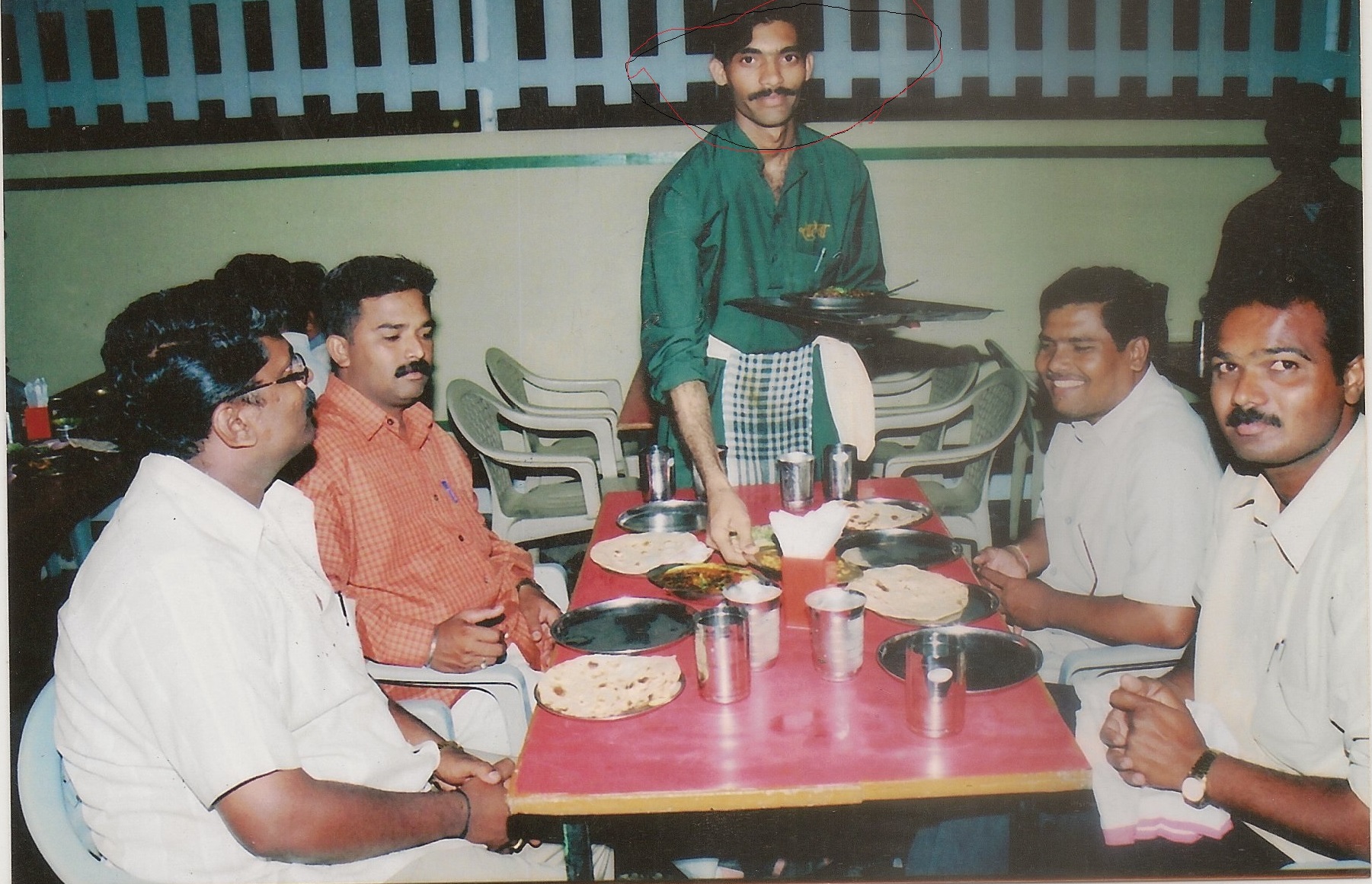

“Sometimes it feels like a dream. All my struggles have disappeared,” says Sachin Kharate who worked as a waiter for a decade since his teenage days.

Early days

A backbencher in school, Sachin just managed to score passing marks till his secondary school. Cut to today, he drives Swift Dzire and owns five acres of land on which he plans to do organic farming.

Grown up in a poor family in Akola, a city located 580 kilometers from Mumbai in the Vidharbha region, Sachin had to drop out after finishing secondary schooling as his father could not afford his education. A paddle rickshaw driver, his father was responsible for looking after seven family members with his meager income.

Like his father, Sachin too struggled. He walked to his school which was situated 10 kilometers away from his home, sometimes barefoot.

First job

At 16, after completing his secondary schooling, Sachin left his family to earn a livelihood. He reached Nashik in his search for a job. “This city of lord Shriram showed me the way of life. When I came here I was orphan and had to sleep on railway platform without food. I used to search for a job everyday and after three days I got the job of a helper in a restaurant,” Sachin recalls his early days.

As a helper, he used to clean the floor and utensils at a restaurant, earning Rs. 20 a day. He was happy with his first job because it provided him shelter and food. “I became friends with other helpers and fell victim to many bad habits in their company. I left the job when I realized this,” says Sachin.

His search for another work got him the job of a waiter at a restaurant which increased his monthly income from Rs 600 to Rs 1,700. He changed many jobs, moving from one restaurant to another. But his job and the occupational hazards – insults and abuses from pesky customers were same everywhere. He toiled as a waiter for a decade.

Inflection point

Then came the turning point in his life. One day he accompanied his colleague who had to pay his premium to an insurance company. The insurance firm was desperately looking to empanel agents. An official from the insurance firm coaxed them to become agents by shelling out Rs 350 each to get the agent’s license. Sachin was not willing to spend his hard-earned money on this license as he had no idea about this business and whether he will make any money out of it. His colleague recommended him to give it a try by lending him Rs 350, to which he obliged.

Armed with this license, he started pitching life insurance policies to his colleagues in the hope of building his alternate career. “I approached the cook at my restaurant and he said he will buy the policy. But he never paid the premium! None of my colleagues bought policies as they themselves were living hand-to-mouth,” says Sachin.

Nevertheless, he continued his effort by putting up stalls on streets after his work. This strategy too did not yield any result as no one would trust a waiter to advise on their finances.

Sachin then started helping orphan policyholders who had not updated their addresses with the insurance firm and had thus lost out on their maturity corpus cheques. He helped them get their maturity money by updating their addresses at insurance firms. His first life insurance client was one such orphan policyholder. He got Rs 2,100 as commission for selling his first policy, an amount much higher than what he was earning after toiling and putting up with customers abuses for an entire month. This fueled his confidence to chase his ambitions.

Slowly, his client base increased through referrals. Parallelly, Sachin continued to work as waiter till his commission income was sufficient to make ends meet. Thankfully, his clientele kept increasing which allowed him to quit his job. He was finally free from the shackles of his tiring and thankless job.

As his earnings grew, his quest to excel in his profession through continuous education increased. He started spending a major chunk of his commission income in buying books, attending events and acquiring certifications. When he quit his job, he had Rs 17,000 in his bank account. Of this, he spent Rs 12,000 for a stall in an exhibition to expand his business.

Foray in MFs

To generate wealth, Sachin started investing his money in stocks. While researching on stocks, he came across the concept of mutual funds. He started researching about mutual funds and took up AMFI license in 2007. “The markets were at all-time highs in 2008. Many investors were keen to invest in mutual funds. I was operating as a sub-broker. I was recommended by the broker to sell infrastructure funds to my clients. Many of my clients burnt their fingers when the markets crashed towards the end of 2008. Around 25% of my clients left me. I managed to convince the remaining clients to get their portfolio rejigged. Those who remained invested earned well,” recalls Sachin.

Sachin converted his existing insurance client base to invest in mutual funds. Realizing that mutual funds are an ideal route to generate long term wealth and far superior in comparison to insurance-cum-investment products, he turned his focus away from insurance. To graduate to goal based investment planning, he completed his CFP in 2012. Now, he only sells term plans to his clients.

The trust reposed on him by his customers is evident by the rapid growth in his business. His MF assets under advisory (AUA) has grown from Rs 6 crore to Rs 15 crore last fiscal and his dream is to build Rs 100 crore AUA by 2021.

To achieve this target, Sachin is busy organizing investor meets in government offices, colleges and schools. To reach out to net savvy prospects, he is planning to upload short educational Marathi videos on his website. He has also invested one lakh rupees in developing his company’s app which helps his clients transact on the go.

Success mantra

Sachin recalls that many MF agents dropped out after seeing the 2008 crash. But he continued.

He draws an analogy from cricket to reveal his secret sauce. “You have to remain on the pitch to score runs. Similarly, you have to be in this business during tough times in order to flourish,” believes Sachin.

How he caught our eye: Waiter turned financial adviser whose current net worth is Rs 50 lakh and assets under advisory of Rs 15 crore.

Favorite book: The Magic of Thinking Big by David J Schwartz.

Personal: Married to Meenakshi and has a five-year-old son Varad.