As the country entered into lockdown last year, real estate was among the worst-hit sectors. Even before the pandemic, the sector faced multiple headwinds like demonetization, the introduction of the Real Estate Regulatory Authority (RERA) and Goods and Services Tax (GST) implementation.

The sector seems to be coming out of the woods if the sales numbers clocked by real estate developers are anything to by. According to Knight Frank data, property registrations in Mumbai were up 8% to 8,576 in October 2021, which is a 10-year peak. Even compared to the pre-pandemic year of October 2019, the registrations were up by 48%.

Reflecting this trend, the BSE Realty Index PRI has shot up by 122.25% over a one-year period as of November 16, making it the biggest gainer among all indices. However, the index is still 69% down from the January 2008 high. The BSE Realty Index comprises ten stocks and currently trading at PE of 70.51.

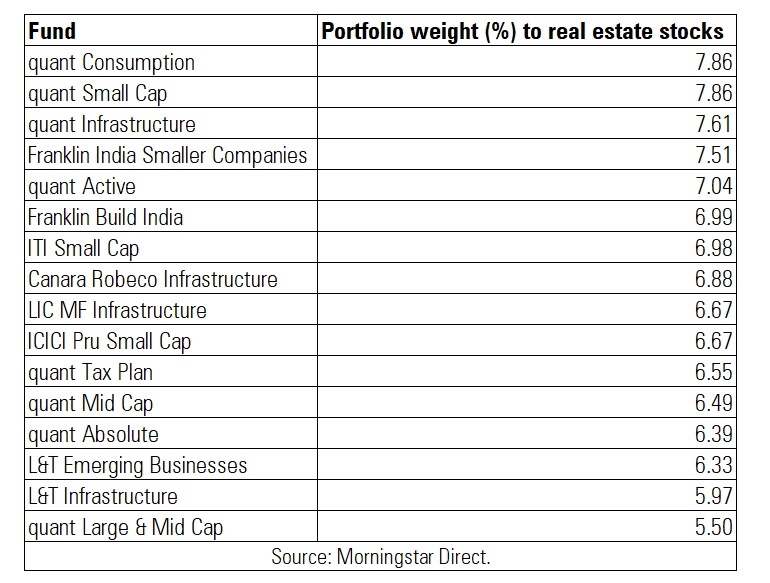

Schemes having the highest exposure to real estate developer stocks as of October 2021

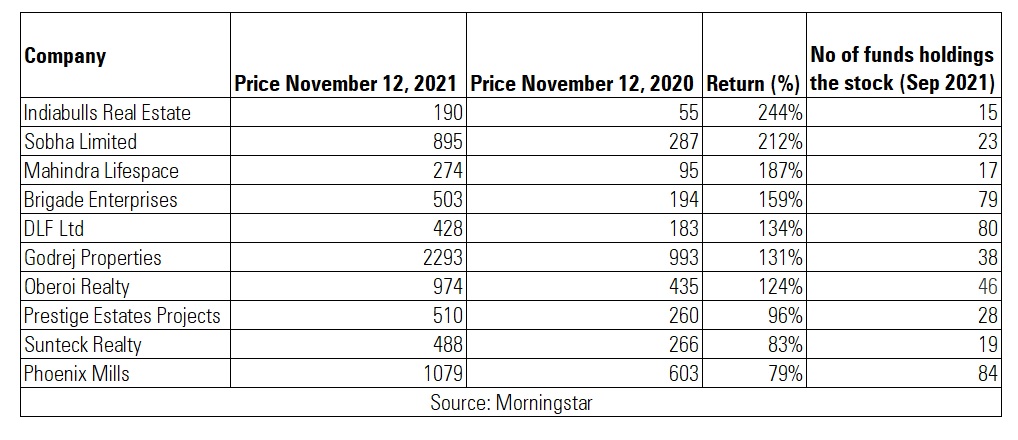

Performance of Realty Stocks over 1-year period

We asked fund managers about how they are riding on the real estate story. Is the recent spurt in demand for homes due to a pent-up demand or a sustainable trend? Abhinav Sharma, Senior Research Analyst & Fund Manager, Tata Asset Management Ltd, expects most listed companies to continue to deliver strong sales and cash flow numbers along with continued market share gain from smaller developers in the residential segment.

Besides investing in real estate companies, there are ancillary companies through which investors can benefit from this theme. “We have been very positive on the residential real estate cycle and have been participating in the theme through investments in real estate developers and in building material space like cement, pipes, tiles, paints & plywood as long as valuations are reasonable in this space. We are also positive on housing finance space as valuations have come off while the growth opportunity is quite large,” says Abhinav.

Valuations

Abhinav says that currently most of the players in the BSE Realty Index companies are trading close to or at a slight premium to their net asset values (NAV). He expects valuations to remain high as developers add to their launch pipeline and acquire new projects.

Risks

Abhinav says that apart from the covid third wave possibility and other macro-economic risks like delay in approvals, execution challenges while foraying into new micro-markets, faster than expected interest rate increases, higher supply and challenges in other real estate segments (commercial, hospitality) for some players are some of the material risks he foresees for the real estate sector.

Abhinav says that direct equity investors wanting to ride on the real estate theme need to carefully watch the balance sheet evolution and cash flows of the companies while investing.

Nilesh Shetty, Fund Manager, Quantum Mutual Fund, says that investors need to be wary of the quality of management and the amount of leverage these companies have. “If you see the last cycle, some of the companies didn’t survive as they built up leverage on their books. If you want to invest, look for low leverage and a healthy balance sheet.”

Why some funds are avoiding real estate

Some fund managers have avoided investing in real estate companies due to corporate governance issues. “We have never owned a real estate developer stock in our portfolio. There are very few names with good corporate governance so most of these stocks get filtered out. They don’t meet our value criteria. Companies that are good in this space are not available currently at attractive valuations. We own two home mortgage companies and one cement stock through which we get delta on the real estate theme,” says Nilesh.

Will the party continue?

Nilesh says that while real estate is a great macro story but when it comes to micro stories, it is difficult to spot companies that can generate good long-term returns. "Investors should view it as a cyclical theme. They should enter the sector when it is facing headwinds and exit during an upturn. The sector is at the cusp of a revival and can have a great run over the next few years. Since the sector is transitioning from pessimism to optimism, there could be some further upside in these stocks as companies deliver good results but the returns might moderate.”