Equity markets took a pause after having rallied for two consecutive months. The decline could be primarily attributed to uncertainty hovering around the US stimulus measures which for long now have dictated trends across the globe. Back home too factors like lower-than-expected growth in key economic releases played an equal role in pulling the markets lower. However markets did witness some in between recovery which in turn helped cap the downside.

Shedding away the festive cheers, the month started off on a disappointing note with mainly the disappointing services activity to be blamed for. The services activity data grew slower than expected. It rose to 47.1 last month from 44.6 in September. Comments by rating agency Standard & Poor’s that it would consider lowering Indian’s rating from investment grade to speculative grade if the elected government after general elections does not provide a plan to reverse the low economic growth situation of the country also dampened sentiments. To add to this, FDI data released indicated that the FDI into the country’s services sector declined by 47.5% to $1.19 billion during the April-August period of 2013 as compared to $ 2.28 billion in the same period last year. Rupee too depreciated against the dollar. The constant volatility in the rupee despite drastic measures taken by the RBI has made investors jittery.

Key indices rose temporarily on the back of the IIP data released which indicated an improvement as compared to the previous month. However the markets resumed their fall as the numbers were below the market expectations. Inflation number released back home also weren’t quite encouraging. Wholesale inflation was reported at an eight month high of 7% for the month of October.

On the global front, speculations’ regarding US Federal Reserve’s decision to slow down its bond buying program has caused discomfort among the investors especially after the release of better than expected jobs and service data in US. Statements by Federal Reserve chairman nominee Janet Yellen signaling that the stimulus will be maintained until the US economy improve did bring in some respite. However this optimism was short lived post the release of Fed’s latest policy meeting that showed the apex bank is still considering winding down stimulus measures. Central bank policy makers "generally expected that the data would prove consistent with the committee's outlook for ongoing improvement in labor-market conditions and would thus warrant trimming the pace of purchases in coming months," according to minutes of the Federal Open Market Committee's Oct. 29-30 meeting. This proved to be big blow to the markets.

Asian markets too fell after the much awaited meeting of China's government official’s yielded little, disappointing investors who had hoped for much greater clarity on business and economic policies for the next decade. European markets were lower ahead of a batch of data from the euro-zone, including the November inflation report.

It was only towards the end of the month that saw markets reviving helping them wipe out some of its losses. What helped the markets was the fall in global crude prices after Iran struck a nuclear deal with world powers, lessening political risk, thereby boosting sentiments. This also helped ease concerns regarding India’s fiscal deficit which would benefit from the falling crude prices. Buying by foreign investors also continued to boost sentiments. Further expectations of good GDP data to be released also kept the momentum high.

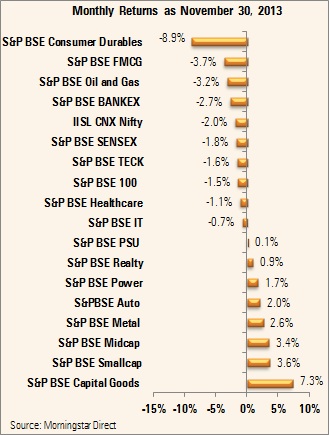

The S&P BSE Sensex ended the month lower by 1.8% to close at 20,791 points shedding the 21K mark. During the month it touched a high of 21,196 and a low of 21,194. The Nifty too dropped close to 2% to end at 6,176. The mid cap and small cap stocks bucked the trend as they rose thereby outperforming their large cap counterparts. The S&P BSE Mid-cap and S&P BSE Small-cap indices grew by 3.6% and 3.5% respectively.

The S&P BSE sectoral space also witnessed a mixed performance. The S&P BSE Consumer Durable emerged as the highest loser which fell close to 9% during the month. Within this space, the index heavyweight Titan Company fell about 14%. This was followed by Rajesh Exports which too dropped 7.7%.

This was followed by the S&P BSE FMCG and the S&P BSE Oil & Gas indices which dropped 3.7% and 3.2% respectively.

On the other hand, the S&P BSE Capital Goods index emerged as the top gainer which grew by 7.3%. The S&P BSE Metal, S&P BSE Auto and S&P BSE Power indices also followed next which each grew by 7.3%, 2.6% and 2% respectively.

As per the data released by SEBI, foreign institutional investors (FIIs) turned huge buyers in equity making this the third consecutive month of buying. They net bought equities worth Rs 8,115 crores in November as compared to Rs 15,706 crores in October. Year-to-date they remain net buyers in equities to the extent of Rs 97,051 crores. However they have been net sellers in debt segment to the tune of Rs 55,838 crores in November.