Following lacklustre performance in 2018 and 2019, midcap funds have made a strong comeback by delivering 22.98% category average return over a one year period. However, compared to their January 2018 high, mid-caps are only 5% up so far.

Following the COVID-19 led-sell off early in the year, markets have surged sharply with the broader markets (S&P BSE 500 Total Return Index) now up 97% as on January 20, 2020, while mid-caps (S&P BSE Mid Cap Total Return Index) has soared 100% during the same period. This has helped most mid-cap funds deliver eye-popping returns in 2020. In fact, mid-cap funds category has outperformed the large cap funds category by 5.33%, on average, over a one-year period.

Mid Cap funds invest a minimum of 65% of assets in mid cap stocks, while the remaining 35% can be invested in large caps and small caps depending on the fund manager’s discretion.

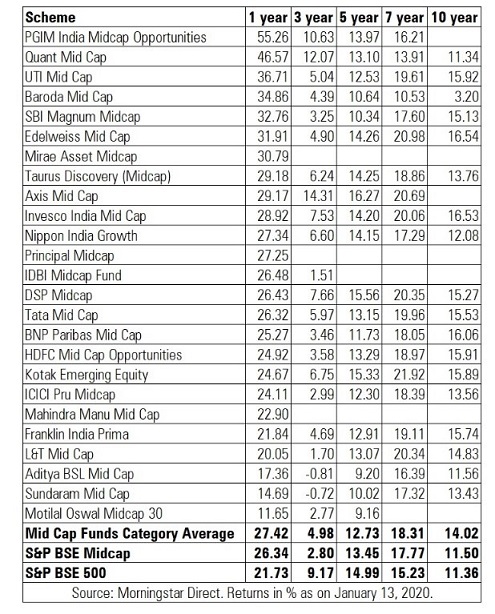

Here’s a look at the performance of mid cap funds curated based on the highest return over a one year period.

Blank cells indicate that these funds have not completed three years.

As we can see from the above table, mid cap funds category has outperformed the S&P BSE 500 Index over one year, seven year and ten year period.

High risk-reward proposition

Investing in mid-caps can be a double-edged sword, given the high risk-reward proposition, along with the higher inherent volatility, compared with large-caps. Investors need to have patience and a long term investment horizon to tide over the volatility that tags along with such investments.

Let us look at how the mid-cap index has performed vis-à-vis the Sensex. In the 2008 market meltdown, the Sensex dropped by 52% while the BSE Mid Cap Index had plunged by 67% during the same year. In the same vein, mid-caps can bounce back faster than large-caps. In 2009, when the Sensex recovered by 81% following the ferocious drop in 2008, the mid cap index surged sharply by 108% during the same period. To cite another example, in the 2017 rally, the Sensex gained 28% while the mid-cap index was up 48%.

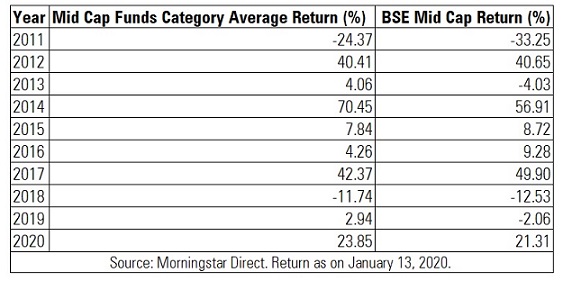

As we can see from the below table, in six out of the past ten years, the mid-cap funds category has outperformed the BSE Mid Cap Index. In 2011 and 2018, mid cap funds category was able to protect the downside.

Evaluating mid cap funds

As is evident from the above numbers, mid-cap funds can be susceptible to huge performance gyrations. Therefore, when selecting a fund in this space, investors should evaluate funds based on their performance in bull and bear markets. Investors should also look at the extent of downside protection a fund has offered in the past bear markets, which is equally important as its performance in up markets. For instance, if the mid-cap index has dipped by say 10% in a particular year and your mid cap fund has fallen by 3% during the same period, the fund manager has protected your portfolio to the extent of 7%.

Vinod Jain, of Jain Investment, shares how he chooses mid-cap funds for his clients. “I look at a variety of factors such as fund house pedigree, team, fund size, inflows and the existing portfolio while filtering mid cap funds. The portfolio should offer a differentiation and should be liquid enough which can help the fund manager manoeuvre the fund easily. Another important filter is that the fund should be getting regular inflows which helps the fund manager find new opportunities. The fund size should ideally be between Rs 500 crore to Rs 1,500 crore. Once the fund size goes beyond Rs 1,500 crore, we stop deploying fresh money to such funds. We don’t recommend such funds to clients but keep a close watch on the fund’s performance.”

There are 15 funds in the industry with fund size above Rs 1,500 crore. As on December 2020, HDFC Mid Cap Fund is the largest with assets under management of Rs 24,714 crore, followed by DSP Mid Cap Fund which manages Rs 9,823 crore.

You can read our analysts view on the mid cap funds covered by us here.

Should you invest at the current valuations?

While the jury is still not out on whether the sharp rise in markets justifies an entry into mid caps at this juncture, experts suggest that investors should not ignore mid caps outright.

For investors who might have missed the mid cap rally in 2020, is it the right time to invest or should they wait on the sideline for a correction? Kaustubh Belapurkar, Director – Manager Research, Morningstar Investment Adviser India, recommends investors should take a staggered approach and moderate their return expectations going ahead. “Mid-caps are currently trading in the overvalued zone. That said, it doesn’t mean that investors should stay away from this segment. Investors should have a minimum of seven years of investment horizon in such funds. If you want to enter the mid cap space at this juncture, you can stagger investments over the next 12 months. The markets are up almost 100% since the Mach 2020 lows. Going ahead, investors should lower their returns expectations given where the valuations are.”

While the valuations certainly appear stretched, advisers believe that the mid cap segment offers good opportunities if investors are willing to stay put for a minimum of seven years. Vinod isn’t so much concerned about the valuations in the mid cap space. “The retail ownership in mid cap stocks has gone up. A lot of mid cap firm promoters have diluted their stake and come out with further equity issuances to raise capital. The supply is increasing. When the supply increases the prices tend to tire out. The stock price is a function of supply and demand and not so much about valuation. If it were a function of valuation, then Tesla should not be trading where it is currently. The Tesla stock has gained 750% in 2020,” points out Vinod.

Higher volatility

Kaustubh cautions that investors should be ready to brace for higher volatility when they are invested in mid cap funds. “We have seen drawdowns of 70-80% in 2008 in this segment and close to a 50% drawdown since early 2018 till March 2020. The drawdowns can be sharp and prolonged. Mid caps are wealth generators in the long term, but investors should have the right approach and investment horizon when investing in such funds. We have been trimming exposure in mid caps due to high valuations in our managed portfolios. We don’t recommend investors to invest lumpsum in mid caps at this juncture.”

To sum up, investing in mid cap funds requires a longer time horizon and patience to ride out the volatility. Mid-caps are an integral part of your overall strategic asset allocation and the exposure should be in sync with your risk appetite. Those who can withstand this volatility can expect to earn superior risk-adjusted returns over the long term.