The Asia ex-Japan sustainable fund universe encompasses open-end funds and exchange-traded funds that, through their prospectus or other regulatory filings, claim to focus on sustainability, impact, or environmental, social, and governance factors. This article is adapted from a recent report published by Morningstar Sustainalytics and details regional flows, assets, and launches for the fourth quarter of 2025.

Flows

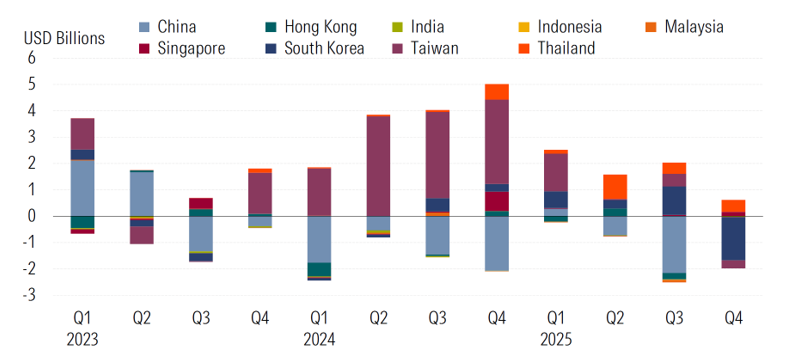

The Asia ex-Japan region posted USD 1.4 billion in net outflows in fourth-quarter 2025, marking the third quarterly outflows in two years. South Korea led the withdrawals with USD 1.6 billion in outflows, while Taiwan registered USD 300 million in outflows, its first negative quarter since third-quarter 2023. The market’s largest sustainable fund, Cathay Sustainability High Dividend ETF, accounted for the largest single-fund outflow at USD 273 million. Mega ESG Taiwan–U.S. Sustainable Double Profits Multi-Asset, which splits its exposure between Taiwan and U.S. markets, experienced one of the largest outflows within the allocation category in the fourth quarter and saw consistent monthly net outflows throughout 2025. Launched in November 2024, it aims to deliver growth and income through equity and bond holdings that meet its sustainability criteria.

Thailand remained a bright spot, attracting USD 452 million in inflows, supported by ThaiESG sovereign bond funds such as KKP Government Bond Thailand ESG and Bualuang Sovereign Instruments Thailand ESG.

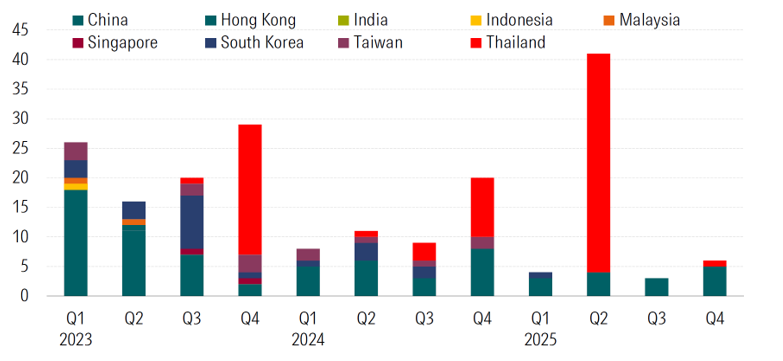

Exhibit 1: Asia ex-Japan Sustainable Fund Flows by Country

Source: Morningstar Direct. Data as of December 2025. China is not included in Q4 flows due to data unavailability.

Meanwhile, China-domiciled sustainable funds recorded USD 2.2 billion of outflows in the third quarter of 2025 (Q4 flow data was not available at the time of writing), their largest quarterly loss since the second quarter of 2022. The biggest single-fund outflow came from Penghua Carbon Neutralization Thematic Mixed Fund, an open-ended index fund tracking the CSI Mainland Low Carbon Economy Thematic Index, which saw USD 425 million in net redemptions during the third quarter.

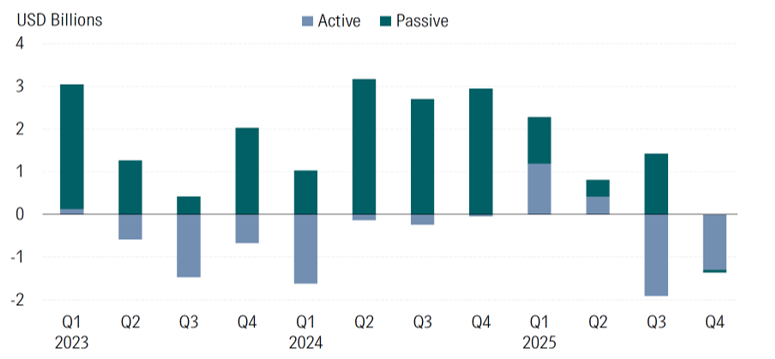

Exhibit 2: Asia ex-Japan Sustainable Fund Flows

Source: Morningstar Direct. Data as of December 2025. China is not included in Q4 flows due to data unavailability.

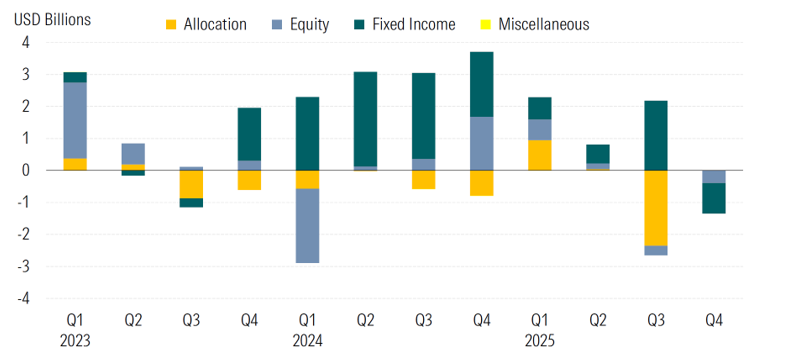

Over the full year, fixed income dominated with inflows of USD 2.3 billion, followed by equity (USD 1.0 billion) and allocation (USD 543 million). This continued the fixed income leadership trend from 2023 and 2024, driven by attractive yields and policy-supported green bond issuance amid market uncertainty.

Exhibit 3: Asia ex-Japan Sustainable Fund Flows by Asset Classes

Source: Morningstar Direct. Data as of December 2025. China is not included in Q4 flows due to data unavailability.

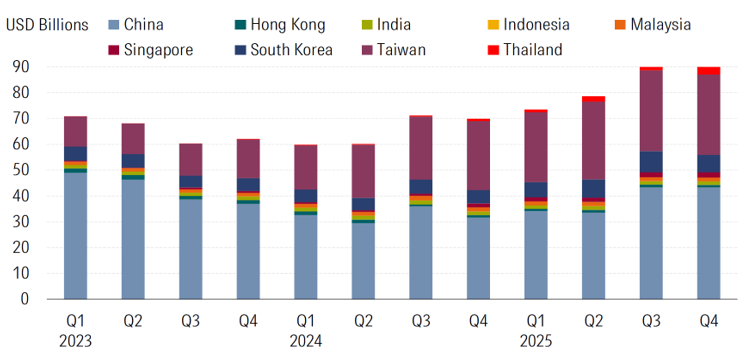

Assets

Total sustainable fund assets in Asia ex-Japan (including China) closed fourth-quarter 2025 at approximately USD 90 billion, down 1.2% from the prior quarter’s reconstituted AUM. Passive funds represented USD 52 billion (58%), while active funds accounted for USD 38.2 billion (42%).

Exhibit 4: Asia ex-Japan Sustainable Fund Assets

Source: Morningstar Direct. Data as of December 2025. Due to the unavailability of China's Q4 assets, we used third-quarter data as a proxy for fourth-quarter assets.

After China (for which up-to-date data was not available at the time of publication), Taiwan remains the second-largest market at roughly one-third of total Asia ex-Japan AUM or two-thirds of ex-China assets. South Korea followed at 7.4% of total Asia ex-Japan assets, with Southeast Asian markets Thailand (3.5%) and Singapore (2.2%) rounding out the top five. By asset class, regional AUM comprised USD 53.6 billion in equity, USD 21.3 billion in fixed income, and USD 15.3 billion in allocation strategies.

Launches

Six new sustainable funds debuted in Asia ex-Japan during the fourth quarter of 2025. Five launches were in China, including two focused on the low carbon economy theme, two on new energy, and one passive product—Harvest CSI Photovoltaic Industry ETF. The latter tracks the CSI Photovoltaic Industry Index, a free-float, market-cap-weighted benchmark that acts as a barometer for China A-share stocks in the solar power sector. The remaining launch was Thailand-domiciled K ESG Bond –ThaiESG, which invests in green, sustainability, or sustainability-linked bonds issued by sovereigns and corporates.

For full-year 2025, 54 new funds were launched in Asia ex-Japan, slightly above 2024 but well below peak volume in 2021-2023, when annual launches averaged nearly 100. 2025 launch activity was concentrated in Thailand (38) and China (15), with one launch in South Korea.

Exhibit 5: Asia ex-Japan Sustainable Fund Launches

Source: Morningstar Direct. Data as of December 2025.

Regulatory Update

In the final quarter of 2025, regulatory bodies and government-related agencies continued to roll out new sustainability initiatives and refine existing ones relevant to the asset management sector.

Hong Kong’s Accounting and Financial Reporting Council (AFRC) released a consultation on a proposed sustainability assurance regime in late December. The framework aims to introduce standards for external verification of climate-related disclosures. Assurance requirements are expected to improve data reliability and reduce greenwashing risk, a priority for both regulators and investors.

The Hong Kong Monetary Authority (HKMA) also issued updated FAQs on the sale of green and sustainable investment products. These guidelines clarify distributor obligations around product due diligence, suitability assessments, and disclosure practices. For asset managers, this oversight into how ESG-labelled products are marketed and sold reinforces the need for robust internal governance and transparent labeling.

Meanwhile, Taiwan’s Financial Supervisory Commission (FSC) confirmed the adoption of IFRS Sustainability Disclosure Standards (ISSB-aligned) starting in 2026. The FSC introduced new rules for TWSE- and TPEx-listed companies, requiring enhanced sustainability governance and third-party assurance for greenhouse gas reporting. These changes raise the compliance bar for firms and improve comparability of ESG disclosures across markets, benefiting investors who rely on consistent data for risk assessment.

In China, authorities issued the “Corporate Sustainability Disclosure Standard No. 1 - Climate Trial”. While voluntary for now, the framework aligns with international best practices and sets the stage for mandatory requirements in the coming years.

South Korea continued to strengthen governance disclosure requirements, with the Korea Exchange highlighting (Korean) best practices in corporate governance reporting and announcing priority review items for 2026 reports, including shareholder meeting timing and dividend predictability.

For the full report, please visit: Global Sustainable Fund Flows: Q4 2025 in Review

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar's editorial policies.