Key Points:

• Performance of dividend yield funds has picked up very smartly over the past one year, with many of the funds topping the returns charts over that period within their respective categories. This is despite the fact that these funds maintain higher exposure to mid- and small-cap stocks, which have been battered in the recent correction. The performance over longer periods like 3 years and 5 years is also impressive.

• Dividend yield funds are conventionally suited for those investors who are looking for decent capital appreciation in rising markets, but want to cushion themselves a bit in falling markets. An analysis of past bull/bear market phases indicates that these funds have indeed managed to protect the downside somewhat in falling markets, and at the same time give decent returns or even top quartile returns (when compared to other diversified equity funds) in past bull market years.

• The Morningstar five-star and four-star ratings secured by most of these funds further stand testimony to their superior risk adjusted performance over longer time frames.

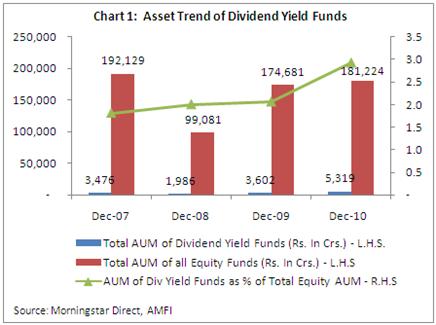

• The assets of these funds have risen over the years, but still constitute a very marginal part of overall assets of all equity funds (less than 3% of total assets of equity funds as of Dec 2010).

• Dividend yield funds are overweight in certain sectors like Financial Services (especially PSU banks), Consumer Goods (FMCG and auto), Utilities and even to some extent in Energy. Many of these sectors have been outperformers over the past year, and some have even turned out to be defensive plays.

The origin and concept of dividend yield funds

Dividend yield funds have been around for quite some time within India’s asset management industry. The first dividend yield fund in India viz. Birla Sun Life Dividend Yield Plus was launched in early 2003, followed by a handful of launches by other fund houses in the years of 2004, 2005 and 2006. Presently there happens to be around eight such funds in the industry, with one of the funds viz. Templeton India Equity Income even having partial exposure to international equities. Dividend yield funds typically invest in stocks of companies with high dividend yield. These high dividend paying companies generally have stable cash flows, steady growth in earnings and a healthy balance sheet. Because of that, these funds are conventionally considered to provide decent capital appreciation in rising markets and a cushion for investors in falling markets. Naturally then, these funds would be more suited to conservative investors who are looking for capital appreciation, but at the same time want to limit their downside risk when markets plunge. We will examine going forward whether this particular strategy indeed works in favour of these funds.

Performance of dividend yield funds picks up, but assets don't rise as much

Even though dividend yield funds have been around for a while, investors have still not entirely warmed up to the concept of such funds when compared to other diversified equity funds. The assets of these funds have risen over the years, but still constitute a very marginal part of overall assets of all equity funds. Chart 1 highlights that even though contribution of dividend yield funds in overall equity fund assets of the industry has been growing over the years, they still constitute less than 3% of equity fund assets at the end of 2010.

However performance of these funds have picked up smartly in recent times, especially amidst the volatile markets. Even though it would not be advisable to just look at the 1 year returns, a quick glance at the same would bring to the fore that most dividend yield funds have topped the charts within their respective categories over this time frame. Over a 1 year period ended 28 March 2011 dividend yield funds have yielded an average return of 14.23%, much higher than the return of an average diversified equity fund (+5.11%) and the Sensex (+7.36%). What probably is even more noteworthy is that mid and small cap stocks, to which dividend yield funds maintain higher exposure, have fared quite poorly over the past year, with the BSE Midcap index returning -0.19%. However dividend yield funds have still managed to hold their ground and curtail some losses in the volatile markets of past few months. A look at the trailing returns over 3 years and 5 years also reveals that dividend yield funds have managed to outperform both a typical diversified equity fund and the key benchmark indices by a comfortable margin over these time periods.

Let’s now analyze how dividend yield funds have typically fared in bull and bear market phases compared to other diversified equity funds in the country. Conventionally a dividend yield fund is supposed to provide a cushion to investors in falling markets and at the same time deliver decent capital gains in rising markets. Our analysis highlighted in Table 1 shows that dividend yield funds have indeed managed to walk the talk in this context, more or less. Let’s first look at some instances of bear markets or market corrections. In the financial crisis of 2008, dividend yield funds delivered an average return of -49.02%, while diversified equity funds fell by an average 55.66%, and the BSE Sensex and BSE Midcap indices returned -52.45% and -66.95% respectively in the same year. Even in the recent market correction between 5 Nov 2010 and 10 Feb 2011, which saw the benchmark sensitive index losing close to 17% and the BSE Midcap index plunging close to 27%; dividend yield funds managed to restrict some losses and fell by an average 17.32%. A typical diversified equity fund fell by 19.53% over the same period.

Meanwhile, a look at past bull market years of 2007 and 2009 reveals that dividend yield funds have managed to provide decent gains to investors, and in some cases even top quartile returns when compared to other diversified equity funds. However the year 2006, was quite a dismal year for these funds as most of them finished the year in the bottom ranks among other diversified equity funds. A review of the Morningstar star-ratings in Table 1 also implies that many of these dividend yield funds have delivered superior risk-adjusted returns and have secured a Morningstar five-star or four-star rating. The ones with the highest rating of five-stars include Birla Dividend Yield Plus, ING Dividend Yield and UTI Dividend Yield. All these funds have consistently managed to deliver decent returns and at the same time reduce the downside risk in market downturns. Incidentally, UTI Dividend Yield Fund - Growth won the award for the Best Large Cap Fund in the Morningstar India Fund Awards 2011.

Portfolio bets of dividend yield funds turn out to be outperformers and defensive plays as well

A look at the portfolios of these dividend yield funds would indicate that most of them are heavily loaded up with mid and small cap stocks, and their exposure in these stocks are considerably higher compared to a typical diversified equity fund. Of the eight dividend yield funds in the market, six belong to the Morningstar India Small/Mid cap category. Only two funds belong to the Large Cap category, of which UTI Dividend Yield Fund has mostly been large cap oriented historically. The other one viz. Templeton India Equity Inc invests in attractive dividend yielding Indian stocks, and at the same time can also allocate upto 50% of its portfolio in foreign securities with present or future potential of higher dividend yield. Please refer to Table 2 for sector exposure and style analysis of dividend yield funds.

A deeper review of their portfolios shows that these funds are overweight in certain sectors like Financial Services (especially PSU banks), Consumer Goods (FMCG and auto), Utilities and even to some extent in Energy. Also a point to note would be that dividend yield funds usually have higher allocation in stocks of government owned companies, which are believed to have more stable cash flows and higher dividend yield potential. Many of the above mentioned sectors have been outperformers over the past 1 year, and some of them like FMCG and Utilities have turned out to be good defensive plays as well in volatile markets. The dividend yield funds seem to generally be underweight in sectors like Industrial Materials (capital goods), Healthcare (except for Escorts High Yield Equity fund with 17% allocation to the sector); and some even have limited or nil exposure in the technology space. Underweighting capital goods stocks would have benefited these funds, due to the sector’s relative underperformance in the past year. However, technology and healthcare sectors have managed to do quite well for themselves over the same period.

Conclusion

Even though dividend yield funds haven’t managed to catch the fancy of investors entirely, they have been able to reward investors with good enough returns, and at the same time protect their downside in market downturns. The Morningstar five-star and four-star ratings secured by most of these funds further stand testimony to their superior risk adjusted performance over longer time frames. With Indian equities not looking as attractive in 2011, as compared to previous years, dividend yield funds could turn out to be a suitable alternative for the more conservative investors who are wary of volatile equity markets and want to limit their downside risk.