The market has been losing steam recently due to a continuous streak of sell-off by FIIs, on the back of concerns over the fast-spreading new virus variant, Omicron and expectations of faster-than-anticipated Fed tapering amid inflation concerns. From its peak, the market corrected by 10% before recovering. Yet, many funds have weathered the storm by outperforming their respective benchmarks.

As we bid adieu to 2021, we looked at the calendar year returns of funds (regular plan) across three categories: Large, Mid and Small Cap. Do note that investors should not solely base their decision to invest in funds by looking at the recent past performance alone.

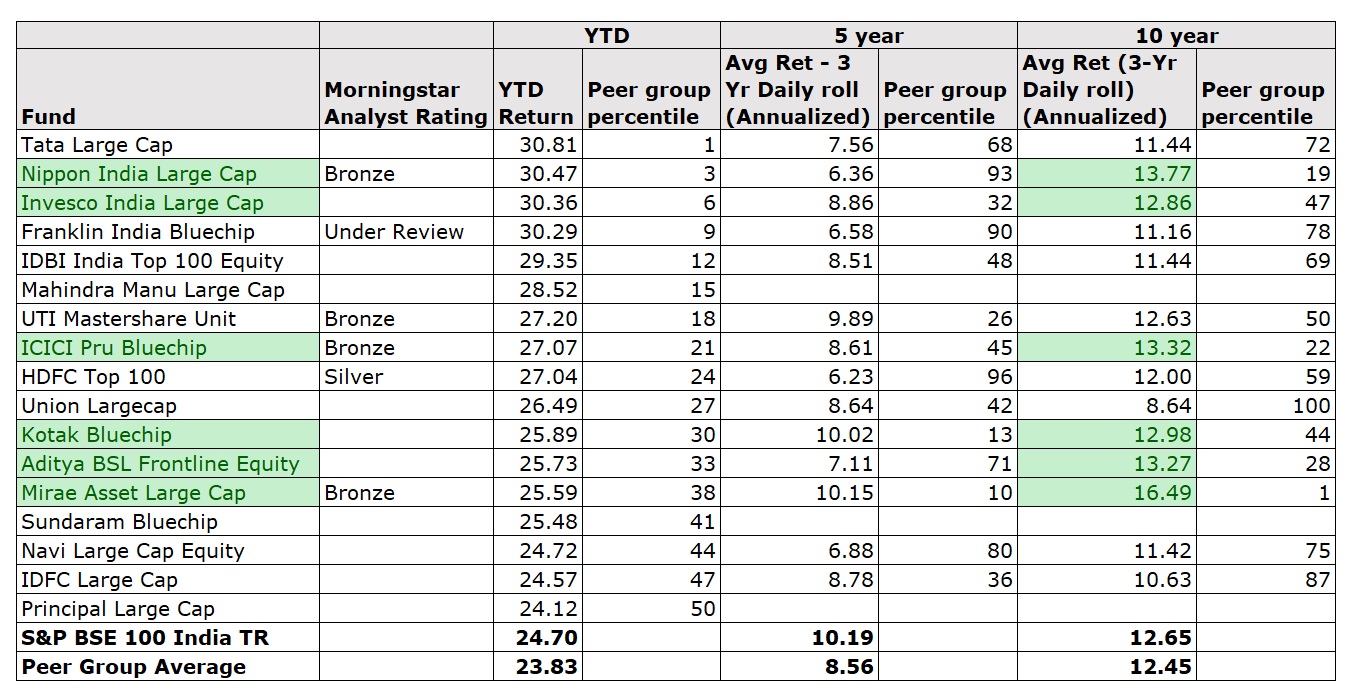

Large Cap

There are 32 funds in the Large Cap universe. Of these, 17 have outperformed the benchmark YTD as of December 23, 2021.

Of the funds that have outperformed YTD, only 6 funds have outperformed over a 10-year period as can be seen in the green text highlighted below. They are Nippon India Large Cap, Invesco India Large Cap, ICICI Pru Bluechip, Kotak Bluechip, Aditya BSL Frontline Equity and Mirae Asset Large Cap.

Funds that have outperformed YTD

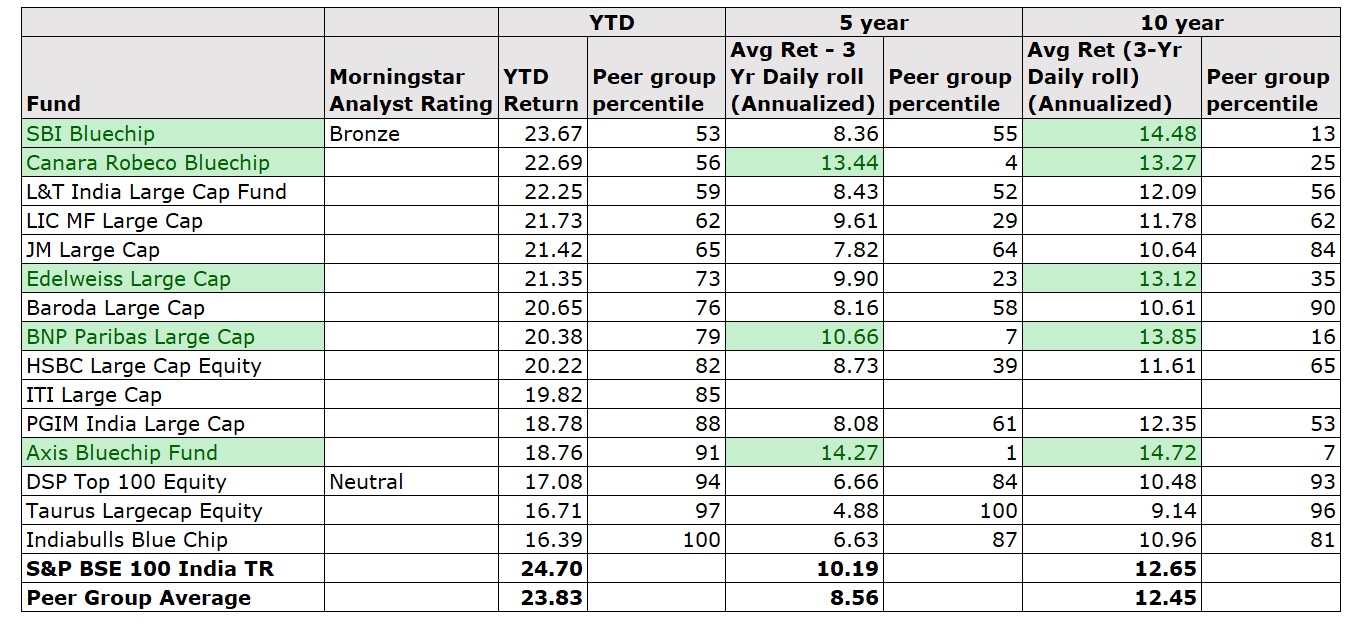

It is worth noting that three funds that have underperformed YTD have outperformed over 5-year and 10-year period. They are Canara Robeco Bluechip Equity, BNP Paribas Large Cap and Axis Bluechip, which are highlighted in green text in the table.

You can also see percentile rank of each fund next to the returns. It is a standardized way of ranking items within a peer group. The observation with the largest numerical value is ranked one; the observation with the smallest numerical value is ranked 100.

Funds that have underperformed YTD but outperformed 5-year and/or 10-year period

(Click on the image to enlarge. Data Source: Morningstar Direct. Blank cells indicate that these funds did not exist during that period.)

Large Cap Funds invest a minimum of 80% of net assets in up to 100 largest companies in terms of market capitalisation. In the recent past, not many Large Cap Funds have been able to beat the benchmark . For instance, over a 10-year period, 11 funds outperformed BSE 100 and over a 5-year period, only three funds outperformed this index.

Have a look at the Morningstar Analyst Rated funds in this universe here.

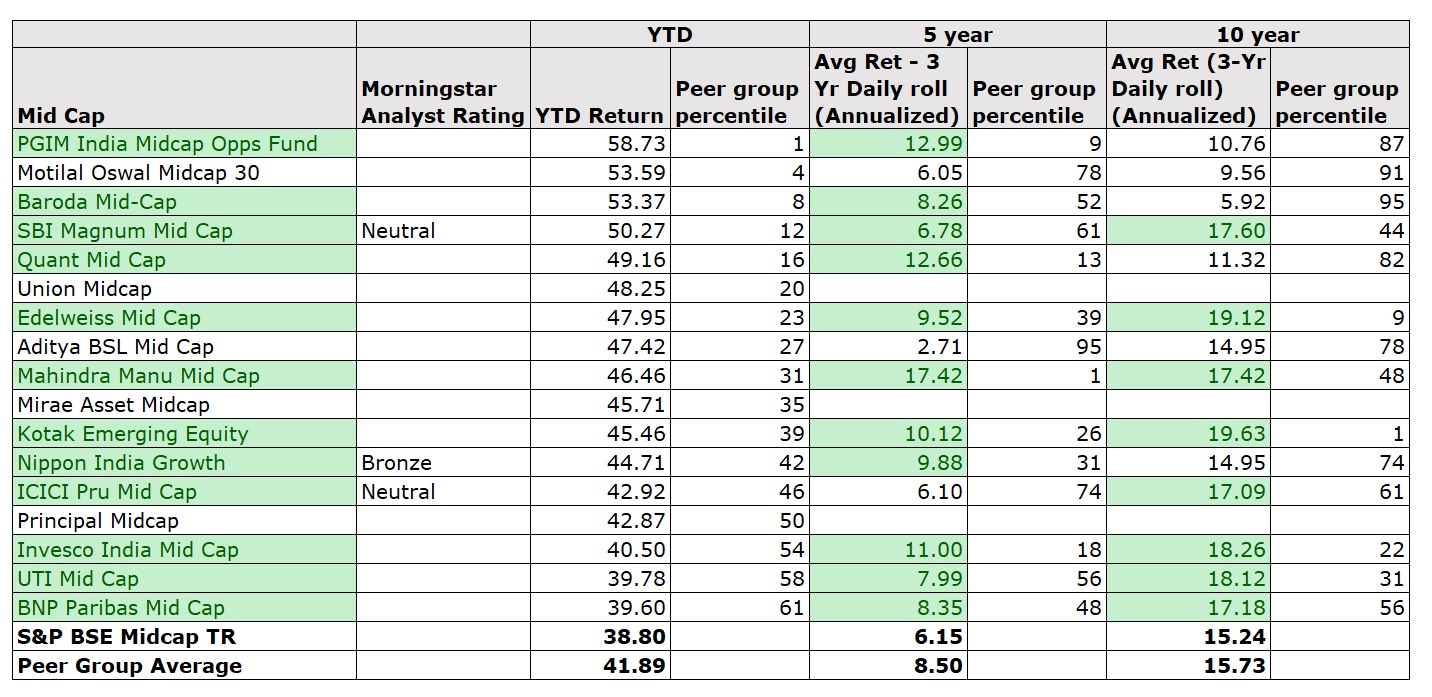

Mid Cap

These funds invest a minimum of 65% of assets in stocks that rank 101 to 250 in terms of market capitalisation.

This category generated relatively higher alpha relative to Large Caps and more number of funds outperformed the benchmark as compared to Large Cap Funds. Of the total 26 Mid Cap funds, 17 funds outperformed BSE Mid Cap TRI as of December 23, 2021. The BSE Mid Cap TRI index has clocked 38.80% return YTD as of December 23, 2021.

Funds that have outperformed YTD

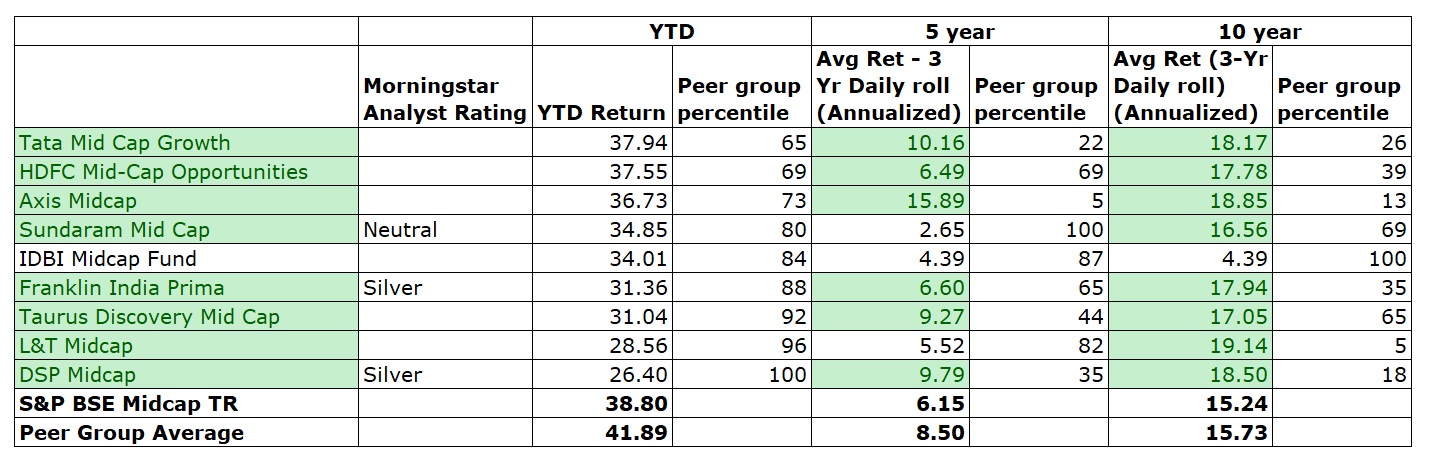

Of 23 funds that are in existence for ten years, 16 funds have outperformed the index over ten years. Over a five-year period, 17 funds have outperformed the benchmark.

Funds that have unperformed YTD but outperformed over 5-year and/or 10-year period

Have a look at the Morningstar Analyst Rated funds in the Mid Cap universe here.

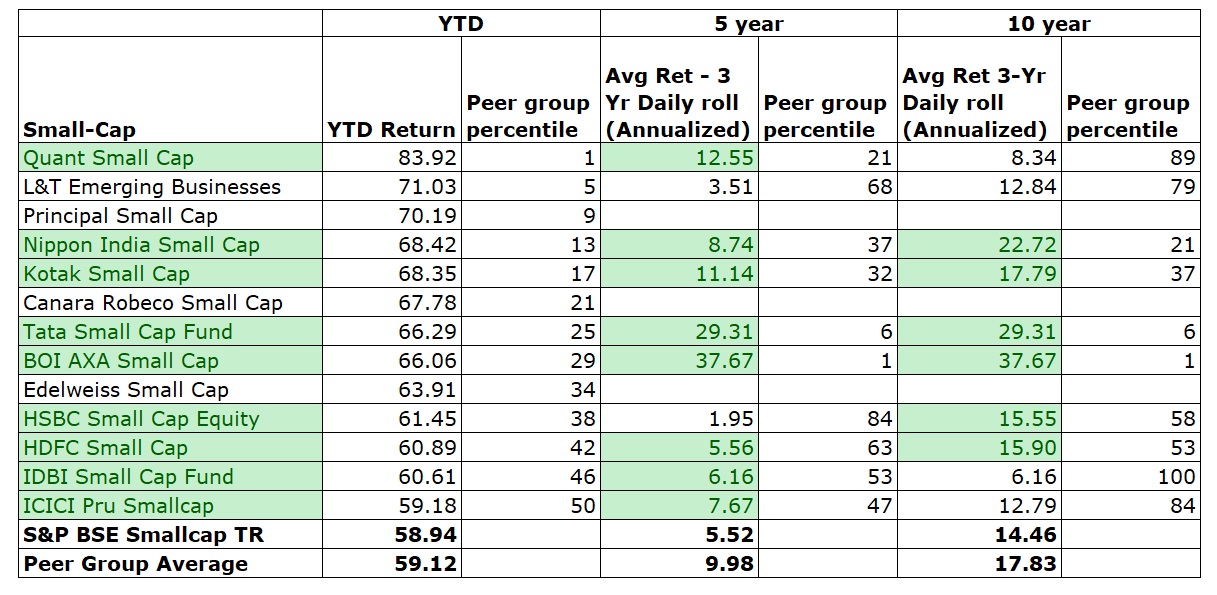

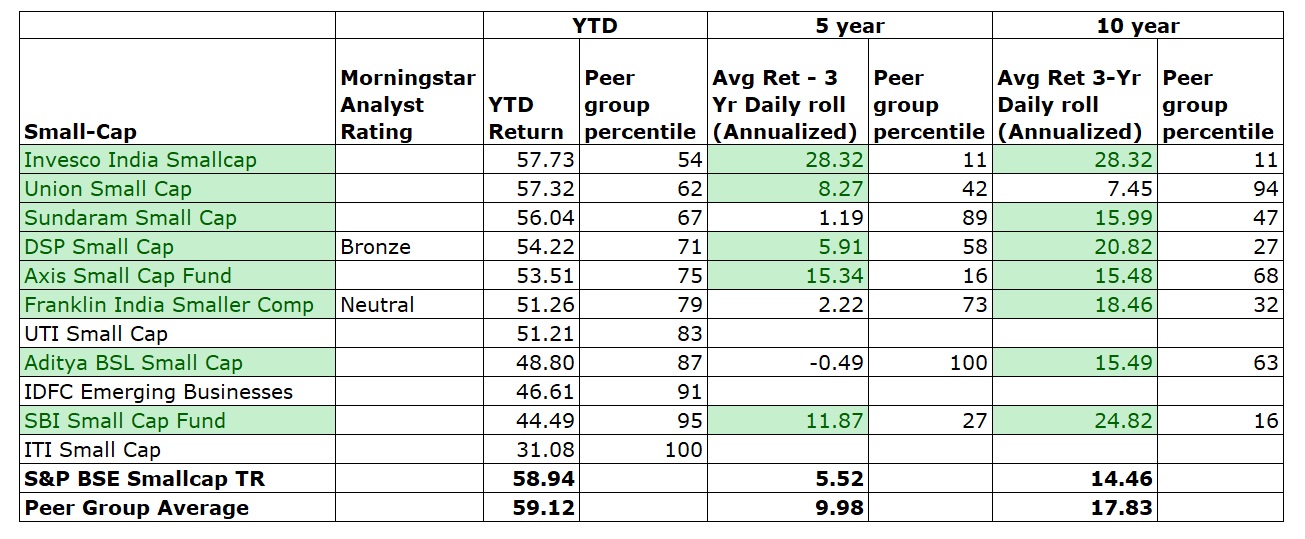

Small Cap

The BSE Small Cap TRI has delivered 58.94% return YTD as of December 23, 2021. Out of the 18 funds that are in existence for 10 years, 13 funds or 72% of funds have outperformed the BSE Small Cap TRI over a ten-year period.

Funds that have outperformed YTD

Funds that have underperformed YTD but outperformed over 5-year and/or 10-year period

Have a look at the funds covered by our analysts in this space.

Investors should follow an asset allocation approach while investing by diversifying their investments across Large, Mid and Small Caps as per their investment horizon, risk appetite and goals. Mid and Small Cap indices are relatively riskier as compared to Large Caps and can potentially subject investors to sharp drawdowns.

For instance, in the 2008 market meltdown, S&P BSE Small Cap Index dipped by -72.41%, S&P BSE Mid Cap Index lost -66.95% while S&P BSE 100 fell by -55.28%. By the same token, Small and Mid Cap Indices tend to recover faster compared to Large Caps. In 2009, Small Cap Index shot up by 126.92%, Mid Cap Index was up 107.66% while the BSE 100 was up 85.04%. (CY returns)

In the 2020 market crash, BSE Top 100 witnessed a drawdown of 38.05% the Mid Cap Index saw drawdown of 38.68% while BSE Small Cap fell by almost 40%. Since January 2018 till December 29, 2021, BSE Small Cap has witnessed a drawdown of 55%.