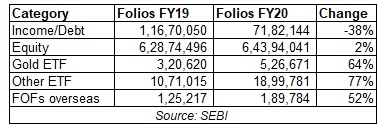

While the industry’s asset base inched up by 1% (Rs 24.58 lakh crore in March 2019 to Rs 24.70 lakh crore in March 2020) in FY20, there was a healthy increase in investor accounts or folios. Categories like Gold ETF, Other ETF, and fund of funds investing overseas saw more than 50% increase in folio count.

All in all, the industry has added 72.89 lakh folios in FY20, which means an addition of 19,917 folios each day. The total folio base went up from 8.24 crore in FY19 to 8.97 crore in FY20.

Each investor tends to hold multiple folios across different schemes. According to unique Permanent Account Number (PAN), the industry has 2.07 crore investors as on March 2020.

*In FY19, equity savings fund, and arbitrage funds were clubbed under the equity category. In FY20, these scheme categories are reported under Hybrid Funds category.

Folio growth in sub-categories:

- Liquid funds folios increased by 1.46 lakh from 16.69 lakh in FY19 to 18.15 lakh in FY20. Assets under management, or AUM, in this category increased by 1.88 lakh crore from 3.82 lakh crore to Rs 5.71 lakh crore during the same period.

- Gilt fund folios went up by 77,369 from 73,775 in FY19 to 1.51 lakh in FY20. Reflecting this growth, gilt fund assets rose from Rs 7,983 crore to Rs 9,819 crore during the same period.

- Folios under ELSS category jumped by 4.21 lakh from 1.19 crore in FY19 to 1.23 crore in FY20. Due to mark-to-market losses, ELSS assets dipped by 10% from Rs 92,107 crore to Rs 83,199 crore during this period.