I want to continue with my SIPs for another 15 to 20 years. What do you think of my fund selection? Franklin India Feeder Franklin US Opportunity (Rs 500), DSP World Gold Fund (Rs 500), PGIM India Global Equity Opportunity Fund (Rs 500), Motilal Oswal Nasdaq 100 FoF (Rs 1,000).

It's great to know you have an investment horizon of 15-20 years. You need time on your side to generate wealth.

It is also nice to note that you invest systematically. That instills discipline in the investing process. Increase your SIP amounts by at least 10% every year. As your earnings go up, make sure your investments keep pace.

It is your selection of funds that is surprising. While we are huge proponents of international diversification, we still believe domestic equities should form the core holding of an investor’s long term portfolio. Core allocation to Indian equities along with allocation to international equities and allocation to fixed income, depending upon your liquidity requirements, helps create a well-diversified portfolio.

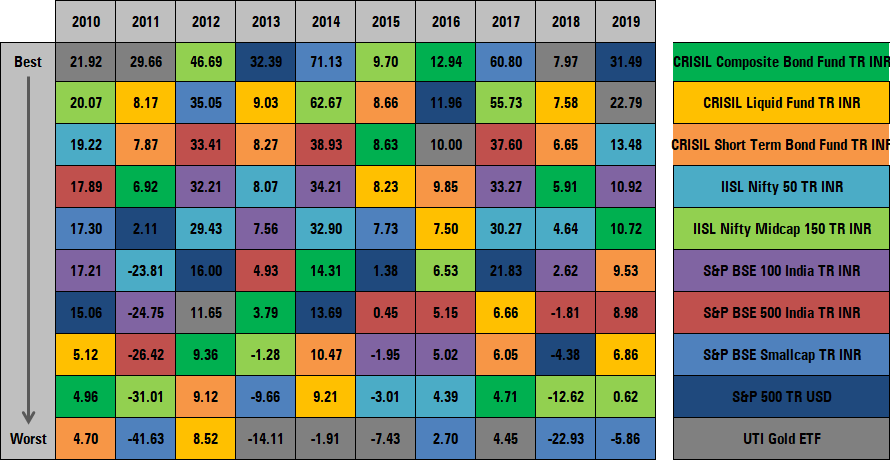

The chart below shows the calendar year returns of various asset classes including domestic equities, international equities, fixed income and gold. While U.S. equities and Gold (and thus gold mining stocks) have done well over the last couple of years, they have been laggards for many years in periods where Indian equities and/or Indian fixed income performed well. That is why diversifying across asset classes is key, so that you have an all-weather portfolio.

Suggested Allocation

- 10% Indian Fixed Income funds: Ultra Short Duration, Short Duration

- 15-20% International Equity

- 5-10% Gold: Gold ETF, Gold mining fund

- You can retain either the Franklin India Feeder - Franklin US Opportunity Fund or the Motilal Oswal Nasdaq 100 FoF and reallocate the remaining amount towards the rest of your portfolio.

- Gradually start reducing your equity exposure once you are within 5-7 years of your goal target date by switching to a less volatile asset class such as fixed income. This will help you de-risk your portfolio from any potential event risk leading to large drawdown in portfolio value closer to your target investment completion date.

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.