In December 1999, during the height of the dot-com bubble, Barron’s released an article titled, “What’s Wrong, Warren?” that questioned whether Buffett (then 69) had become an old man who was out of touch with the shiny new internet economy. With Berkshire trailing the S&P 500 by 43% at the time, the theory seemed not only plausible, but convincing.

But it was Buffett who would go on to have the last laugh as the bubble popped and wiped out nearly 80% of the Nasdaq’s value, resulting in the loss of billions of dollars of equity. In the three years after “What’s Wrong, Warren?” was published, Berkshire went on to gain 36% while the S&P 500 lost 37%:

It was quite a fitting end to the debate over who was the greatest investor of all time — or was it?

That is how Nick Maggiulli,

a brilliant financial blogger, began a detailed post on Warren Buffett in Marker.

Below is an extract.

- From 1965 to 2002, Berkshire underperformed the S&P 500 in only four of those 38 years (roughly 10% of the time) and outperformed the S&P 500 by double digits in over half of the others (53% of the time).

- In the 17 years since then from 2003 to 2019, Berkshire has underperformed the S&P 500 in eight years (47% of the time) and has outperformed by double digits on only four occasions (24% of the time).

- If you had purchased Berkshire stock on December 27, 2002, you would have underperformed the S&P 500 by 2% annually through today.

- Since the dot-com bubble burst, Berkshire has been four times more likely to underperform and half as likely to outperform (by double digits) the S&P 500.

- Additionally, Berkshire has lagged the market over basically every time scale for the last 15 years.

Why did Buffett lose his touch?

The main culprit seems to be driven by Buffett’s failure to invest in companies that have become central to the digital economy, a strange twist of irony given the current market’s strong reliance on e-commerce. If you’ve been an astute student of Buffett’s investment philosophy like myself, this theory makes perfect sense.

Historically, Buffett has made his money by betting on things that never change — things like the addictiveness of sugar (for example, Coke, See’s Candy, Dairy Queen), risk aversion (for example, insurance companies like Geico), and the supremacy of traditional banking. And these bets paid off for decades, as reflected in his market returns when tracking the first four decades of his career.

Then the internet came along and transformed our modern-day economic infrastructure — the effects of which we are seeing play out in real time today. Just take a look at how fintech and SaaS companies like Stripe, Square, and Shopify are undergirding our current digital economy.

Simply put, the internet provided a completely new way of doing business. Unfortunately, investors during the heyday of the ’90s went wild with anticipation over just how much things would change, which led to a boom-and-bust cycle and the subsequent internet crash.

While it’s easy to say that this bubble was a foolish mania, I don’t think that’s quite accurate. As Marc Andreessen pointed out in his interview with Barry Ritholtz, the dot-com bubble wasn’t wrong, it was just early:

The dotcom crash hit in 2000, and all these ideas that were viewed as genius in 1998 were viewed as complete lunacy and idiocy in 2000. Pets.com being the classic example. So, it’s actually really striking. All of those ideas are working today. I cannot think of a single idea that isn’t working today. The kicker for the Pets.com story is that there is a company, Chewy, that just got bought for $3 billion.

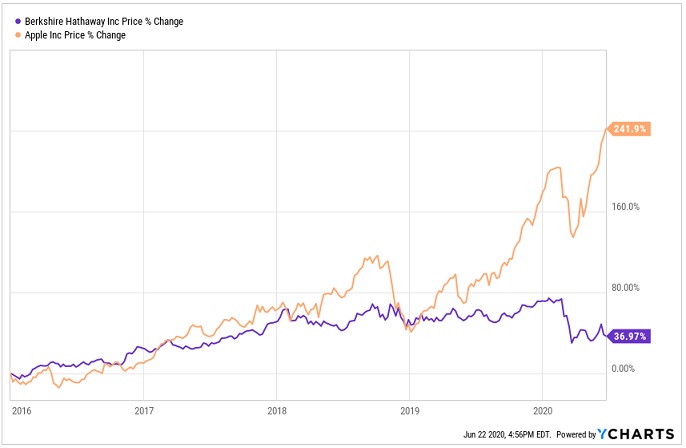

If you compare the investment holdings of Berkshire Hathaway from year-end 2018 to year-end 2019, you will see that roughly half the gain in market value of Berkshire’s investment portfolio came from one company — Apple. This was also in a year where Berkshire returned 11% for shareholders compared to 31.5% for the S&P 500.

So, just imagine how much worse Berkshire would have performed had it not started acquiring its Apple position in 2016.

Berkshire’s stake in Apple represents 21% of its current market capitalization. One-fifth of Buffett’s empire came from one technology investment that was brought into Berkshire’s portfolio only four years ago. (This article was written on July 1. According to Business Insider, Berkshire's $132 billion Apple stake represents 25% of its $521 billion market capitalization.)

Buffett prides himself on not investing in things he doesn’t understand. This quote from “What’s Wrong, Warren?” has aged particularly well:

Absent from Berkshire’s portfolio is technology. Asked at Berkshire’s annual meeting in May why he hadn’t bought Microsoft, Buffett replied: “If I had to bet on anybody [in technology], I’d certainly bet on Microsoft-and heavily. But I don’t have to bet. And I don’t see that world as clearly as I see the soft-drink world.” Buffett recently told a group of Nebraska high-school students that he once told Bill Gates that explaining technology to him was a waste, that Gates would have “better luck with chimps.”

Since 1999, the world has only continued to change at a relentless pace — Silicon Valley’s success, digital consumer habits, and the growth-obsessed model for VC-backed unicorns have rapidly taken shape and evolved.

His track record is amazing

Despite not being able to accurately predict technology’s dominance over the modern economy, you still have to marvel at what Buffett has been able to achieve in his decades-long career.

There’s no doubt that he is an incredible manager of money to keep pace with the S&P 500 all these years.

But as Buffett’s portfolio performance over the past 15 years has shown, his investing edge — his alpha — has been on the wane since the dot-com crash and has flickered even more today in the era of monolithic tech giants.

Still, no one has quite the track record of beating the market as long and as consistently as Buffett has, and no one likely ever will.

A more detailed version of this article initially appeared in Marker.

Nick Maggiulli

is the Chief Operating Officer for Ritholtz Wealth Management.

You can also follow him on Twitter.