The large cap category received an estimated net inflow worth Rs 4,533 crore in the calendar year 2021.

There are 32 schemes in this category. Of this, 16 funds received net inflow while the remaining 16 saw net outflows.

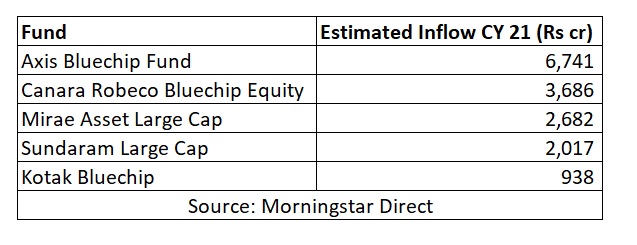

Five funds that received the highest inflows in CY 2021

Axis Bluechip Fund

- Inception: January 2010

- Star rating: 5 stars

- Analyst rating: NA

- Performance: 18.57% (2019), 19.72% (2020), 20.64% (2021)

- Equity holdings: 38

- % of assets in top 10 holdings: 64

- Top 5 holdings: Infosys, Bajaj Finance, ICICI Bank, Avenue Supermarts, Tata Consultancy Services

- Fund managers: Shreyash Devalkar, Hitesh Das

- Investment Style: Large Growth

Canara Robeco Bluechip Equity

- Inception: August 2010

- Star rating: 5 stars

- Analyst rating: NA

- Performance: 15.68% (2019), 23.06% (2020), 24.54% (2021)

- Equity holdings: 49

- % of assets in top 10 holdings: 52

- Top 5 holdings: Infosys, ICICI Bank, HDFC Bank, Reliance Industries, Tata Consultancy Services

- Fund managers: Shridatta Bhandwaldar, Vishal Mishra

- Investment Style: Large Growth

Mirae Asset Large Cap

- Inception: April 2008

- Star rating: 4 stars

- Analyst rating: Bronze

- Performance: 12.73% (2019), 13.70% (2020), 27.74% (2021)

- Equity holdings: 62

- % of assets in top 10 holdings: 53

- Top 5 holdings: Infosys, ICICI Bank, HDFC Bank, Reliance Industries, State Bank of India

- Fund managers: Gaurav Misra, Gaurav Khandelwal

- Investment Style: Large Growth

Sundaram Large Cap Fund

- Inception: October 2020

- Star rating: NA

- Analyst rating: NA

- Performance: 27.48% (2021)

- Equity holdings: 67

- % of assets in top 10 holdings: 57

- Top 5 holdings: Infosys, ICICI Bank, HDFC Bank, Reliance Industries, Tata Consultancy Services

- Fund managers: Rahul Baijal, S. Bharath

- Investment Style: Large Growth

Sundaram Select Focus and Principal Large Cap Fund were merged into Sundaram Large Cap Fund in 2021.

Kotak Bluechip Fund

- Inception: December 1998

- Star rating: 4 stars

- Analyst rating: Neutral

- Performance: 14.20% (2019), 16.37% (2020), 27.74% (2021)

- Equity holdings: 56

- % of assets in top 10 holdings: 48

- Top 5 holdings: Reliance Industries, Infosys, ICICI Bank, HDFC Bank, Tata Consultancy Services

- Fund managers: Harish Krishnan

- Investment Style: Large Growth

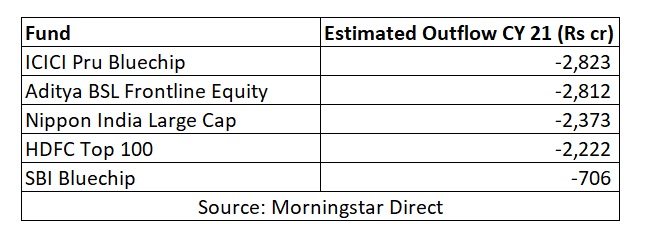

Five funds that received the highest outflows in CY 2021

ICICI Prudential Bluechip Fund

- Inception: May 2008

- Star rating: 4 stars

- Analyst rating: Bronze

- Performance: 9.77% (2019), 13.49% (2020), 29.17% (2021)

- Equity holdings: 66

- % of assets in top 10 holdings: 58

- Top 5 holdings: ICICI Bank, HDFC Bank, Infosys, Reliance Industries, Larsen & Toubro (December 2021)

- Fund managers: Rajat Chandak, Anish Tawakley, Priyanka Khandelwal

- Investment Style: Large Blend

Aditya BSL Frontline Equity

- Inception: August 2002

- Star rating: 3 stars

- Analyst rating: NA

- Performance: 7.64% (2019), 14.22% (2020), 27.90% (2021)

- Equity holdings: 70

- % of assets in top 10 holdings: 50

- Top 5 holdings: ICICI Bank, Infosys, HDFC Bank, Reliance Industries, Larsen & Toubro (December 2021)

- Fund managers: Mahesh Patil

- Investment Style: Large Blend

Nippon India Large Cap

- Inception: August 2002

- Star rating: 3 stars

- Analyst rating: Bronze

- Performance: 7.25% (2019), 4.91% (2020), 32.37% (2021)

- Equity holdings: 58

- % of assets in top 10 holdings: 55

- Top 5 holdings: HDFC Bank, ICICI Bank, Reliance Industries, HCL Technologies, State Bank of India (December 2021)

- Fund managers: Sailesh Raj Bhan, Kinjal Desai, Ashutosh Bhargava

- Investment Style: Large Blend

HDFC Top 100

- Inception: October 1996

- Star rating: 2 stars

- Analyst rating: Silver

- Performance: 7.70% (2019), 5.91% (2020), 28.54% (2021)

- Equity holdings: 57

- % of assets in top 10 holdings: 58

- Top 5 holdings: Reliance Industries, ICICI Bank, Infosys, HDFC Bank, State Bank of India (December 2021)

- Fund managers: Prashant Jain, Sankalp Baid

- Investment Style: Large Blend

SBI Bluechip Fund

- Inception: February 2006

- Star rating: 4 stars

- Analyst rating: Bronze

- Performance: 11.64% (2019), 16.34% (2020), 26.08% (2021)

- Equity holdings: 58

- % of assets in top 10 holdings: 48

- Top 5 holdings: HDFC Bank, ICICI Bank, Infosys, HCL Technologies, Larsen & Toubro (December 2021)

- Fund managers: Sohini Andani

- Investment Style: Large Blend

Equity holdings as of December 2021.