Why must I be concerned about Sequence Risk? What is it?

Sequence-of-returns risk, or sequence risk, is something that is grossly overlooked, but must never be ignored.

This is the risk that comes from the order in which your investment returns occur. Timing matters. If the stock market declines just before you retire and in the early years of your retirement, it truly hits your portfolio.

Just imagine: You have just retired. Inflation goes on. The stock market falls and so does the value of your equity portfolio. And now you have to start withdrawing from your savings to live. When you start making portfolio withdrawals, the value of your portfolio reflects both market performance and cash outflows. Not a great combination.

Different Sequence, Different Results

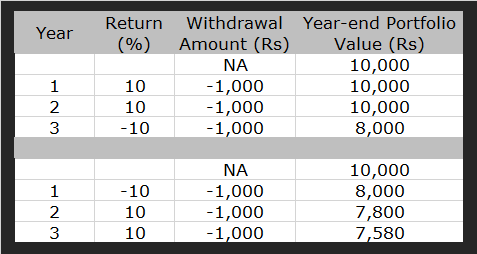

- Amount: Rs 10,000

- Amount you plan to withdraw: Rs 1,000 per year

If you earn 10% (first year), 10% (second year), and -10% (third year), you'd end up with Rs 8,000 by the end of the third year.

If you earn -10% (first year), 10% second year, and 10% (third year), you’d end up with Rs 7,580 by the end of the third year.

Under both scenarios the returns are identical, except that they are in reverse order. And the results are different. Why? Because the negative return at the beginning of the period (when more assets are in the account) carries more weight in the overall results. The portfolio doesn’t benefit as much in rupee terms from the two years of positive returns because there are fewer rupees remaining.

This is why a balanced portfolio that takes into account your current lifecycle helps.

Also, the bucket approach that Morningstar's director of personal finance, Christine Benz, advocates is one way to mitigate the risk of an unfavorable sequence of returns. By putting at least one or two years’ worth of planned withdrawals in a separate cash “bucket”, investors can guard against the risk of being forced to withdraw assets during a market downturn. This also leaves the remaining portfolio better positioned to rebound when the market eventually improves.

Sequence-of-returns risk is one of the more underappreciated dangers of investing. Talk to your financial adviser to ensure that you are not overly exposed to the potential downside.

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries relating to mutual funds, portfolio planning and personal finance. While we provide broad guidelines, we suggest you consult a financial adviser before making investment decisions.

ASK MORNINGSTAR archives

Articles authored by LARISSA FERNAND