I have been doing an SIP for a few years: HDFC Mid Cap Opportunities, ICICI Prudential Banking and Financial Services, and Motilal Oswal Multicap 35.

The returns are not impressive. They are either on the downside or negative. Is it worth continuing with an SIP in these funds? What is your take on each of the above funds?

It is impossible to answer this question without knowing your complete portfolio, investment risk-return objectives and time horizon.

So here are our views based on the assumption that these are the only three funds in your portfolio.

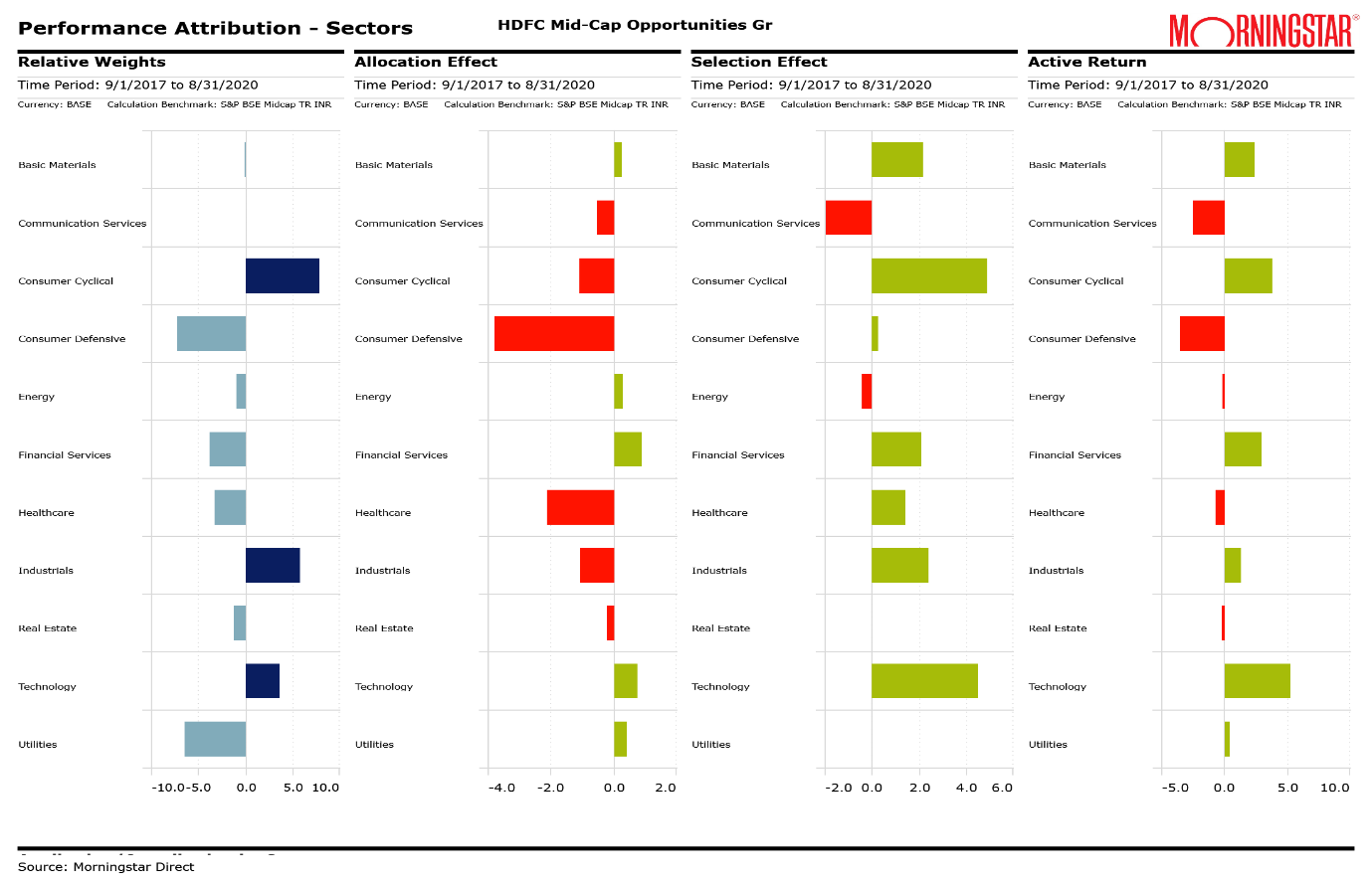

Before I proceed, let me explain how to interpret the performance attribution charts.

These are the relative sector weights of the fund v/s benchmark. The light blue bars to the left indicate an underweight exposure of the fund vs benchmark, while the dark blue bar to the right indicates a overweight sector weight for the fund.

Eg: In the case of HDFC Mid Cap Opportunities, you can see significant underweight positions in Consumer Defensives and Utilities. This will give you a sense if the fund strategy is largely benchmark aligned or does the manager take significant sector calls.

This chart tells you how the underweight/overweight sector calls for a fund have performed vs the benchmark. A red bar to the left indicates a poorer performance while a green bar to the right indicates a better performance. Red bar can be due to two factors – Fund overweight an underperforming sector or underweight an outperforming sector. Green bars are exactly the opposite- Overweight an outperforming sector or underweight an underperforming sector.

Eg: In the case of HDFC Mid Cap Opportunities, you can see that the fund’s underweight position in Consumer Defensives has hurt the performance since consumer stocks have done exceedingly well as compared to the broader benchmark.

This chart tells you how the individual stock calls within each sector have worked for the fund. A red bar denotes poor stock picking. If a fund manager has overweighted stocks that been relatively poor performers or underweighted stocks that are relatively better performers. While a green bar denotes good stock picking, the fund manager has picked or overweighted stocks that are relatively better performers or underweight stocks that have been relatively poor performers.

This is the sum of the Allocation Effect and the Selection effect. Like the others a red bar denotes overall the sector call and stock calls have not worked for the fund. A green bar denotes a combination of sector and stock calls have worked for the fund. The most important thing to look for is a combination of steady green bars with only a few small red bars which suggests steady performance. A couple of large green bars coupled with multiple red bars indicates lumpy performance due to a few stocks/sectors doing well.

HDFC Mid Cap Opportunities

The fund is a well-managed mid-cap fund. The manager, Chirag Setalvad, is an experienced small and mid cap manager and is ably supported by a large research team. The strategy of the fund is to invest largely in mid-cap stocks which have good growth prospects but are reasonably valued. The fund also takes some exposure to small caps, with limited exposure to large caps (as compared to its peer group).

The fund has through a rough patch recently, due to it valuation-conscious approach that led it to be underweight certain Consumer Defensive names, a segment of the market which has done exceedingly well recently. The chart below is a performance attribution summary of the fund over the last 3 years.

We recommend holding on to your investments in the fund.

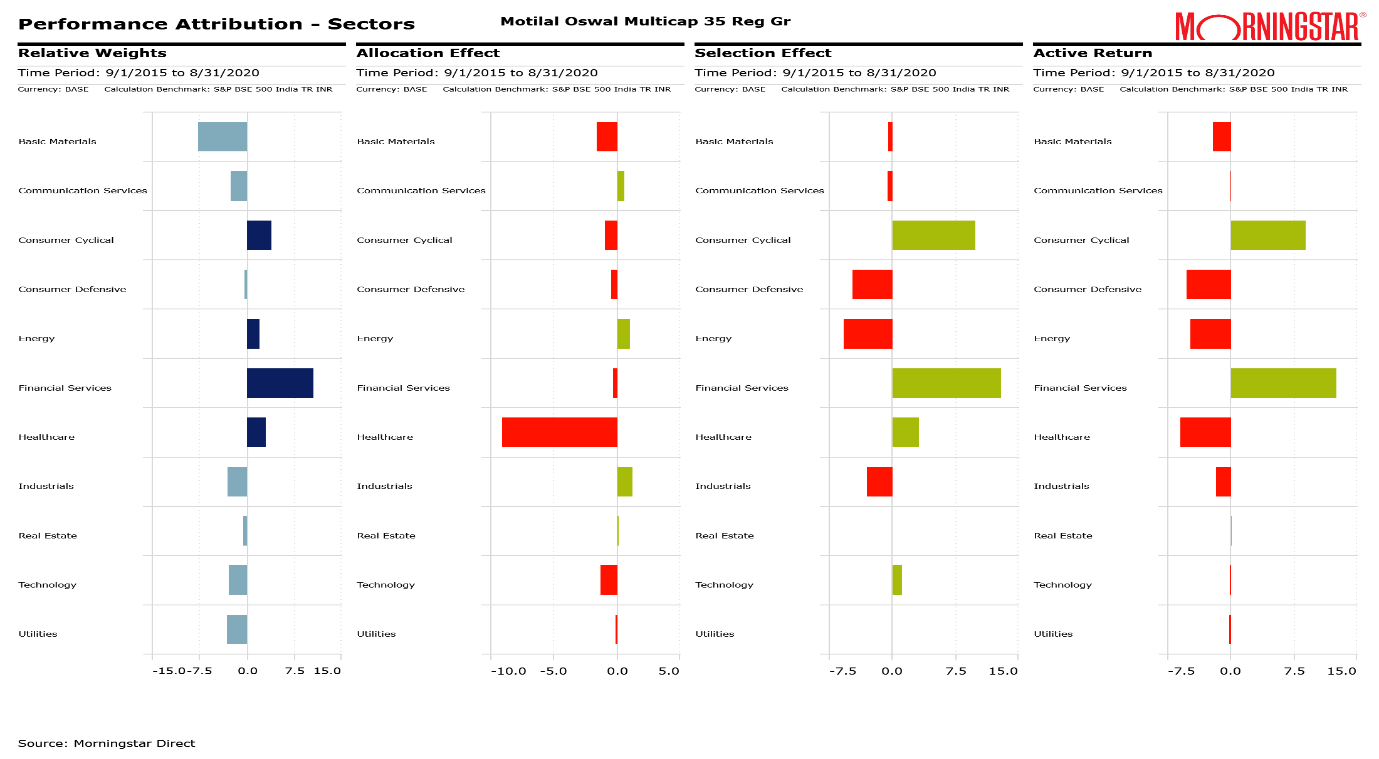

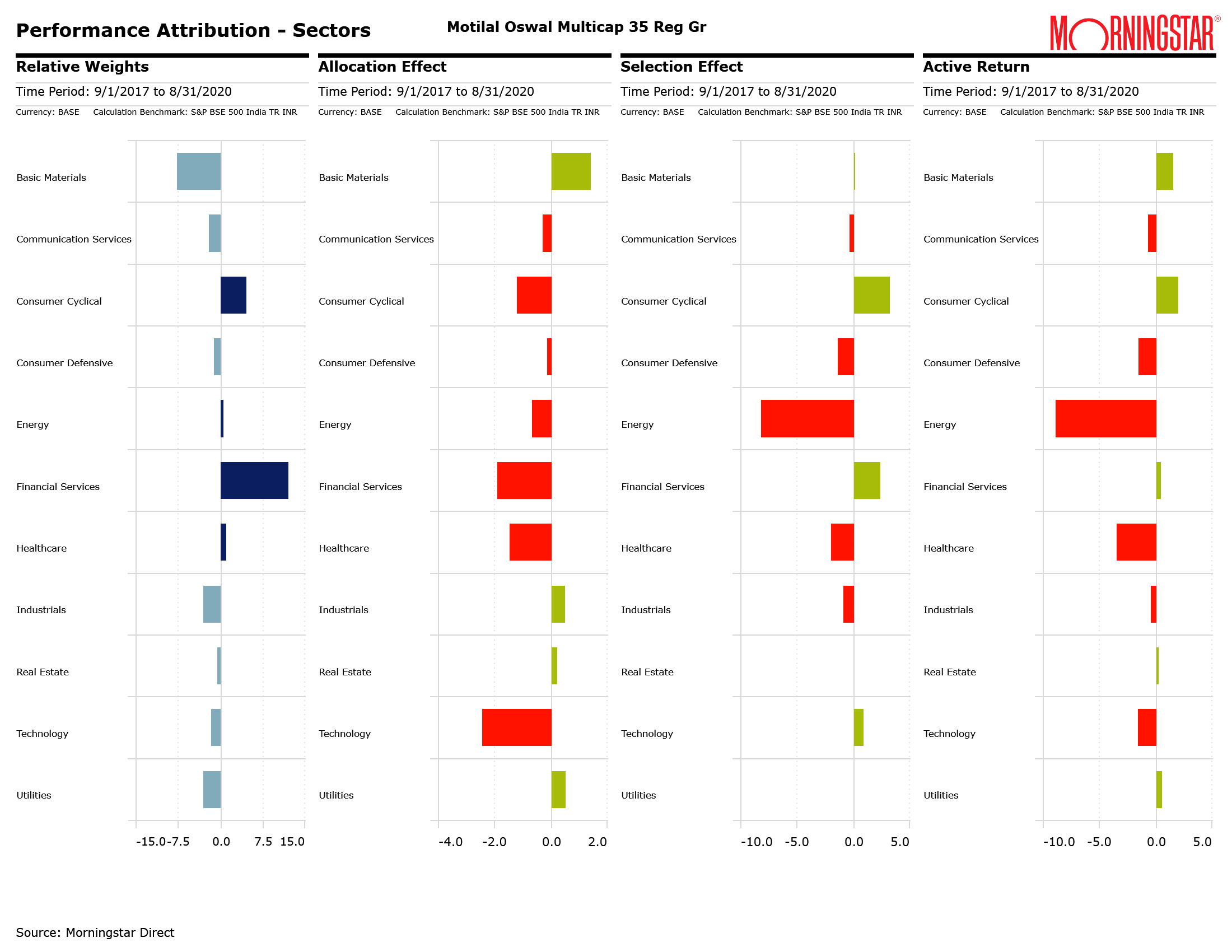

Motilal Oswal MultiCap 35

The fund is run with a focus towards quality companies that can are expected to demonstrate sustainable earning growth and are available at reasonable valuations. Over the past few years the fund has underperformed. Over a 5-year time frame the fund has done reasonably well, but when you break down the returns (performance attribution), the returns are quite lumpy from only a couple of sectors. There has also recently been a change of fund manager in 2019, with long time fund manager Guatam Sinha Roy quitting the AMC. Given the new SEBI definition of multi-cap funds, it would be prudent to keep an eye on how the fund will be managed going forward.

Traditionally, the fund has been fun with a focussed large-cap bias. We would advise to keep this fund under review and take a call once the fund positioning is clearer in the next few months.

ICICI Prudential Banking and Financial Services

The fund invests primarily into banking and other financial stocks like non-banking finance companies (NBFCs), housing finance companies (HFCs), insurance companies, brokerages, and asset management companies (AMCs). The fund has done reasonably well from the context of the peer group. But do remember Financials are already a fairly large part of the broader indices and most managers tend to have a fairly significant allocation towards financials stocks. So unless you want to express a very specific view towards the sector, you are better off investing into diversified equity funds and let the fund manager take the sector underweight/overweight calls. If you do want to remain invested, we recommend not more than a 5-10% allocation towards the fund from your overall portfolio perspective.

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.