delivered between -0.8% to -1% (on average) during the month. These funds had largely reduced duration in the month of June, but the average maturity of many of these funds still remained elevated at the end of June, as a result of which their performance would have been hit in the recent sell-off. Refer to Chart 2 for monthly average maturity of various bond categories. It can be seen that average maturity of the intermediate bond category fell from 6.8 years (on average) at the end of May 2013 to around 6 years at the end of June 2013. However average maturity of quite a few individual bond funds remained at 7-8 years at the end of June. The average maturity of intermediate gilt funds fell from 8.6 years in May 2013 to 7.6 years in June 2013, while the average maturity of long term gilt funds actually rose from 10.2 years in May 2013 to 10.5 years in June 2013.

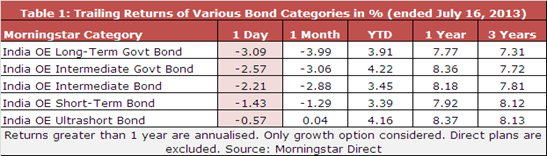

However, the rude shock for fixed income investors came on the fateful day of July 16, after the RBI announced a slew of measures, the previous evening, to suck up liquidity and curb the rupee volatility. As mentioned earlier, the 10 year benchmark yield rose by more than 50 basis points during the day—making it the largest 1-day spike in yield in over 4 years (or since January 2009). The price of the benchmark 10 year bond fell by a massive 3.5% in a single day. Debt fund categories bearing higher duration risk, typically also saw their NAVs falling by a similar quantum on that day. Refer to Table 1 for trailing returns for various debt fund categories (ended July 16, 2013). Long-term gilt (government bond) funds fell the most (by an average 3%) on July 16, therefore bringing down their trailing returns over other time periods as well. Some individual long term gilt funds fell by as much as 4% on July 16. Intermediate gilt funds and bond funds were also hit and delivered average returns of -2.57% and -2.21% respectively on July 16. Short term bond funds were also not spared, and interestingly ultrashort bond funds also ended up delivering negative returns during the day, albeit much milder than those of their longer duration cousins.

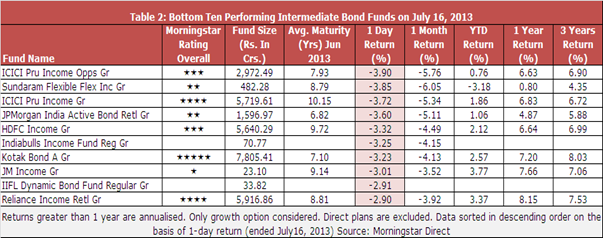

Intermediate bond funds, which maintained a higher duration (or average maturity) typically saw their NAVs fall more on July 16. Table 2 highlights the bottom ten performing funds from the Morningstar Intermediate Bond category on July 16. It can be seen that some the funds lost as much as 3.9% in a single day. The trailing returns of intermediate bond funds have also come down considerably as a result. As mentioned earlier, the trailing 1 year returns at the end of May 2013, stood at a lofty 13-14% (on average) for some of these bond categories (like intermediate and long –term bond & gilt funds). That is now down to around 8% levels at the end of July 16, 2013.

The way forward

The panic selling in the fixed income markets must have taken investors by surprise, especially with large inflows coming into medium and long term bond funds in recent months, on the back of strong performance. The reaction by the debt markets has been a knee-jerk one, and extreme in nature. After all, the 10-year yield is now up almost a full percentage point, from its lows seen in late May 2013. I am not an expert in forecasting yields, but the sell-off seems to be quite extreme, and too quick. It would be advisable for existing investors (especially those who have got in the last couple of months) to not panic and sell-off in a hurry, as they could be exiting at a loss. They should wait for the dust to settle, and the rupee to stabilize a bit, before taking a decision.

Meanwhile, investors who have a higher risk appetite and can digest volatility, can also consider this extreme move as a buying opportunity, and take a duration call through the route of a dynamic bond fund or actively managed bond fund. However, investors who cannot digest volatility, and have a lower risk appetite, are better off with short-term and ultrashort bond funds at this juncture.

All said and done, investors need to realize that much will depend on what the RBI’s course of action will be in the future, especially on the interest rate front. We have said in the past as well (via this article) that the elbow room for further rate cuts appears more limited at this juncture. Therefore investors need to moderate their return expectations from duration bond funds accordingly, when compared to the previous year.