Gold is considered auspicious and a store of value in India. India’s demand for gold is insatiable which is evident by the steady rise in gold imports over the years. In 2020, India imported 720 tonnes of gold.

To curb the demand for physical gold, the government came up with Sovereign Gold Bonds, or SGB, in Union Budget 2015-16. This scheme offers a hassle free and low-cost way of taking exposure to gold. The first tranche was launched in 2015. The 12th tranche opened on March 1 and closes on March 5, 2021.

Both SGB and Gold Exchange Traded Funds, or ETFs, are a low-cost way of taking exposure to gold. Investors do not have to incur costs like making/wastage charges, storage charge (bank locker) and get 999 purity.

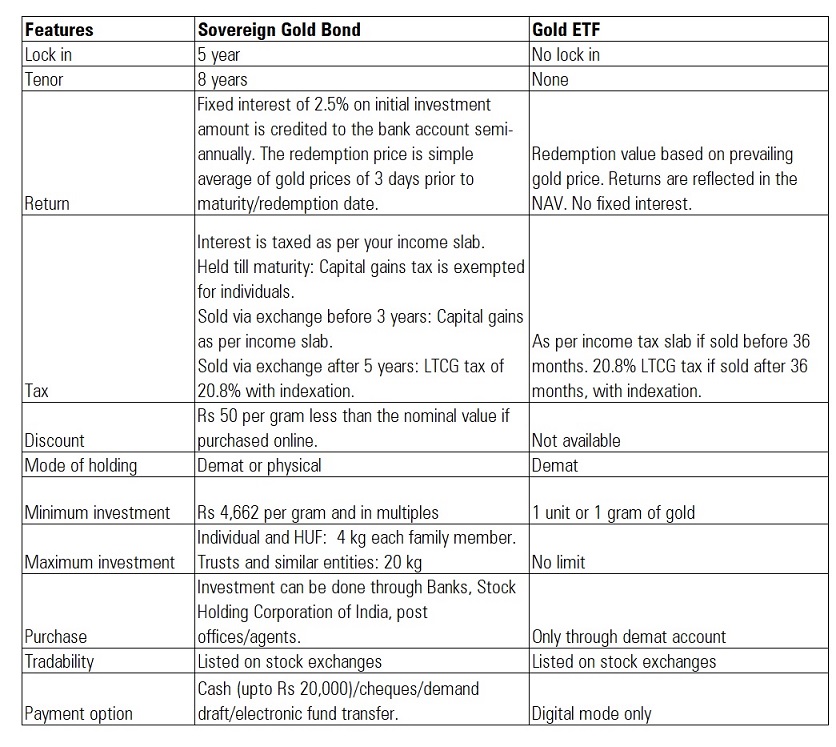

Let’s take a look at some of the features, benefits and disadvantages of SGB versus Gold ETFs.

Risks

Your investment value could decline if the prices of gold slump in SGB as well as Gold ETFs. But that is applicable if you buy physical gold as well.

Which is better?

One area where SGB scores over Gold ETFs is that you get a fixed 2.5% return on your initial investment value till you hold your investment in SGB. Further, the government is providing Rs 50 discount if the investment is done through digital mode. But SGB has a lock in period of five years while Gold ETF units can be redeemed any time. Thus, you need to invest after taking into consideration your investment horizon.

Here are some features of SGB and Gold ETFs to consider while investing.

Do note that the minimum investment is 1 gram in SGB which is priced at Rs 4,662 per gram at the time of issuance. This price may change after the bonds are listed on the exchange depending on the gold price fluctuation.

Factors impacting the price of gold

The price of gold went through the roof during the pandemic-induced lockdown as investors rushed to safety. The yellow metal is losing sheen now due to the arrival of vaccine and expectations of economic recovery around the globe. The prices of gold fluctuate every day due to a variety of reasons including changes in U.S. treasury yields, dollar-rupee movement, economic recovery, geopolitical factors, inflation, demand for gold, and so on.

Exposure to gold

To sum up, experts suggest that gold should be 5-10% of your investment portfolio as it has low correlation with equities and can thus provide stability to your portfolio when the markets crash. For instance, the S&P BSE Sensex tumbled to a low of 25,638 in March 2020 while gold prices peaked above 55,000 in August 2020.