Securities and Exchange Board of India (SEBI) has increased the overseas investment limit to $1 billion per fund house from the current US $600 million per fund house, within the overall industry limit of $7 billion.

Further, fund houses can invest in overseas Exchange Traded Funds (ETFs) of subject to a maximum of $300 million per fund house from the current $200 million, within the overall industry limit of $1 billion.

The circular comes into force with immediate effect.

Currently, $50 million is reserved for each fund house individually within the overall industry limit of $7 billion.

Fund officials laud SEBI’s move

“The SEBI circular on enhancing the limits of mutual funds to invest overseas is very positive. International investing is important in asset allocation and is really taking off now. This move only widens the space for this category to grow, and fund houses to do more in this space,” said Radhika Gupta, Chief Executive Officer, Edelweiss Mutual Fund.

“It is a good move. The realisation of global investing is being acknowledged by the regulator,” said Swarup Mohanty, Chief Executive Officer, Mirae Asset Mutual Fund.

International investing gaining traction

Indian investors seem to have realised the benefits of geographical diversification after U.S markets delivered stellar returns, particularly by Facebook, Amazon, Apple, Netflix, and Google (FAANG) stocks. To cater to this increasing appetite, mutual funds have launched a slew of international funds in the recent past.

The number of international fund of funds has increased from 28 in April 2020 to 35 as of April 2021. During the same period, the assets under management has increased from Rs 3,282 crore to Rs 13,989 crore, a growth of over 300%.

4 reasons you MUST consider global investing.

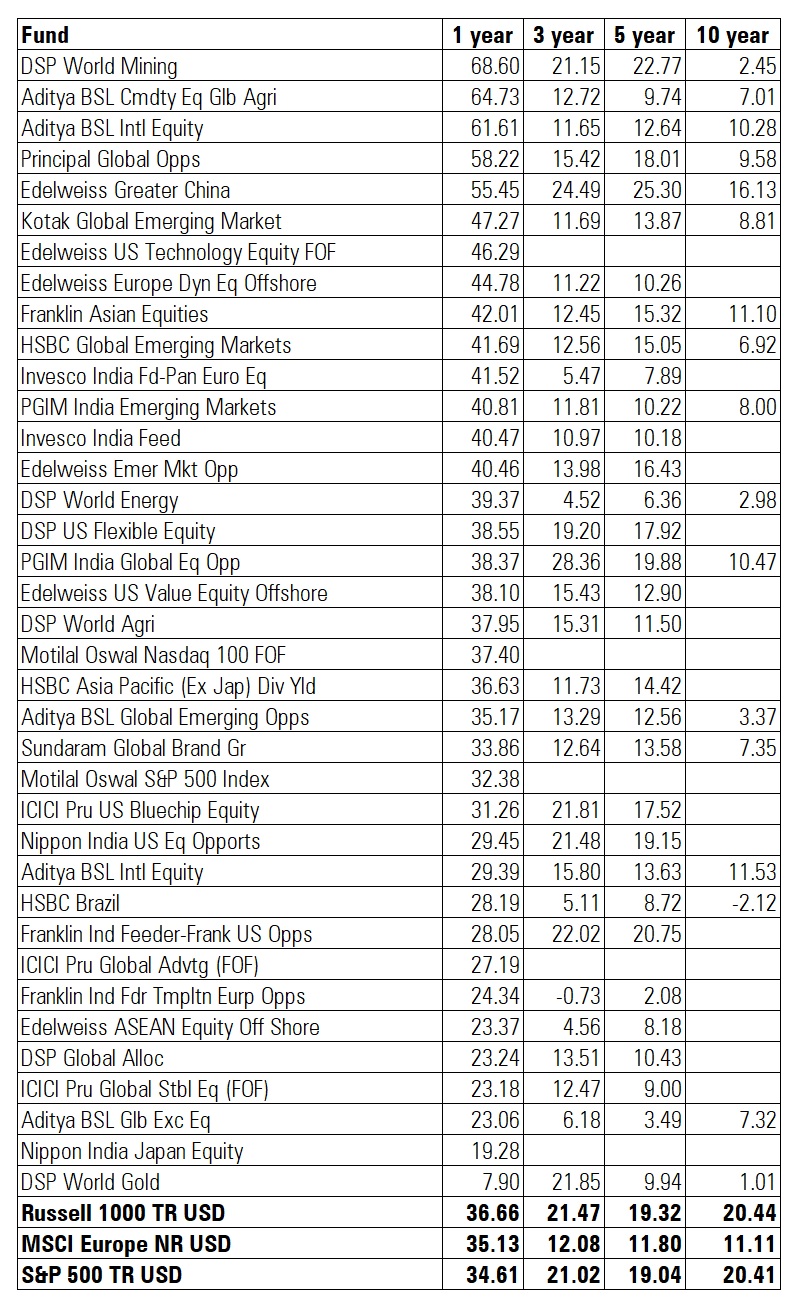

Performance of international funds

The category hosts a wide array of funds ranging from investing in specific geographies to investing in themes such as Environmental Social and Governance (ESG), agriculture, commodities, etc.

Trailing Returns as of May 2, 2021.

(Source: Morningstar Direct).