After falling for two consecutive months, mutual fund industry finally saw its total asset under management (AUM) grow. The growth was primarily due to strong inflows seen in the fixed income categories which had seen significant outflows in the past two months as banks and financial institutions withdrew their money to meet their quarter end commitments. This coupled with equity markets registering strong gains for the month of October 2011 also contributed to the asset growth.

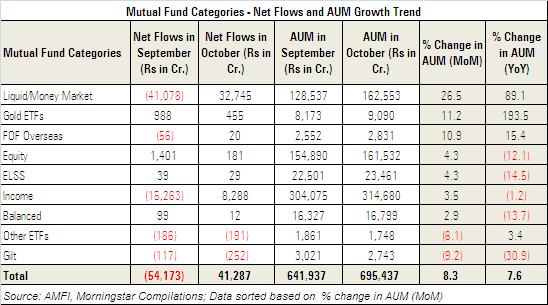

The total asset under management grew by 8.3% on month-on-month basis to Rs 695,437 crores as compared to Rs 641,937 crores in the month of September. The total net inflow during the month of October was Rs 41,287 crores as against outflow of Rs 54,173 crores in the previous month.

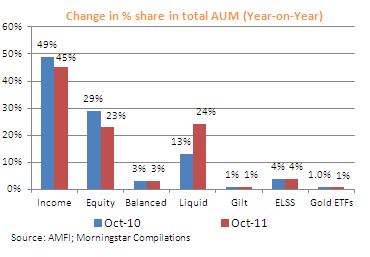

On the debt front, besides gilt category rest all the categories witnessed strong inflows. Liquid & Money market category saw its assets growing by a robust 27%. The category which had seen huge outflows in the past two months, received inflows of Rs 32,745 during October 2011 as banks and financial institutions returned. The overall industry share of the same also surged to 24% after dropping to 20% in the previous month. Similarly the fixed income category AUM grew by 3.5% to Rs 314,680 in October 2011 from Rs 304,075 in the previous month, inflows of Rs 8,288 crores. With the scenario continuing to remain un-conducive for government bond segment the gilt category witnessed the highest drop of close to 9% in its AUM.

Equity markets finally breathed sigh of relief and registered strong gains for the month. The same was reflected on the equity oriented mutual fund categories which recorded net inflows and decent growth in their AUM’s. However the month of October saw lower inflows as compared to the previous month. The categories viz Equity, ELSS and Balanced saw net inflows of Rs 181 crores, Rs 29 crores and Rs 12 crores respectively in October as compared to Rs 1,401 crores, Rs 39 crores and Rs 99 crores respectively in the previous month.

Gold as an asset class continues to remain attractive with investors. This is evident from the sustained growth witnessed by the Gold ETF category which saw its AUM surge by 11% to Rs 9,090 crores on a month-on-month basis. Also year-on-year (ending October 2011), the category recorded robust growth of 194% in its assets. However with the recent correction in Gold prices and uncertainty in the commodity markets the investors’ seemed to have become cautious. The total inflows within the category were Rs 455 crores as against Rs 988 crores in the previous month.