Unit Linked Insurance Plans (ULIPs) are investment cum insurance products that come with a five-year lock-in.

Mid Cap ULIPs typically invest at least 70% in mid cap stocks.

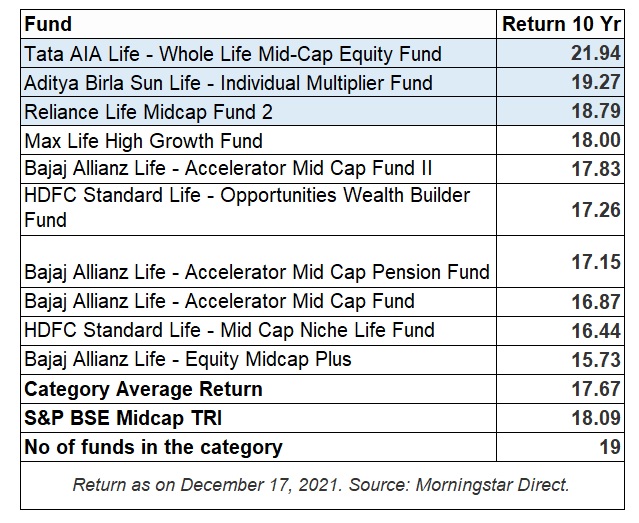

The S&P BSE Midcap TRI has clocked CAGR of 18.09% over a ten-year period as of December 17, 2021.

Three Mid Cap ULIPs have outperformed this index during the same period.

Tata AIA Life – Whole Life Mid Cap Equity Fund

- Star Rating: 5 stars

- Investment Style: Mid Growth

- % of assets in stocks: 70%

- Number of stock holdings: 45

- % of assets in top 10 holdings: 23.56%

- Top 5 holdings: Persistent Systems, Cholamandalam Investment and Finance, Astral, Gujarat Gas, Aavas Financiers. As of November 2021.

Aditya Birla Sun Life – Individual Multiplier Fund

- Star Rating: 4 stars

- Investment Style: Mid Growth

- % of assets in stocks: 98.74%

- Number of stock holdings: 86

- % of assets in top 10 holdings: 21.62%

- Top 5 holdings: Tata Power, Adani Total Gas, Zee Entertainment Enterprises, Crompton Greaves Consumer Electricals, The Federal Bank. As of November 2021.

Reliance Life Mid Cap Fund 2

- Star Rating: 3 stars

- Investment Style: NA

- % of assets in stocks: 98.83%

- Number of stock holdings: 86

- % of assets in top 10 holdings: 37.81%

- Top 5 holdings: Tata Power Co, Zee Entertainment Enterprises, MindTree, SRF, Mphasis. As of November 2021.

Max Life High Growth Fund

- Star Rating: 5 stars

- Investment Style: NA

- % of assets in stocks: 93.70%

- Number of stock holdings: 70

- % of assets in top 10 holdings: 30.54%

- Top 5 holdings: Cholamandalam Investment and Finance, Team Lease Services, Persistent Systems, Coforge, Deepak Nitrite. As of November 2021.

Bajaj Allianz Life - Accelerator Mid Cap Fund II

- Star Rating: 4 stars

- Investment Style: Large Blend

- % of assets in stocks: 98.62%

- Number of stock holdings: 88

- % of assets in top 10 holdings: 22.49%

- Top 5 holdings: HCL Technologies, Housing Development Finance Corp, ICICI Pru Bank ETF, Crompton Greaves Consumer Electricals, Page Industries. As of November 2021.

HDFC Standard Life – Opportunities Wealth Builder Fund

- Star Rating: 3 stars

- Investment Style: Large Blend

- % of assets in stocks: 76.96%

- Number of stock holdings: 60

- % of assets in top 10 holdings: 24.32%

- Top 5 holdings: MindTree, AU Small Finance Bank, Crompton Greaves Consumer Electricals, Voltas Ltd. As of November 2021.

Bajaj Allianz Life - Accelerator Mid Cap Pension Fund

- Star Rating: 2 stars

- Investment Style: Large Blend

- % of assets in stocks: 93.41%

- Number of stock holdings: 65

- % of assets in top 10 holdings: 29.88%

- Top 5 holdings: Persistent Systems, MindTree, ABB India, Indian Hotels Co, Axis Bank. As of November 2021.

Bajaj Allianz Life - Accelerator Mid Cap Fund

- Star Rating: 2 stars

- Investment Style: NA

- % of assets in stocks: 92.83%

- Number of stock holdings: 65

- % of assets in top 10 holdings: 29.33%

- Top 5 holdings: Persistent Systems, MindTree, ABB India, Axis Bank, Varun Beverages. As of November 2021.

HDFC Standard Life - Mid Cap Niche Life Fund

- Star Rating: 2 stars

- Investment Style: NA

- % of assets in stocks: 93.31%

- Number of stock holdings: 24

- % of assets in top 10 holdings: 61.31%

- Top 5 holdings: Tata Power, Crompton Greaves Consumer Electricals, Bajaj Holdings and Investment, Info Edge (India), Alkem Laboratories. As of November 2021.

Bajaj Allianz Life - Equity Midcap Plus

- Star Rating: 2 stars

- Investment Style: NA

- % of assets in stocks: 93.34%

- Number of stock holdings: 65

- % of assets in top 10 holdings: 29.83%

- Top 5 holdings: Persistent Systems, MindTree, ABB India, Indian Hotels Co, Axis Bank. As of November 2021.

(These are not investment recommendation by Morningstar. Investors should consult their financial adviser before making any investment decisions.)

ALSO READ: