Large Cap Funds account for Rs 1.94 lakh crore or 18% of the total Rs 10.95 lakh crore AUM as of June 2021, making it the largest category of open ended actively managed equity funds.

After witnessing nine consecutive months of outflows aggregating Rs 14,557 crore from June 2020 till February 2021, Large Cap category has seen net inflows worth Rs 2,532 crore from March 2020 till June 2021.

Large Cap Funds have been finding the going as not many funds are able to outperform the benchmark over the last few years. What are the reasons for this underperformance? Until January 2018, equity funds were benchmarked against Price Return Index (PRI). The PRI Index only captures capital gains of the index constituents, excluding dividends.

From February 2018, all equity funds are benchmarked against Total Return Index (TRI) which takes into account all dividends/interest payments that are generated from the basket of constituents that make up the index in addition to the capital gains. Thus, equity funds now have a higher bar to measure their performance.

Besides, the Securities and Exchange Board of India (SEBI) designed categorisation rules for funds in October 2017, which mandated funds to follow a pre-determined framework on where they would invest. For instance, Large Cap Funds have to invest a minimum of 80% assets in companies that rank from 1st to 100 in terms of market capitalisation. Before 2018, fund managers had the leeway to move to mid and small cap stocks to generate alpha.

Further, polarised markets can make it difficult for fund managers to outperform the index. In 2018-19, the market witnessed large polarisation wherein a few stocks helped the index rally. If a particular stock's weightage in the portfolio goes upwards of 10% due to a sharp rally, fund managers trim the exposure to comply with the regulatory limits.

This is where market capitalisation weighted passive funds score over active funds as passive funds can replicate in the index in the same proportion as the underlying stocks. Experts say that sustained inflows in ETFs/index funds tracking the large cap index is helping Large Cap passive funds outperform active Large Cap Funds.

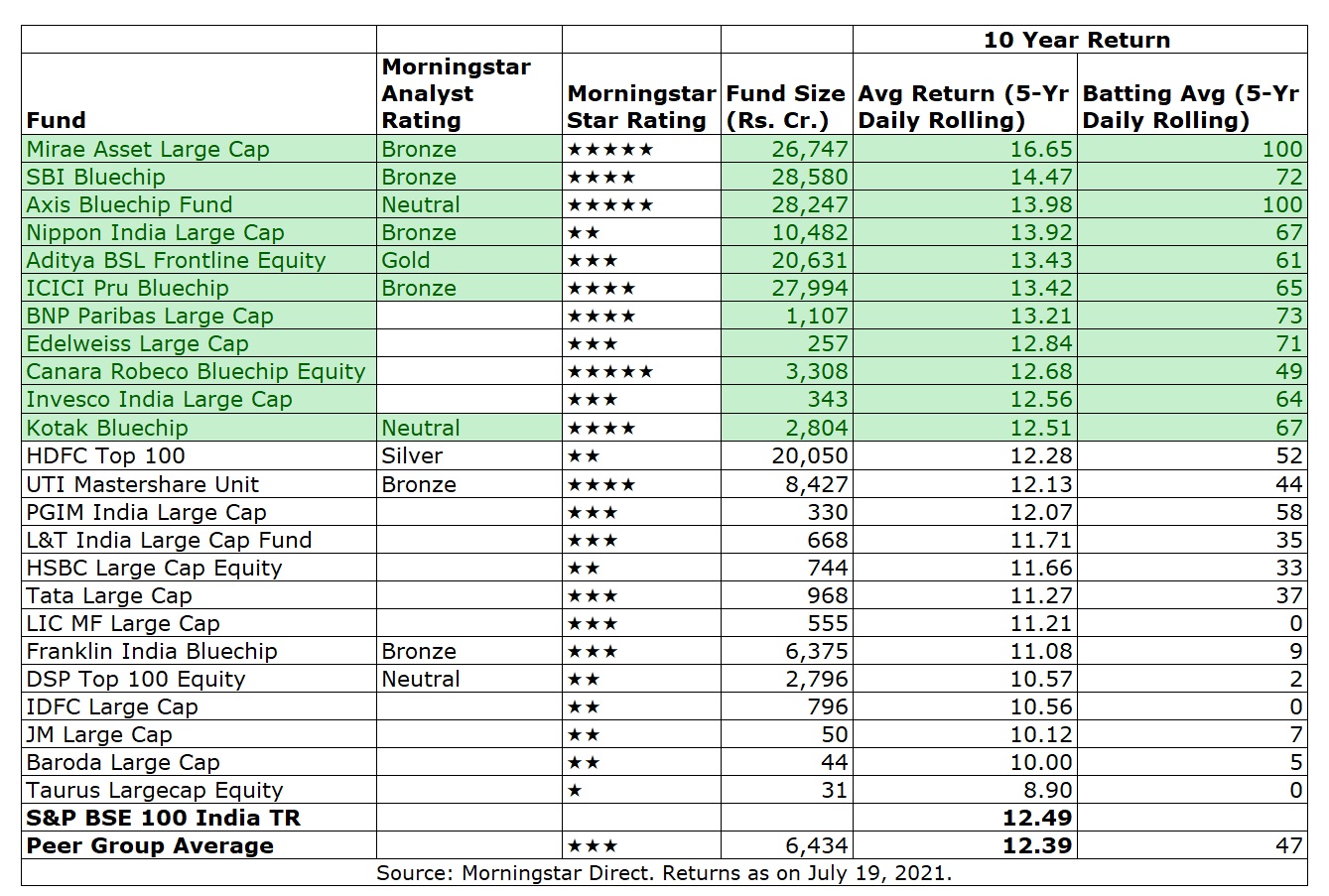

We looked at the performance of Large Cap Funds over a ten-year period. Of 24 actively managed Large Cap funds which have completed ten years as of July 19, 2021, only 11 funds, or 46% have outperformed S&P BSE 100 on a five-year daily average rolling basis for the last ten years. Of these, Axis Bluechip Fund and Mirae Asset Large Cap Fund have outperformed S&P BSE 100 Index for every five-year period in the last ten years under review. They had a batting average of 100. Only five funds had a batting average of more than 70%. Batting Average is measured by dividing the number of periods a fund outperforms a benchmark by the total number of periods. Funds highlighted in green cells have outperformed the S&P BSE 100. (Click on the image to enlarge.)

Funds that have not completed ten years as of July 19, 2021, were excluded. Only regular plans were considered for this study.

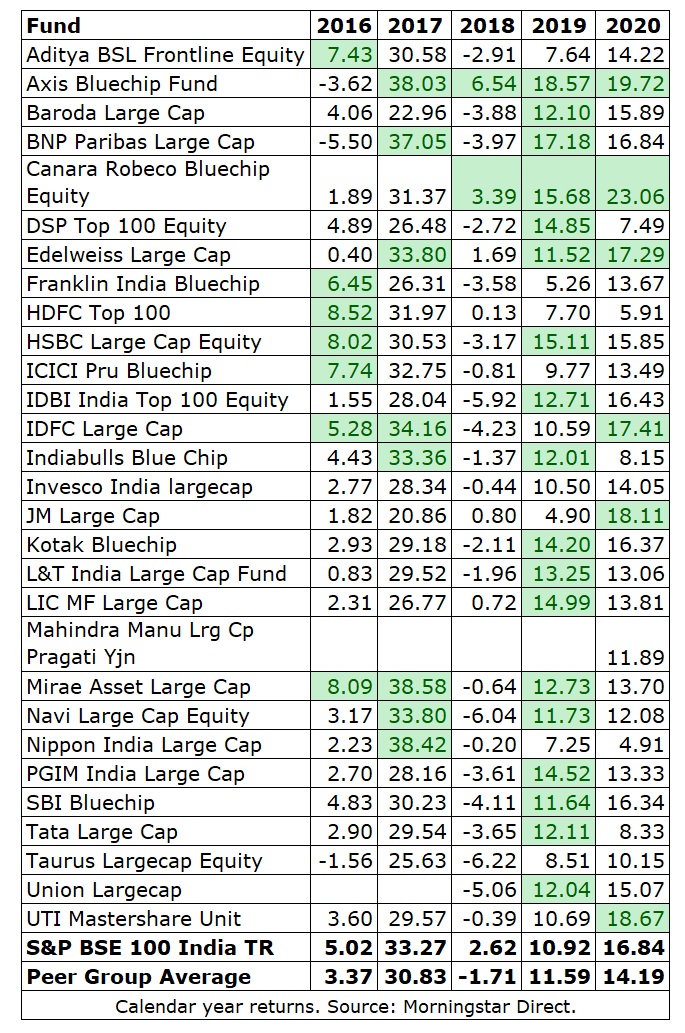

The number of funds outperforming S&P BSE 100 fell from 18 in the calendar year 2019 to six in CY 2020. The year 2020 was marked with heightened volatility due to the Corona Virus pandemic. The Sensex witnessed a drawdown of 38% in March and recovered by late 2020.

(Green cells indicate that these funds have outperformed the S&P BSE 100 Index.)

It remains to be seen if investors will shift to Large Cap passive funds if the underperformance of active Large Cap funds sustains.