EARNINGS GROWTH

It is difficult to get this right.

Taking a longer time frame, say 5-7 years, provides us with a slightly better chance to project earnings growth. (Of course, this can be wrong. But hey, we need to start somewhere.)

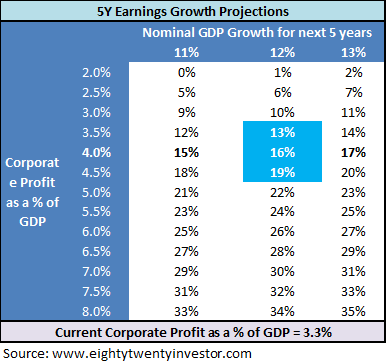

Just like we used mean reversion as our base case in valuations, we shall use mean reversion in Corporate Profits to GDP as our base case to project earnings growth for the next 5-7 years. A longer time frame means we are providing more time and hence a higher likelihood of mean reversion happening.

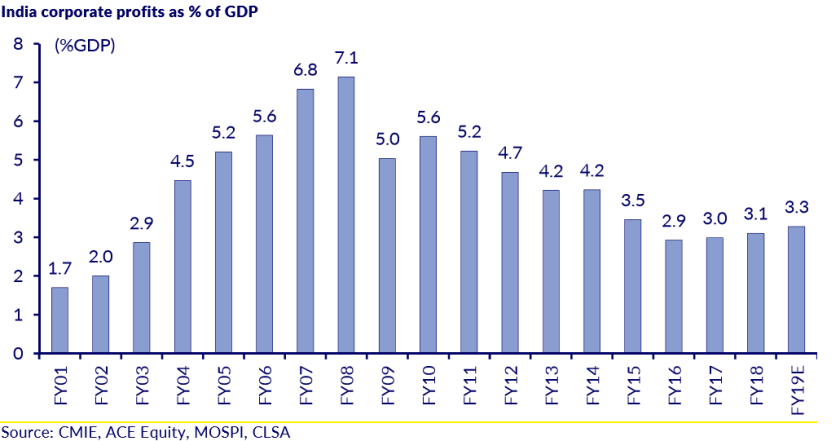

A lot of reports come up with corporate profits as a % of GDP. While different reports have different numbers, the overall number is very close to each other. I have taken CLSA’s data.

The average corporate profits as a % of GDP since 2001 is 4.2%. Currently for FY19 it is expected to be 3.3%.

Now assuming mean reversion to around 3.5% to 4.5% and a nominal GDP growth of around 11% (6% real growth + 5% Inflation) we end up with a profit growth range of 12% to 18%.

Pointing and Calling on Earnings Growth: Profit Growth Expectation for the next 5 years: 12% to 18%

Applying these numbers to our original equation:

Returns from equity = Change in earnings + Change in PE valuations + Dividend Yield

Change in earnings = 12% to 18%

Change in PE valuations = -5%

Dividend Yield = 1% to 1.5%

Pointing and Calling on future equity return expectations: Approximate estimate of equity returns over the next 5 years: 8% to 14%. Assuming an inflation of 5%, that is a real return of around 3% to 9% which is pretty decent!