After eight consecutive months of net outflows, the industry has received net inflows worth Rs 9,115 crore in March 2021 in equity funds. Barring multi-cap and value funds, all categories of funds saw net inflows.

Gross redemptions from equity funds fell from Rs 25,434 crore in February 2021 to Rs 18,908 crore in March 2021 which helped in getting a positive net inflow in March 2021. Also, gross sales were higher at Rs 28,023 crore in March 2021 vis-à-vis Rs 20,900 crore in February 2021.

Sectoral funds received the highest inflows at Rs 2,009 crore. Invesco India ESG Equity Fund launched in March 2021 collected Rs 565 crore.

Given the recent volatility due to the second wave of Coronavirus cases and the ensuing lockdown, investors are preferring to play safe by investing in dynamic asset allocation funds. Dynamic asset allocation funds received 2,711 crore in March 2021. “On the retail equity-oriented schemes, arbitrage and dynamic asset allocation strategy along with mid-cap have witnessed maximum flows, reflective of smart distribution and diversification of their long-term savings,” said N.S. Venkatesh, CEO, AMFI.

The number of systematic investment plan or SIP accounts increased from 3.62 crore in February 2021 to 3.72 crore in March 2021. SIP inflows increased from Rs 7,528 crore to Rs 9,182 crore during the same period.

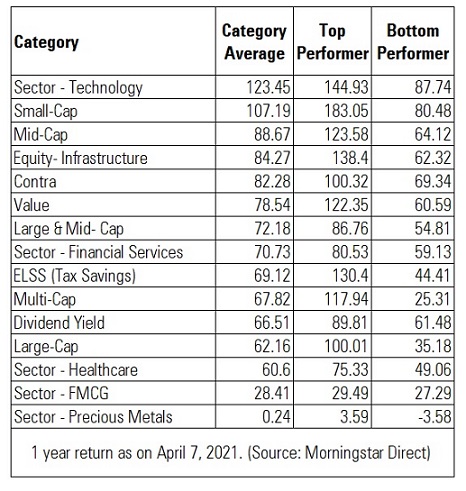

Over a one year period, technology funds have lead the pack with a category average return of 123.45%, followed by small caps and mid caps. Here’s the category average return of different fund categories over a one year period.

Debt Funds

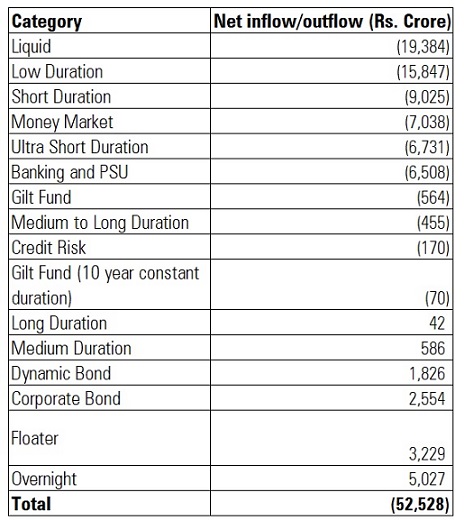

Debt funds saw net outflows of Rs -52,528 crore owing to large outflows from liquid, low duration, short duration, ultra short duration and Banking & PSU Funds due to quarter end.

Lower your return expectations from debt funds

“On the debt side, quarter-end phenomenon has played out with corporates redeeming their allocations to fulfil their tax mandates. However, corporate bond fund, dynamic bond and floater fund have seen positive flows owing to investors preferring to take advantage of the flexibility offered by the duration strategy, and RBI preferring accommodative stance to help pursue growth over inflation,” added Venkatesh.

New Fund Offers

The industry mopped up Rs 4,539 crore from 16 new fund launches. Passive funds collected Rs 797 crore. HSBC Global Equity Climate Change Fund of Fund and SBI International Access- US Equity FoF collectively mopped up Rs 1,961 crore.

Gold ETFs

Gold ETFs saw net inflows of Rs 662 crore. The yellow metal has lost 7.73% in the last six months. Experts feel that it is a good time to accumulate gold from an asset allocation perspective. Gold ETF folios have more than doubled from increased from 5.26 lakh in March 2020 to 12.99 lakh in March 2021.

The industry’s asset base has jumped by 30% from Rs 24.70 lakh crore in March 2020 to reach Rs 32.17 lakh crore as of March 2021.