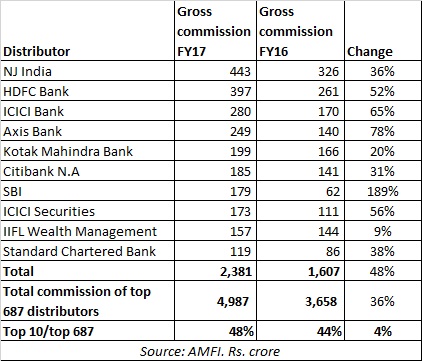

On the back of healthy inflows across categories and uptick in markets, the gross commissions earned by the top 687 distributors went up to Rs 4,987 crore in FY17, up 36% or 1,329 crore from Rs 3,658 crore in FY16, shows AMFI data.

Gross commission earned by top ten distributors

Of the total Rs 4,987 crore commissions earned by 687 distributors, ten distributors earned almost half or Rs 2,381 crore commissions in FY17.

FY17 – a year of comeback

In FY15-16, many large distributors had seen a dip in commission due to the upfront commission cap of 1% which came into effect from April 2016. Many distributors are said to have opted for a trail model, which allows them to earn higher fees on valuation gains. This was reflected in the commission earnings in FY17. For instance, Axis Bank had seen a drop in commission revenues in FY16. In FY17 it has recorded 78% rise in commission revenue from Rs 140 crore to Rs 249 crore.

From the third largest distributor a few years back, in terms of commissions earned, NJ India has raced ahead to reach the number one slot. Having said that, HDFC Bank still remains the top distributor, in terms of the quantum of assets under advisory. As on March 2017, HDFC Bank had the highest AUA of Rs 45,815 crore AUA, earning Rs 397 crore while NJ India managed Rs 30,959 crore AUA and earned Rs 443 crore commission. This could be attributed to to the higher equity component in NJ India’s AUA.

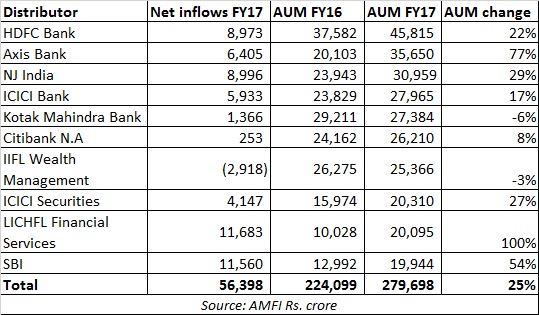

Top ten distributors (in terms of AUA)

The top ten distributors added Rs 55,599 crore to their kitty as their AUA went up from 2.24 lakh crore to 2.79 lakh crore in the last fiscal, which is 16% of the overall industry AUM.

HDFC Bank continued to hold the mantle of the largest distributor (Rs 45,815 crore) in terms of AUA. Axis Bank pipped NJ India to reach the number two slot. The bank managed AUA of Rs 35,650 crore while NJ India managed Rs 30,959 crore.

LICHFL Financial Services, a wholly owned subsidiary of LIC Housing Finance has pipped State Bank of India to emerge as the ninth largest distributor. LICHFL has AUA of Rs 20,095 crore while SBI Bank had AUA of Rs 19,944 crore. However, LICHFL earned a commission of Rs 7 crore on this asset base which indicates a significant proportion of debt assets.

Net inflows

LICHFL Financial Services received the highest net inflow of Rs 11,683 crore, followed by SBI at 11,560 crore. NJ India received the third largest inflow of Rs 8,996 crore.

All in all, the top ten distributors received net inflows of Rs 56,398 crore last fiscal.

The road ahead

Interestingly, the number of distributors qualifying under AMFI’s list of ‘top distributors’ is increasing. From 540 in FY16, the total count of top distributors has gone up to 687 last fiscal. Top distributors are those who fit one of these criteria - multiple point presence (more than 20), AUM raised over 100 crore across industry from retail and HNI clients, commission received of over 1 crore p.a. across industry or commission received of Rs 50 lakh from a single mutual fund.

FY17 was particularly good for distributors as the Sensex was up 15% which resulted in an increase in the earnings of distributors. The uptrend in markets coupled with consistent inflows in equity funds is expected to translate into in higher earnings in the current fiscal.