Have you ever invested in a fund that shows an amazing return, but your investment in that fund does not match up?

A decade ago, Carl Richards, released the book The Behaviour Gap: Simple Ways to Stop Doing Dumb Things with Money. He used the term “behavior gap" to describe the difference between the return an investment organically produces over a fixed time frame, and the return an investor in that very investment actually earns. The result is usually not in the investor’s favour.

Behavior Gap: is the difference between the rate of return an investment produces in a certain amount of time, and the rate of return that investors actually earn on that investment. Investment returns and investor returns are almost always different.

Investment returns: based on the assumption that you invest a lump sum at the beginning of the period, and then you leave it alone. You do not change your mind and sell to invest in another fund. You just buy once and hold.

Investor returns: measure your real-life return. The return you earn as you buy and sell your investments, or switch from one investment to another in your search for the next hot thing.

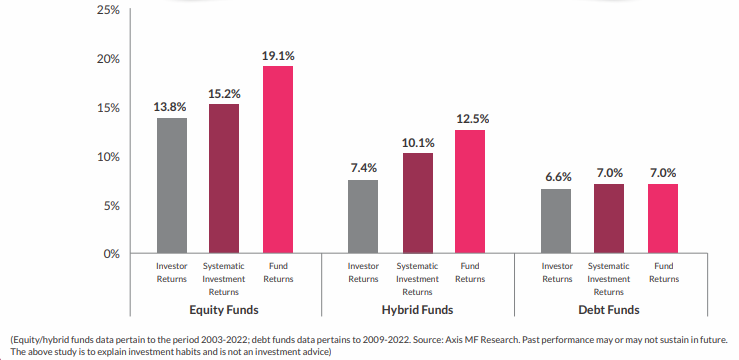

To quantify the effects of Indian investors’ frequent churn decisions on their long-term returns, Axis Mutual Fund analysed investor behavior for equity and hybrid funds over the last 20 years (2003-2022) and debt funds over the last 14 years (2009-2022). The findings indicate that investor returns were significantly worse than both point-to-point fund returns as well as systematic investment returns for all the three categories.

What to note:

- Actively managed, open-ended funds, regular growth plans, across 3 categories – equity, hybrid and debt.

- Fund returns: the asset weighted returns for all funds.

- Investor returns: the consolidated returns that were realized by all investors adjusting for their inflows/outflows into the category. Investor returns were computed using an IRR approach after calculating net sales into each category.

- SIP returns: calculated based on assumption of equal investments quarterly over the tenure of the study.

- All analysis was done using monthly AuM and return data as on June 30, 2022.

- Click on image to enlarge

What is the reason for this gap between the fund return and investor return?

The gap could be causes by various reasons, or a confluence of them: Timing the market, buying (or selling) on the basis of recent performance, chasing after a fad, or just deciding to leave the market when it's temporarily down. All these decisions can be destructive to your portfolio.

Morningstar’s fund research team has done some research on this subject. Here are some of their findings.

- They looked at the 3-year return of a pharma fund as of April 2022. It stood at 23%, but the average return of investors was 6% lower. Pharma Funds received significant inflows since 2020 as this sector performed well when the pandemic hit. Investors chased this recent performance and piled into these funds. Unfortunately, they are often late to enter a theme and sell when they don’t earn returns.

- They did a study spanning 10 years, to understand how many months of performance contributed to a fund’s overall outperformance over the benchmark. They found that only six months contributed to a fund’s entire outperformance over the benchmark. If you, as an investor, missed being invested over those six months, you would have underperformed the benchmark.

- The best-performing equity fund delivered 40% over the last 3-year period as of April 2022. An average investor in this fund made only 20%, so the gap is half. Around 75% of inflows into this fund came only in the last one year.

What leads to the behaviour gap is not that the fund is a dud. It is behaviour driven by emotion or latest performance.

You’re more likely to see the value of your investments rise over an extended period if you leave them alone. Stop chasing latest performers. Stop continually switching your holdings to try and beat the market. Stop timing the market. Automate as much as possible.

Behavioural Finance to help you become a better investor

More on Mutual Funds

Larissa Fernand is an Investment Specialist. Read her articles. Follow her on Twitter.