Flexi Cap and Multi Cap categories collectively account for 20% or Rs 2.56 lakh crore of the total Rs 13.06 lakh crore assets of actively managed equity funds (excluding hybrid and ELSS) as of December 2021.

Flexi Cap category was introduced in November 2020. The key difference between both these categories is that Flexi Cap Funds have the leeway to move across market capitalisation whereas Multi Cap Funds have to maintain a minimum of 25% each in Large, Mid and Small cap stocks at all times.

Do you really need a flexi-cap fund?

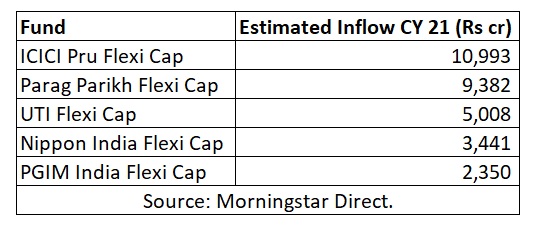

Five Flexi Cap funds that received the highest inflows in 2021

ICICI Prudential Flexicap Fund

- Inception: July 2021

- Star rating: NA

- Analyst rating: NA

- Performance: 8% (since inception, as of February 4, 2022)

- Equity holdings: 51

- % of assets in top 10 holdings: 44

- Top 5 holdings: ICICI Bank, Mahindra & Mahindra, HDFC Bank, Reliance Industries, Infosys

- Fund managers: Rajat Chandak, Priyanka Khandelwal

- Investment Style: Large Growth

Parag Parikh Flexi Cap

- Inception: May 2013

- Star rating: 5 stars

- Analyst rating: NA

- Performance: 14.43% (2019), 32.29% (2020), 45.51% (2021)

- Equity holdings: 27

- % of assets in top 10 holdings: 65

- Top 5 holdings: Bajaj Holdings & Investment, Alphabet Inc, ITC Ltd, Microsoft Corp, Amazon.com

- Fund managers: Rajeev Thakkar, Raunak Onkar, Raj Mehta

- Investment Style: Large Growth

UTI Flexi Cap Fund

- Inception: May 1992

- Star rating: 5 stars

- Analyst rating: Bronze

- Performance: 11.73% (2019), 31.55% (2020), 33.98% (2021)

- Equity holdings: 56

- % of assets in top 10 holdings: 41

- Top 5 holdings: Larsen & Toubro Infotech, Bajaj Finance, HDFC Bank, Infosys, Kotak Mahindra Bank

- Fund manager: Ajay Tyagi

- Investment Style: Large Growth

Nippon India Flexi Cap

- Inception: August 2021

- Star rating: NA

- Analyst rating: NA

- Performance: 9.38% (since inception, as of February 4, 2022)

- Equity holdings: 69

- % of assets in top 10 holdings: 31

- Top 5 holdings: ICICI Bank, Infosys, Reliance Industries, HDFC Bank, Larsen & Toubro

- Fund managers: Manish Gunwani, Kinjal Desai, Nikhil Rungta

- Investment Style: Large Growth

PGIM India Flexi Cap

- Inception: March 2015

- Star rating: 5 stars

- Analyst rating: NA

- Performance: 10.05% (2019), 35.87% (2020), 43.49% (2021)

- Equity holdings: 50

- % of assets in top 10 holdings: 38

- Top 5 holdings: Infosys, ICICI Bank, Larsen & Toubro, Axis Bank, Larsen & Toubro Infotech

- Fund managers: Aniruddha Naha, Ravi Adukia, A. Anandha Padmanabhan

- Investment Style: Large Growth

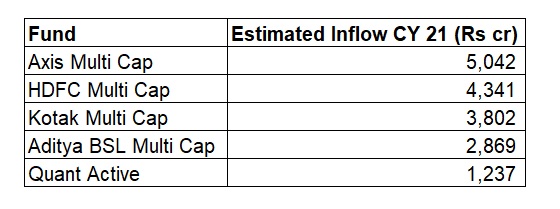

Five Multi Cap funds that received the highest inflows in 2021

Axis Multicap Fund

- Inception: December 2021

- Star rating: NA

- Analyst rating: NA

- Performance: -1.70% (since inception, as of February 4, 2022)

- Equity holdings: 33

- % of assets in top 10 holdings: 24

- Top 5 holdings: Infosys, ICICI Bank, Tech Mahindra, Avenue Supermarts, Birlasoft

- Fund managers: Anupam Tiwari, Sachin Jain

- Investment Style: Large Growth

HDFC Multi Cap Fund

- Inception: December 2021

- Star rating: NA

- Analyst rating: NA

- Performance: 2.26% (since inception, as of February 4, 2022)

- Equity holdings: 101

- % of assets in top 10 holdings: 21

- Top 5 holdings: ICICI Bank, HCL Technologies, UltraTech Cement, Reliance Industries, HDFC Bank

- Fund managers: Gopal Agrawal, Sankalp Baid

- Investment Style: Large Blend

Kotak Multicap Fund

- Inception: September 2021

- Star rating: NA

- Analyst rating: NA

- Performance: -1.92% (since inception, as of February 4, 2022)

- Equity holdings: 67

- % of assets in top 10 holdings: 29

- Top 5 holdings: Persistent Systems, ICICI Bank, State Bank of India, Maruti Suzuki India, Emami

- Fund managers: Harsha Upadhyaya, Abhishek Bisen, Arjun Khanna

- Investment Style: Large Blend

Aditya Birla Sun Life Multi Cap Fund

- Inception: May 2021

- Star rating: NA

- Analyst rating: NA

- Performance: 24.90% (since inception, as of February 4, 2022)

- Equity holdings: 76

- % of assets in top 10 holdings: 32

- Top 5 holdings: ICICI Bank, Infosys, Larsen & Toubro, HDFC Bank, HCL Technologies

- Fund managers: Mahesh Patil, Dhaval Shah, Vinod Bhat

- Investment Style: Large Growth

Quant Active Fund

- Inception: February 2001

- Star rating: 5 stars

- Analyst rating: NA

- Performance: 3.97% (2019), 43.55% (2020), 55.64% (2021)

- Equity holdings: 50

- % of assets in top 10 holdings: 52

- Top 5 holdings: Vedanta, ITC, State Bank of India, Reliance Industries Ltd, Fortis Healthcare

- Fund managers: Sanjeev Sharma, Vasav Sahgal, Ankit Pande

- Investment Style: Large Blend

Equity holdings as of December 2021.