In the previous post, we looked at how to find the performance of five funds over five different time periods through Return Calculator Tool on Morningstar.in. In this post, we shall explore Category Performance Tool. You can view the performance of only open-ended funds using this tool.

Category Performance

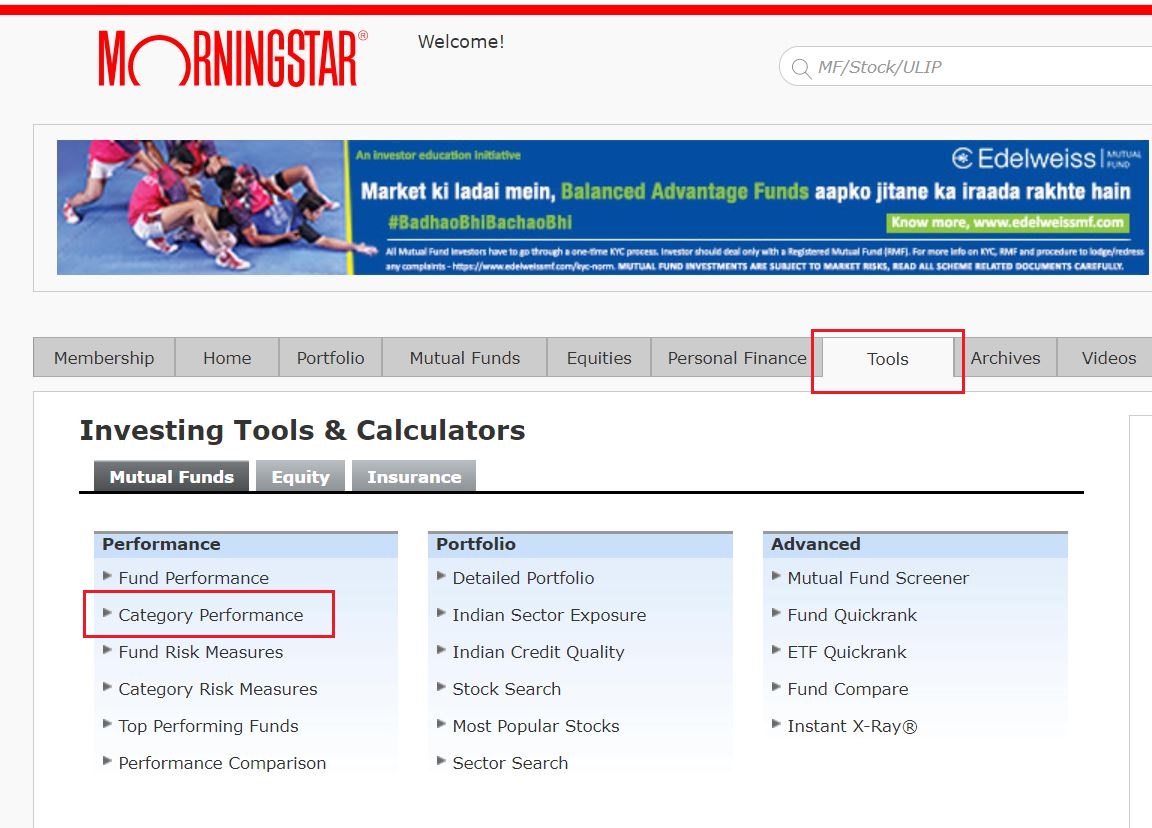

You can access this Tool through our homepage at the top navigation space Tools > Mutual Funds > Category Performance.

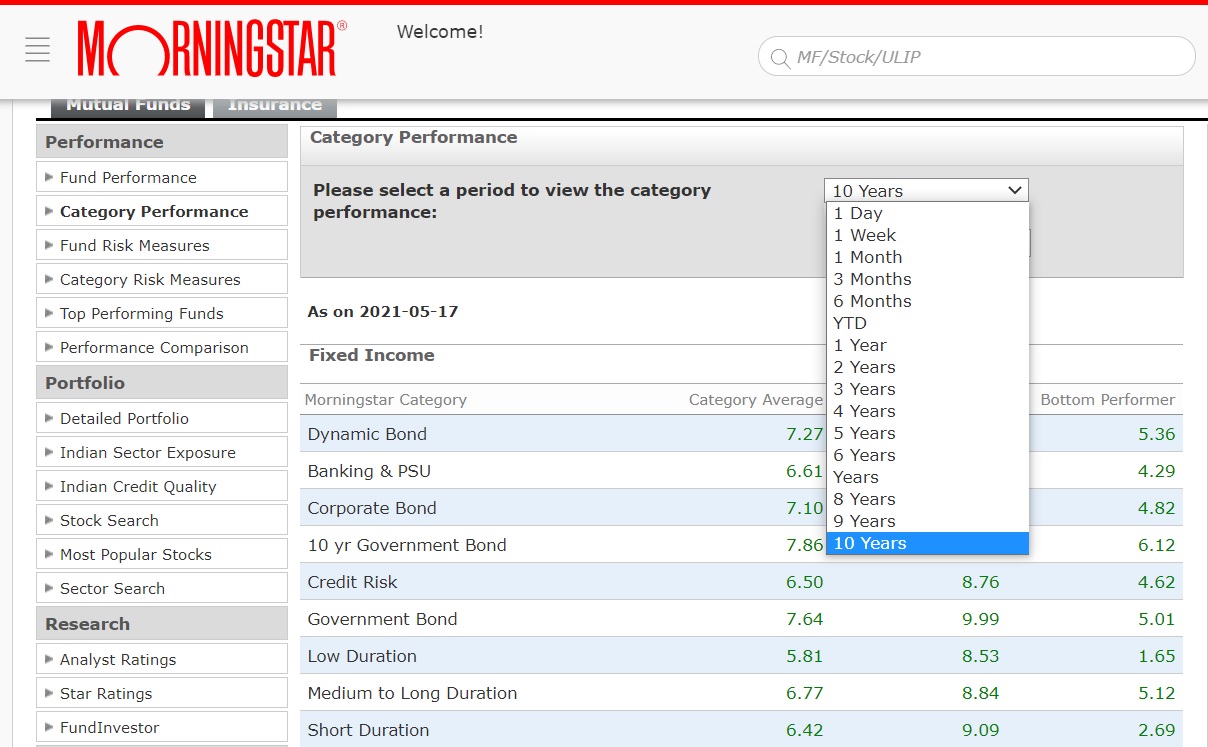

This tool provides the performance of category average, top performer and bottom performer during a time period selected by you. The time period range for performance is 1 day, 1 week, 1 month, 3 months, 6 months, Year to Date, 1 year up to 10 years. By selecting a time period, and hitting the Go button, you can view the performance of 39 scheme categories.

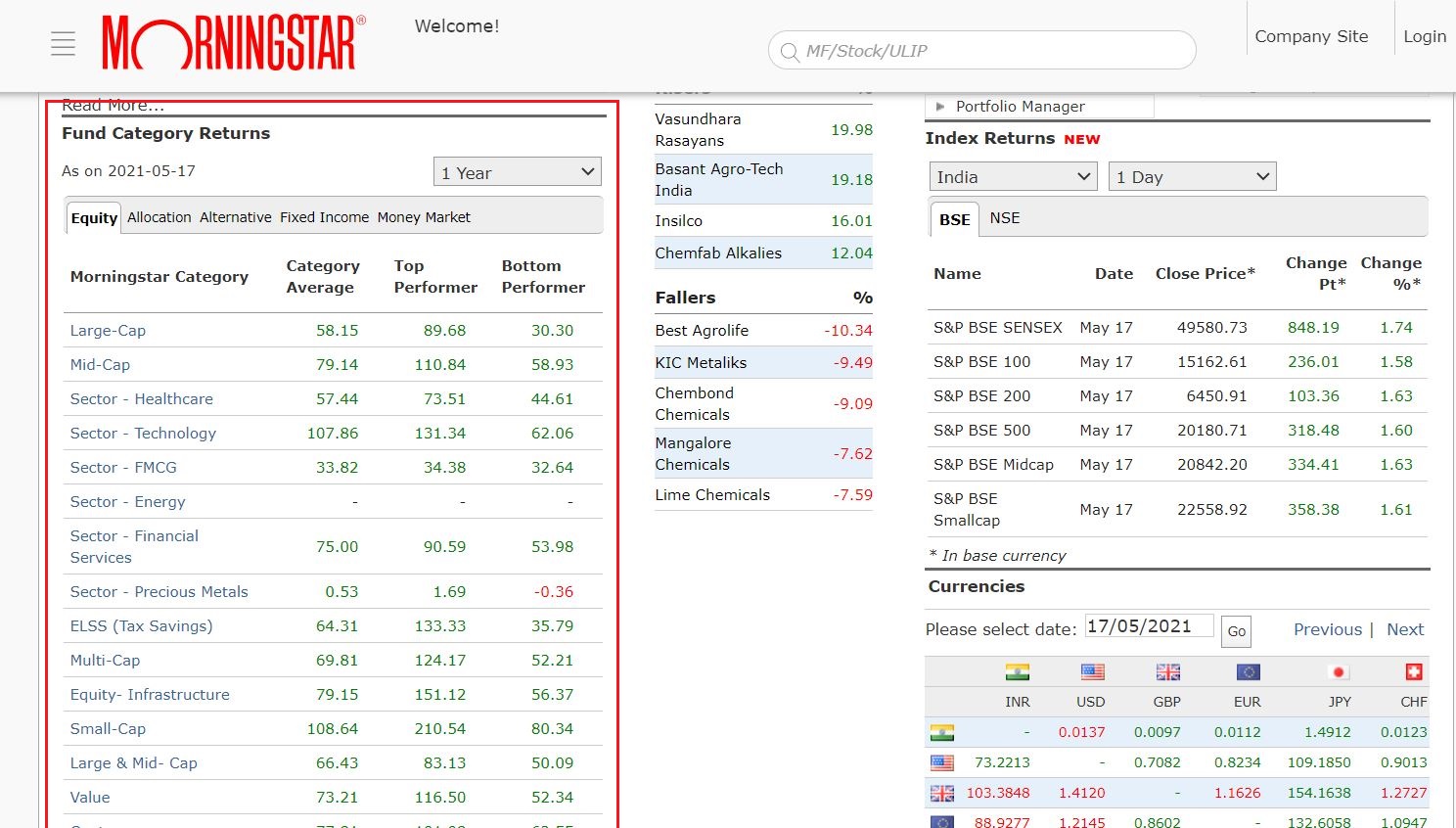

Fund Category Returns

If you wish to check the performance of all funds under any category, you can access this feature directly through our homepage from this section shown below. The funds are grouped under five broad categories: Equity, Allocation, Alternative, Fixed Income and Money Market.

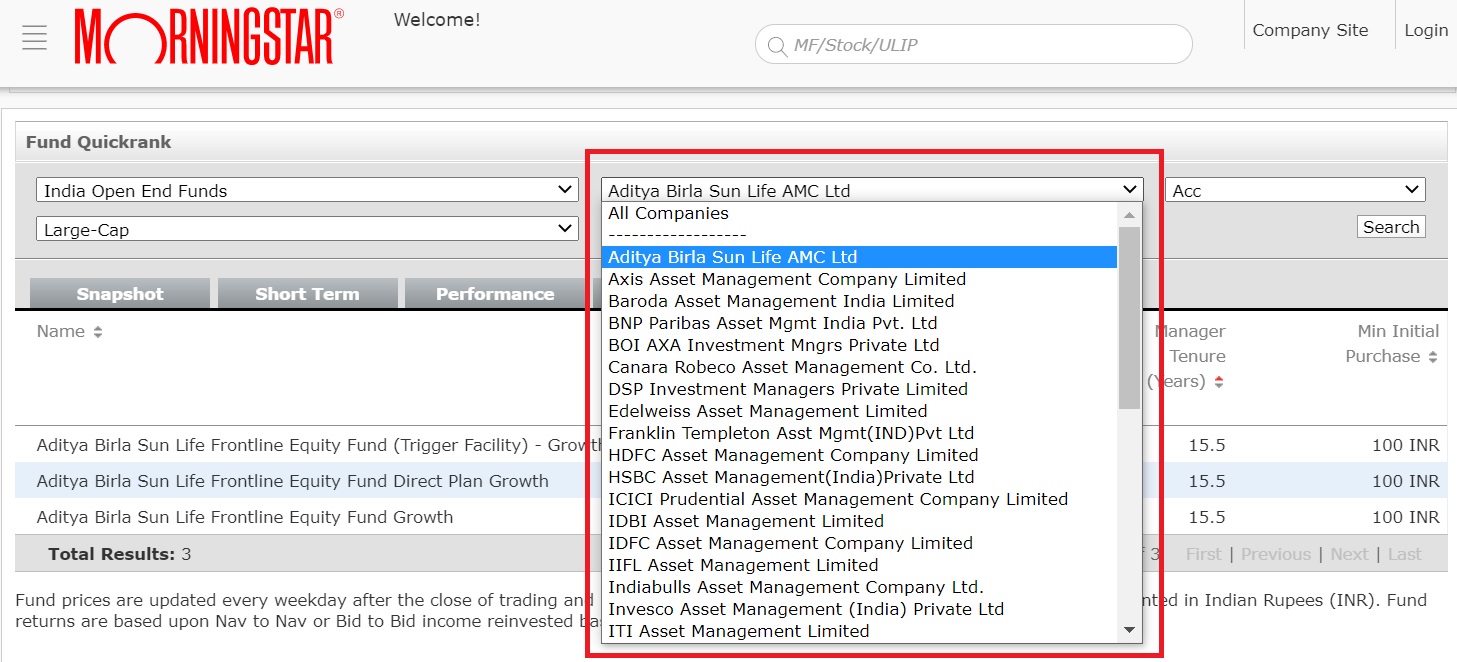

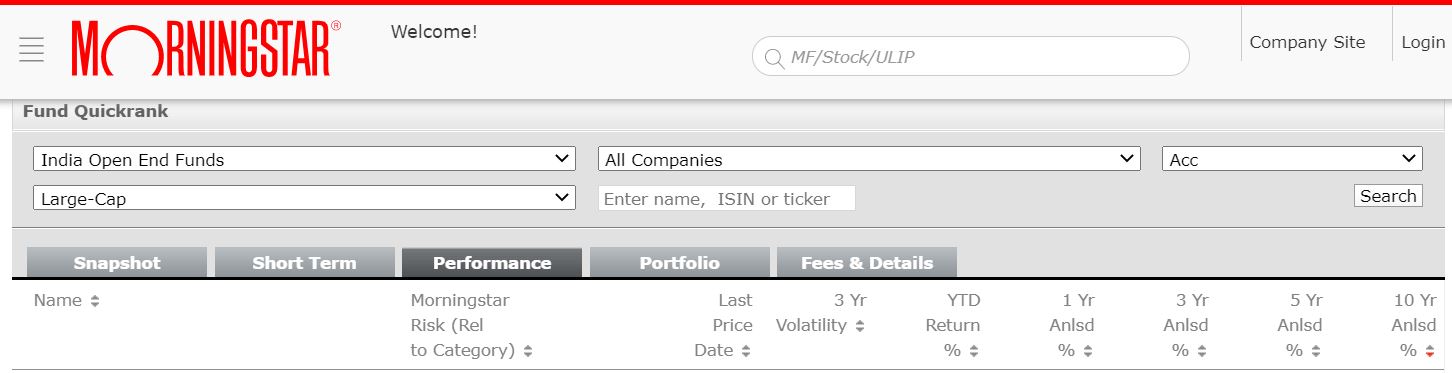

By clicking on the category name highlighted in blue, you will get to see all the funds under one category. We have selected Large Cap Funds. Under this section, you can view the performance of all funds under the large cap category. You can filter Growth, Dividend or select both under the All Distributions option. Acc denotes Growth Option and Inc denotes Dividend Option. In the Snapshot section, you can filter funds based on highest to lowest or vice versa based on parameters like Morningstar Star Rating (5 stars to 1 star), Year to Date (YTD) return and Total Expense Ratio.

Under the Short Term Tab, you can view the performance of funds ranging from 1 Day to 6 months. Under the Performance tab, you will get to see the Risk of each fund relative to the category, 3 year volatility, YTD return, 1,3,5 and 10 year annualised return of funds.

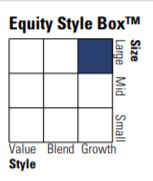

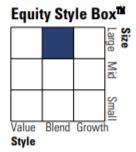

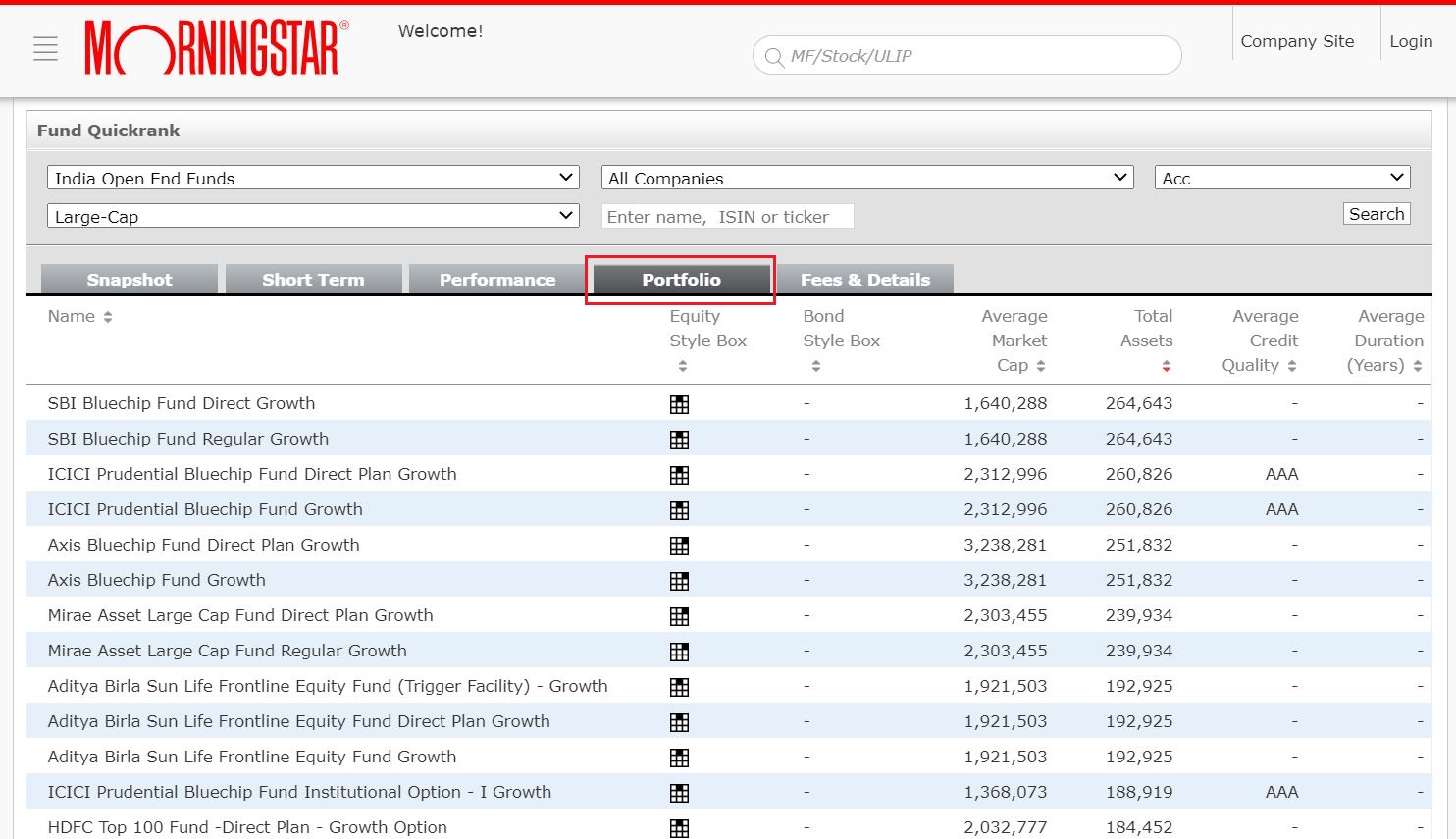

Under the Portfolio Tab, you can see the Morningstar Style Box of the fund. This 9-grid tabular box which gives an indication of the underlying holdings of the fund.

For instance, if the shaded portion appears on the top right hand side of the box, it means the fund invests in growth-oriented large cap firms. For instance, Mirae Asset Large Cap follows Large Growth style.

SBI Bluechip follows a Large Cap Blend Style (mix of growth and value). In the case of SBI Bluechip, the shaded portion will appear in the middle.

You can also filter funds based on the assets under management from high to low and vice versa. As on April 2021, the largest fund under this category is SBI Bluechip (Rs 26,464 crore) while Taurus Large Cap is the smallest fund with AUM of Rs Rs 29 crore. The AUM numbers mentioned on the website are in million. The Average Credit Quality and Average Duration information are more relevant for debt funds.

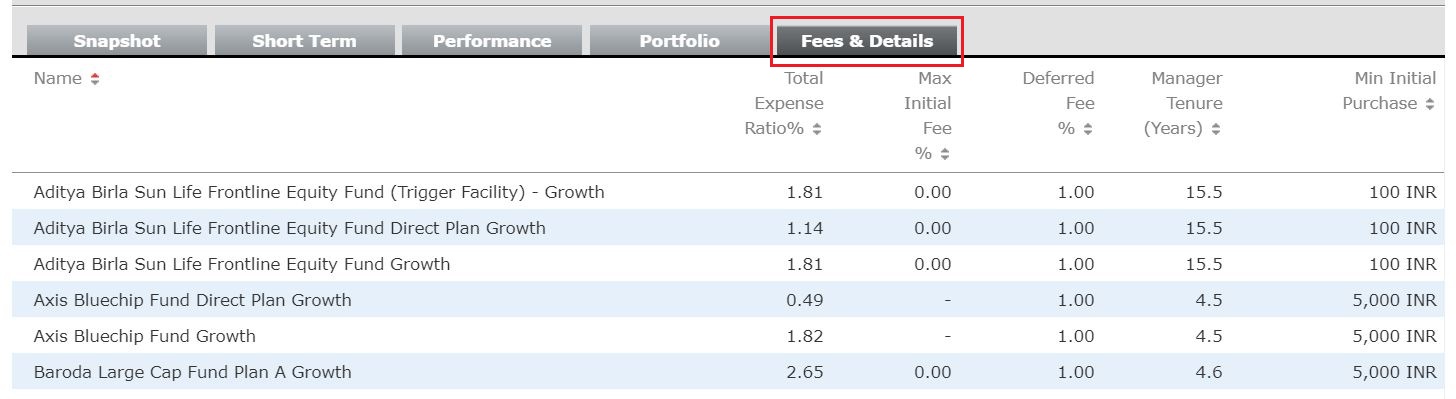

Under the Fees & Detail Tab, you can see the annual expense ratio of the fund. Deferred fee is the exit load. Manager Tenure shows the time period for which the current fund manager is managing a particular fund. For instance, Prashant Jain is managing HDFC Top 100 for 17.9 years, i.e. since 2003. The minimum initial purchase tab shows the minimum investment that the fund accepts for lumpsum investments.

You can also shortlist a single category or all the categories from a particular fund house.