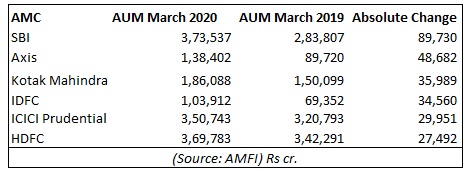

SBI Mutual Fund recorded the highest jump in its assets last fiscal. Its assets under management, or AUM, increased from Rs 2.83 lakh crore in March 2019 to Rs 3.73 lakh crore in March 2020. It also held the mantle of being the largest fund house by assets as on March 2020.

"The growth has come from all distribution channels. Our unwavering commitment to process, investor centric approach and focus on consistent fund performance has helped us gain market share steadily. The core debt category has got maximum inflows. That said, equity funds also saw good traction. Further, our systematic investment plan book continued to grow while the contribution from beyond 30 cities also increased," said D.P. Singh, Executive Director and Chief Marketing Officer, SBI Mutual Fund.

The second highest growth was recorded by Axis AMC. Its asset base went up from Rs 89,720.06 in March 2019 to reach Rs 1.38 lakh crore in March 2020. The fund houses added assets across scheme categories.

Kotak Mahindra Mutual Fund saw the third highest increase in its asset base. Its AUM increased by Rs 35,989.07 crore from Rs 1.50 lakh crore in March 2019 to Rs 1.86 lakh crore in March 2020.

IDFC Mutual Fund also saw its asset base increase by 50% which helped it reach the Rs 1 lakh crore AUM club. Its assets grew from Rs 69,351.96 crore in March 2019 to Rs 1.03 lakh crore in March 2020.

Among large fund houses, Aditya Birla Sun Life Mutual Fund recorded a flat growth of 0.4% last fiscal. As of March 2020, its asset base stood at Rs 2.47 lakh crore.

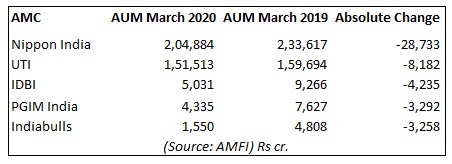

Nippon India saw its asset base erode by Rs -28,733.11 crore. Its AUM fell from Rs 2.33 lakh crore in March 2019 to Rs 2.04 lakh crore in March 2020.

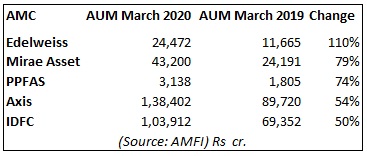

Edelweiss and Mirae Asset record highest percentage growth

In percentage terms, Edelweiss recorded the highest growth in assets at 110%. The fund house launched Bharat Bond ETF in December 2019 which mopped up Rs 12,395 crore. As a result, its asset base increased from Rs 11,665.11 crore in March 2019 to reach Rs 24,471.58 crore in March 2020.

After Edelweiss, Mirae Asset recorded the second-highest jump (79%) in AUM percentage wise from Rs 24,191.29 crore to Rs 43,200.31 crore during the same period.

PPFAS Mutual Fund recorded the third highest (74%) percentage wise jump from Rs 1,805.20 crore to Rs 3,137.64 crore during the same period.

Highest fall in assets

Nippon India witnessed the highest fall in assets, followed by UTI and IDBI.